Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. China dropped 2.6%; Indonesia, Japan, singapore and Taiwan rallied more than 1%. Europe is currently up across the board. Austria and Germany are up more than 1%. Futures here in the States point toward a flat open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down more than 1%.

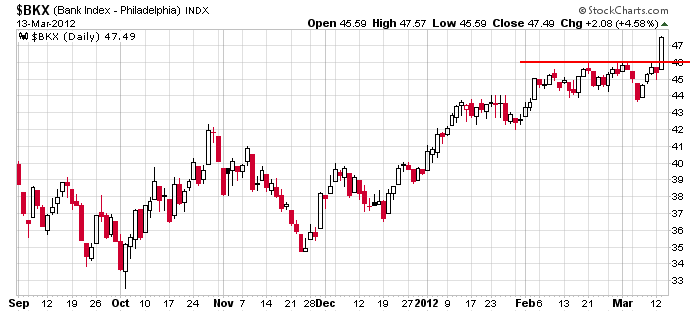

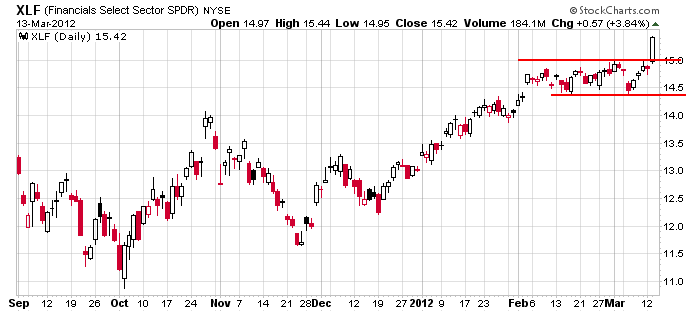

The Fed spoke yesterday, but the big news came from JP Morgan where they’ll be raising their dividend and doing a $12 billion buyback. The news vaulted $BKX through the resistance level I’ve been tracking for about two weeks and also pushed the financials (XLF) through their own resistance. Oh and the two banking stocks that are on the Long List (BAC and C) did great. Here are the charts.

