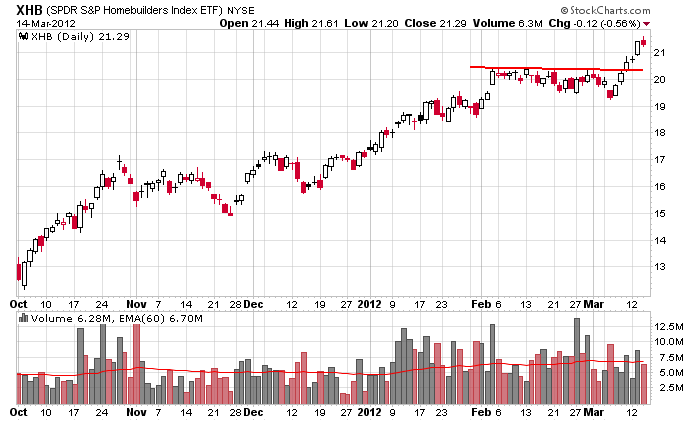

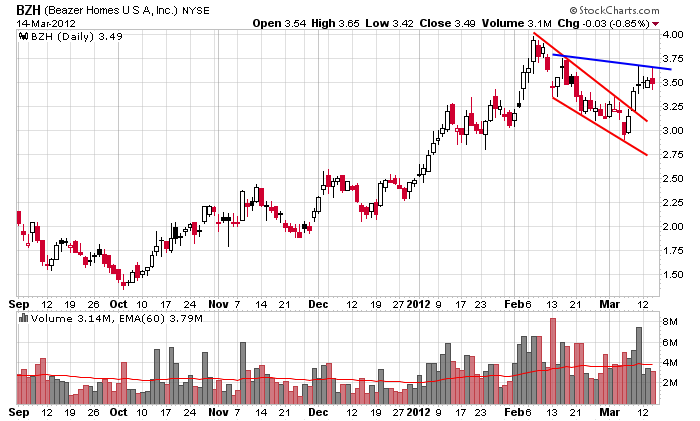

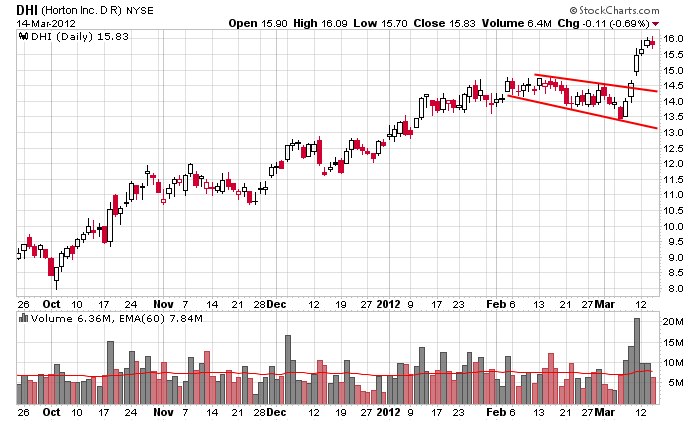

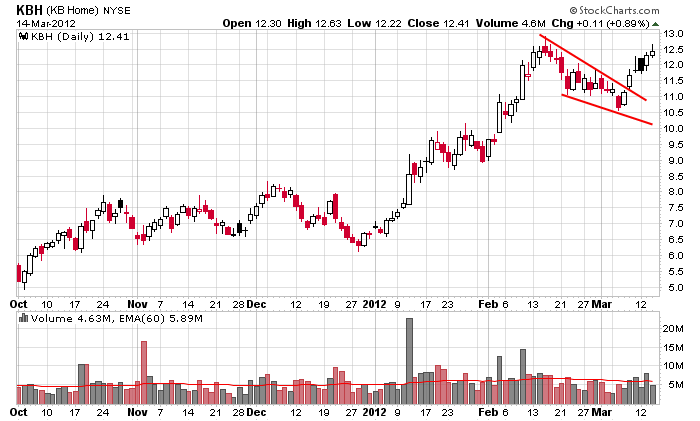