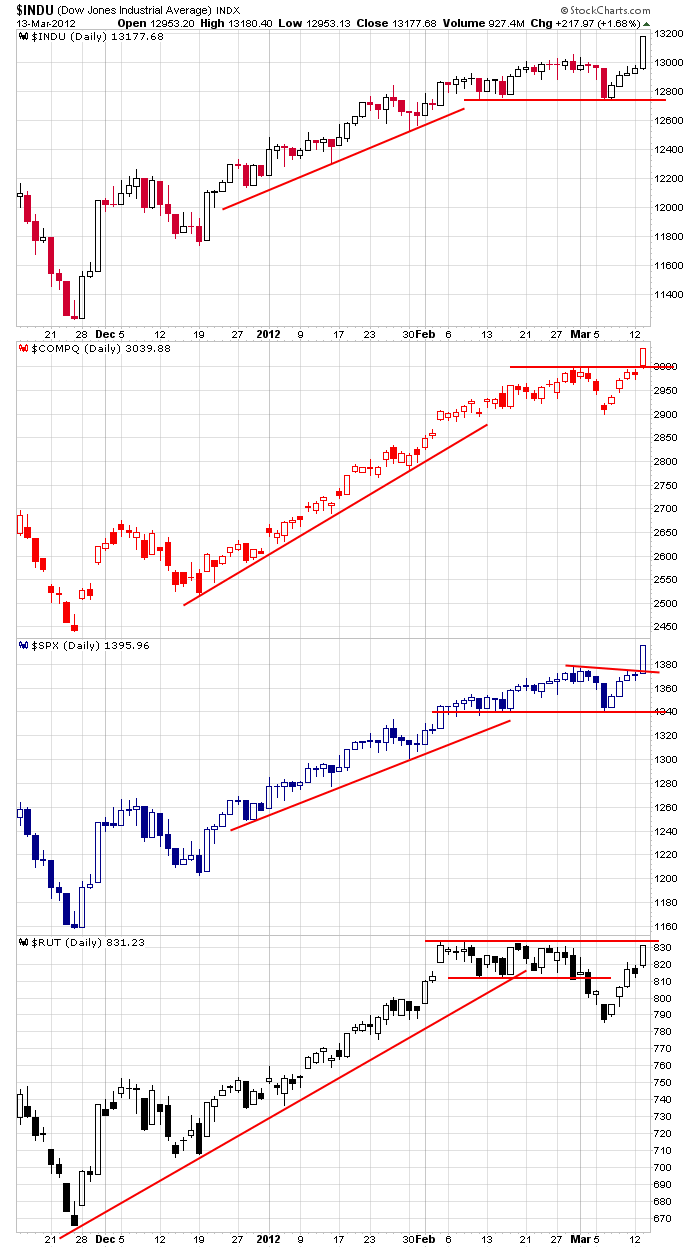

And here are the daily index charts. You can’t argue with or fight these. A steady uptrend was followed by about 6 weeks of consoliation and now we have continuation breakouts. The small caps are still lagging. I would consider it a yellow flag if the Russell can’t make it’s own new high, but I still wouldn’t take a position opposite this movement.

The market tends to reverse its post-Fed move the next day. Obviously yesterday was super bullish. If history holds, the market will give back some of those gains today. If a give-back happens, I fully expect it to be bought and new highs to be made again. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 14)”

Leave a Reply

You must be logged in to post a comment.

JPM.. 12b.. and no leeway or honorable restitution for MFGlobal rank/file clients’ seg account balances.. theyre reall princes.. & lower than worm sh-t..

One note of caution, Shanghai dumped overnight, gave back over a weeks work of upside. This may just be an anomaly.

Here is more validation why banks need to be broken up and regulated –

http://www.nytimes.com/2012/03/14/opinion/why-i-am-leaving-goldman-sachs.html?pagewanted=1&_r=1&src=twr

Good luck

I think this news piece reinforces the insight Lewis gave in Liars Poker.

The fncl industry as a whole is full of manipulative characters. Once that is understood and we dumb money see what all the fed and government is bad / we need an even more wild and free fncl sctr babbling and public dis-information BS is really about, trading can make sense – at times.

FIO YNDX taking off

YOKU going through a shake out

The China syndrome may last for a bit.

Raise cash if you entered late.

This morning I shorted ESM12, Jun S&P mini, @ 1390. We can have a reasonable pull back and still screw most of the option holders. But, I’m not going to tolerate much strength with a tight stop. I’m looking for a pull back to about 1383.

With yesterday’s breakout in the major averages the bull move since 2009 remains intact with new upside targets not far away, IMO. E.G. I now have an SPX target of 1430, INDU 13200-13300, NDX 2800. The problem for me at this point, from an intermediate term time frame, is that the upside potential may be outweighed by a larger downside risk. A reversal may be several weeks out, but, having missed this uninterrupted move upward (as a trader) since DEC, I’m not about to chase at these levels. If the targets are reached from current levels without at least some consolidation or pullback (to the MAR lows for instance), I’m resigned to missing it. This is a good time to rethink my trading approach and not confuse it with my longer term investing approach. Besides, I have clients and March Madness to attend to.

Here’s my problem, both fundamentally and technically. IMO, the U.S. economy is not improving despite what coincident indicators say. I’m in the camp that says that leading economic indicators are deteriorating (just as they were last year at this time prior to the MAY high). Profit margins are shrinking and future earnings expectations are unrealistic (part of the reason I mentioned insider snd institutional selling yesterday).