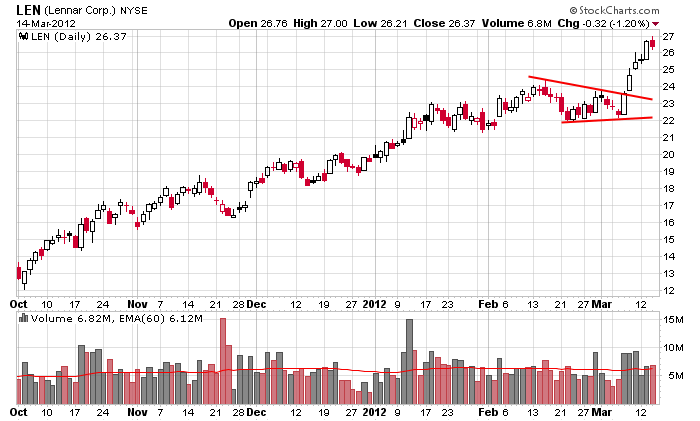

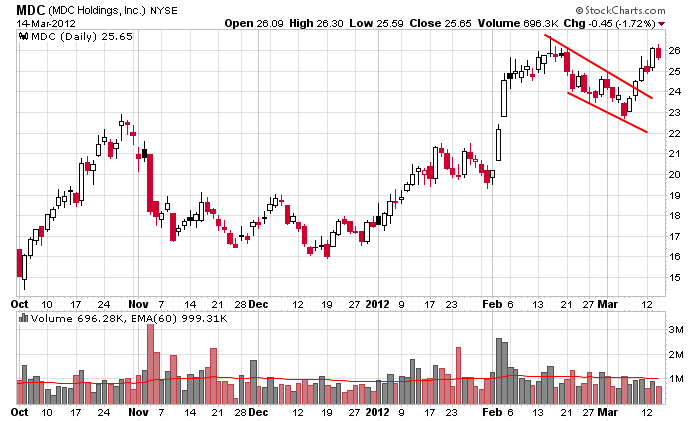

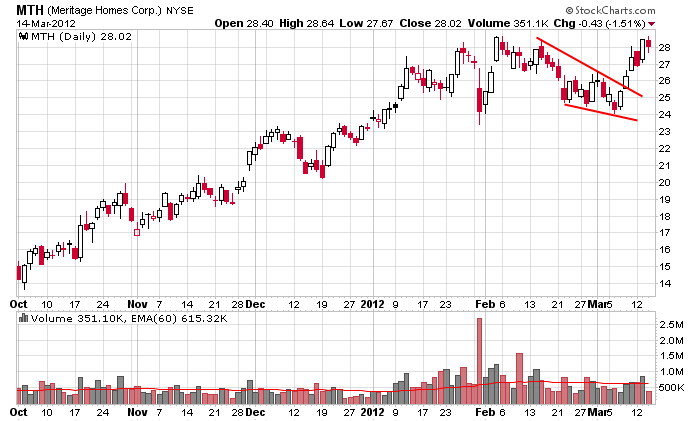

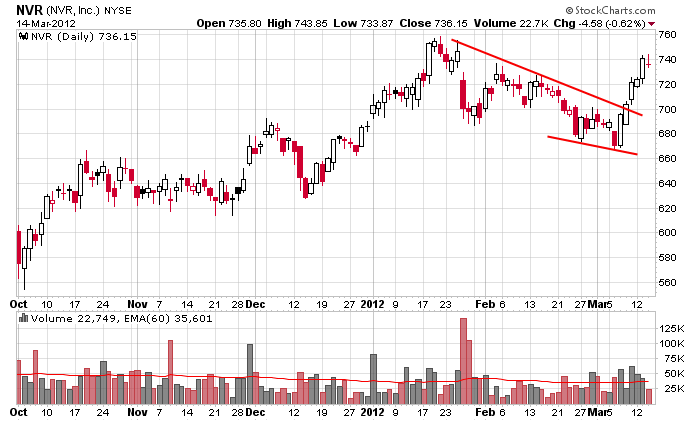