Technically, the bearish divergences are building, both on the daily and weekly charts. Are there short term trading opportunities? Sure, Raymond & Jason have nailed them consistently from what I can see and I’m not too old or too proud to look more closely into their trading approaches and suggested readings on trading. In the meantime, I have Michigan State winning it all!

the market will come down when it can go without crashing and they take the training wheels off, when europe is stabilized

35 years of investing has taught me a couple of things. When more people than not are anticipating a turn, it will just keep going – climbing the wall of worry or sliding down the slop of hope, that is. And, everything I expect to happen takes longer than I expect it will.

Time to focus on shorter term swings, either way or stand aside.

New leaders are still strong, consolidating. Too early to say if they are topping out.

You’re right Brian. Bull markets don’t let you in; bear markets don’t let you out.

thanks for your comments Pete

the root word of government is

GOVERN

transitive verb

1a : to exercise continuous sovereign authority over; especially : to control and direct the making and administration of policy 2a : manipulate

Sold 1/2 AAPL long swing this gap up looks to be it

All out TTM TSLA

Still net long but the drop in china is a concern.

Closed AON HOG and other entries for some profit. Narrowing the focus.

Closed FAS DRN and all late entries

you sure sell alot for never buying

I buy a lot, sell a lot (for both profit & loss), and have shared a lot, but not everything.

But unless there is equitable input of trade ideas, my sharing becomes limited. It looks to become even more limited.

Go back through the records, I have shared after entry and at add ins.

Anyways the pt is not to make a pt but to make money. Collaboration can help. Still trying to be patient.

nah, I don’t care. If you were holding all those longs overnight threw this rain of shit, you are very lucky indeed

fortune favors the bold. you can be bold when you have a profit margin with some booked profits.

also, disaster awaits the reckless 😉

2/3 out BOIL for profit looking to hold balance attempt another start to a swing

will dump if brk out attempt fails

ABC broke out of dbbl bttm but not sure of holding much longer

I am inclined to think the Shanghai drop is a trade balance uncertainty thing and still think China will transition more to a consumer / discretionary model.

May even get aggressive prior to the close.

Cant find any catalyst other than the ongoing currency / trade balance rhetoric BS why Shanghai took a dump last night but other Asian tigers held steady.

And AAPL dumps

All out, now after giving some nonsense about the meaning of AAPLs fall, we can mover on to new trading toys. I will be pissed if APPL pulls another pop drop and rip like mid Feb.

It is the end of earnings time for a pullback, the real leaders will show up soon.

lol – maybe AAPL is doing it again.

OK done with this bleeping bleep.

Damn it I am going to take all my kids and wifes ipads and have my dog take a good dump on em 😉

Damn AAPL she is a bleeping bleep!

bizarre day with bonds, stocks, gold, euro and even oil, corn and wheat are down big together. coming the day after the fed said economy was picking up and declined to announce another round of qe, we have got to wonder how much further qe expectations were factored into prices across the board.

follow the fed….until the trend is dead 😉

I still contend reading the following gives the best insight into some understanding of the psychosis of the mrkts

Ken Fishers – all his works

Nial Fergusons – ascent of money

Mike Lewis – Liars Poker

Nicolas Darvas – Wall St, the other Las Vegas

Raymond, How will you decide the trend is dead?

Read Martin Prings works, required reading for CMT certification, attended one of his talks, better than John Murphy I think.

Apparently you can get pirate versions according to one of my nephews.

china announced leadership contention. dr copper taking it hard. our printing presses are smoking, better plant more trees

Also I would not get too hung up on inter mrkt analysis (per John Murphy et al) and their correlations.

A friend has done a lot of back testing based on quarterly and bull / bear phase behavior

– intermkrt correlations come and go

– sell in May has not worked for over a decade, more like swing long biased into june / july then selectively short or take a vacation.

– seasonal and assess reallocation trading is hit or miss

A lot of myths and BS out there, very few take the time to look at facts. Very few have the patience and discipline to decipher data noise from real information.

Still learning, still getting confused.