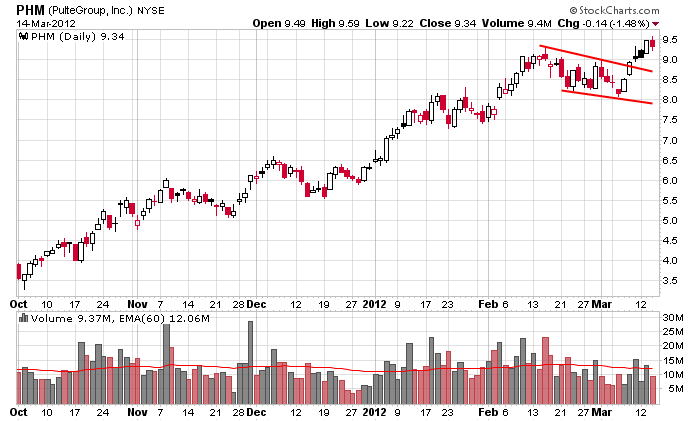

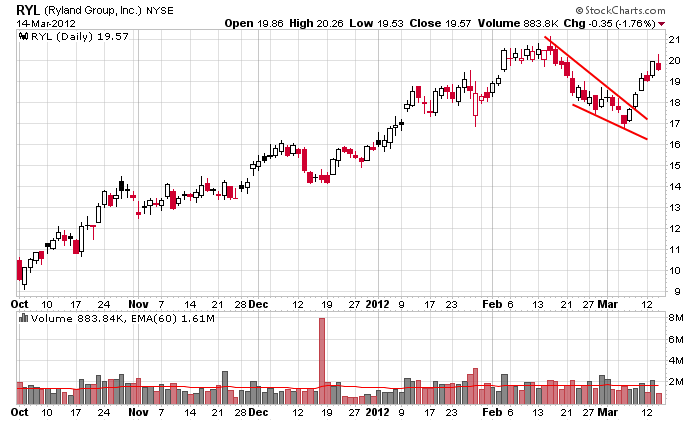

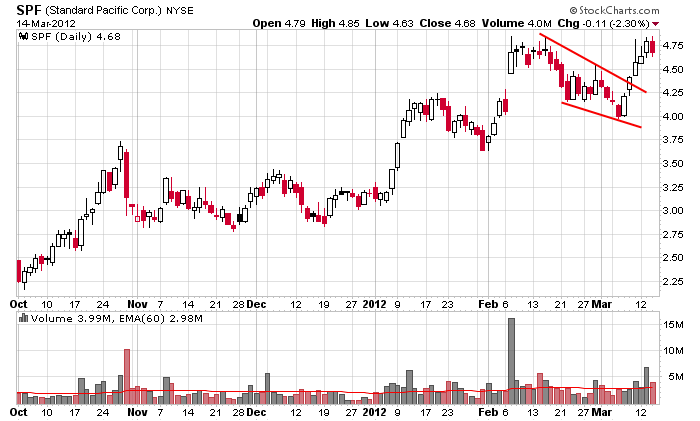

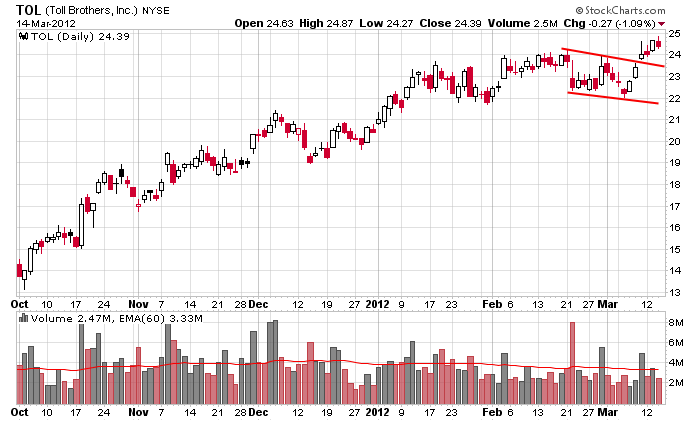

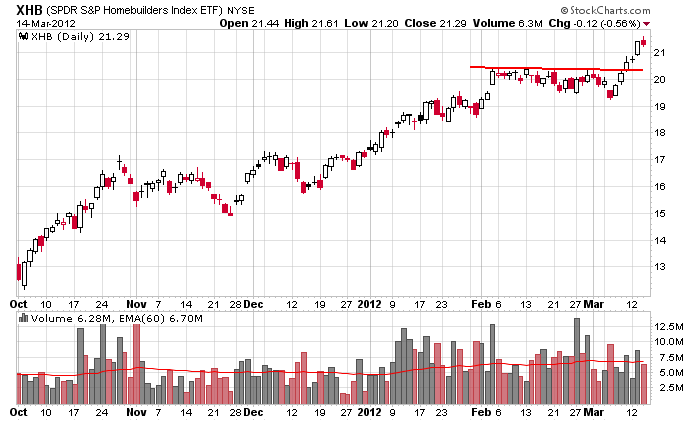