1/2 out UVXY

All out

Also if anyone started the TSM SPRD trade noted a few days ago as a ww item, probably best to dump it, play the odds. Or at least book some profit if you have any.

All out DUST

covered my short @ 1385.5

Building more cash, still net long.

All out RAD.

watching BVSN for rebuy / addin, but looks to be done. for now.

YOKU looks to be putting in a Dr Kacher type buyable gap

It may be that we will transition into a sideways or grind down sideways mode for the indices / sectors for now.

Money still seems to be flowing into the big caps.

There should be strong leaders still, if not should be a concern.

the quarterly witches opts ex have been rolling over since mon with fri prob being flat

it has been volitile till fri

looks like we are working our way from top down

no idea where we go after fri but there are to many bulls with hot ,ill gotten bailout money

the bears hope to trap them and take all their pension money

You know I used to hunt bear when I was younger, used a 90lb pull compound bow.

Bears squeal when you hit em with a broad point. 😉

we should have some tasty bull meat for earnings,with bank propoganda for the first 2 weeks of earnings at least and will prob hit Petes targets then

A day, perhaps a week for concern.

If China bounces, and the rest are neutral or have upside follow through then yesterdays spike was not just short covering or a blow off top imo. But getting more paranoid than normal.

Best to do some real rigorous analysis.

I am going to smash all those damn ipads and have my dog poop all over em.

Good luck.

cheif crazy horse hunts bulls for his whicieup

lol… benake head on his lodgepole

Looking under the hood tonight there are a lot of dojis, haramis, top tweezers pairs and some topping tails. As I post this both China indices have undercut yesterdays intraday low and are struggling to get back up above the close.

There were more leaders showing strength today but most popped and pulled back, some on volume others neutral.

Some of my trading acquaintances agree with my growing paranoia although we are all still neutral / bullish.

But it ain’t over until its over, one candle pair does not make a reversal until confirmed. But there is need for caution. Especially if China does not stabilize or bounce and China’s action is concurred by the European markets. If there is further weakness I may have to limit any more pullback.

All late starters except for 2 were sold today.

Still net long, looking for more potential shorts.

Best of luck.

Looks like the China dip was about political in fighting and liberalization of the economy.

Today was a buy / re-entry day.

As it turns out the China syndrome was related to gutting alleged corrupt government officials.

The fall out may last for a few more days for some china specific stocks.

This article may be a tell, perhaps there is something circulating with the big money of some uncertainty of or disunity within the World Feds next move.

http://finance.yahoo.com/news/little-extra-inflation-backfire-volcker-202313504.html

There is as everyone knows some under tones of trade protectionism / inequality confrontation. Now that the new age sissy boy management of globalization (I don’t know what the bleep I’m doing so to justify my useless overhead exec position I am moving operations from my home country to a slave labor center so I can collect my bonus and get promoted to a position where I can use a jackhammer as a pleasure tool to really bleep the dumb bunny Muppet employees and this country) have intertwined us to a level where we are all bleeped if one significant country makes the wrong turn. Any talk of protectionism or trade confrontation should have a good shake down of the markets.

Just my paranoid opinion.

The momentum is still up, but……???

Sometimes its bes to just consider your indicators but focus on price action.

This is how you avoid opportunity costs, missing trades. And how you can make the big money.

And always consider the fundamentals, the relevant fundamentals, not just forget about them. But trade on technicals.

Alpha China stocks are at or nearing ideal add in / buy pts.

IRE is up +4% on the day huge vol mover takes semi block trades no problem, its on its 2nd up day. Historically it moves up 3-4 bars then fades. What is interesting now is that IRE may be forming a big bottoming saucer like CROX did in 2009 prior to its 1000% run. However, I am still of the opinion that fncls are dead money tho now I am in JPM BAC WFC (the Buffet pumps). This also applies to NBG.

INVN continues to brk out, shaking off the fleas.

Go with the momentum until it ends.

Best of luck.