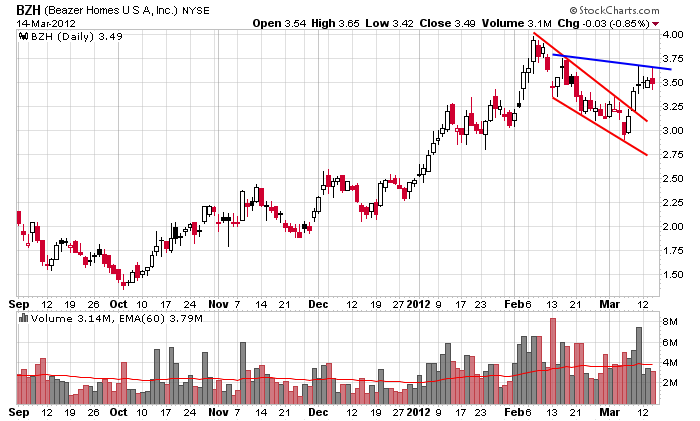

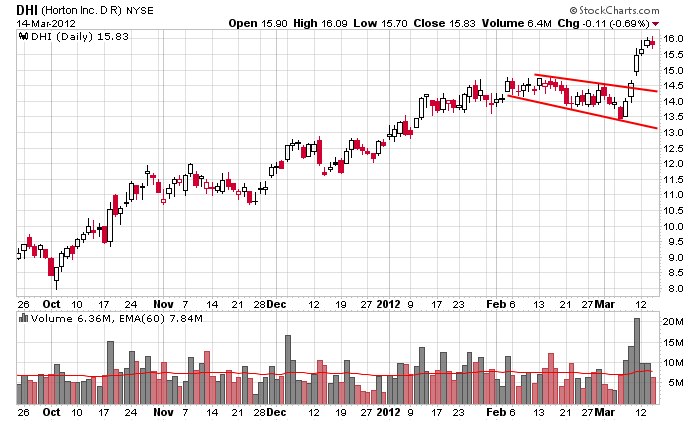

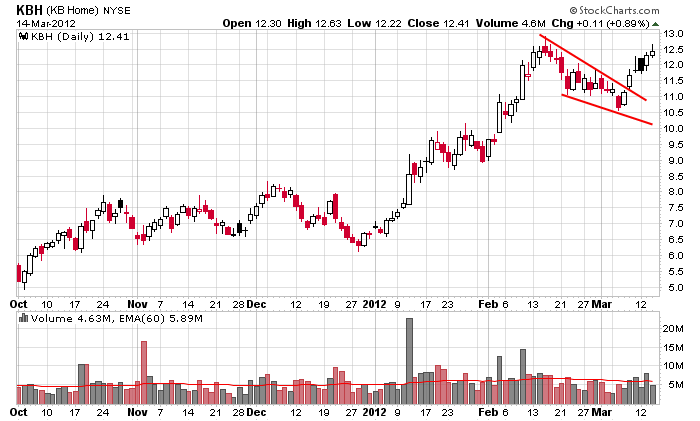

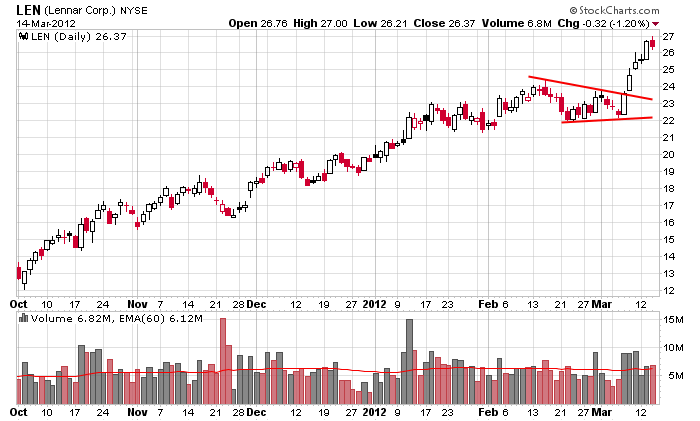

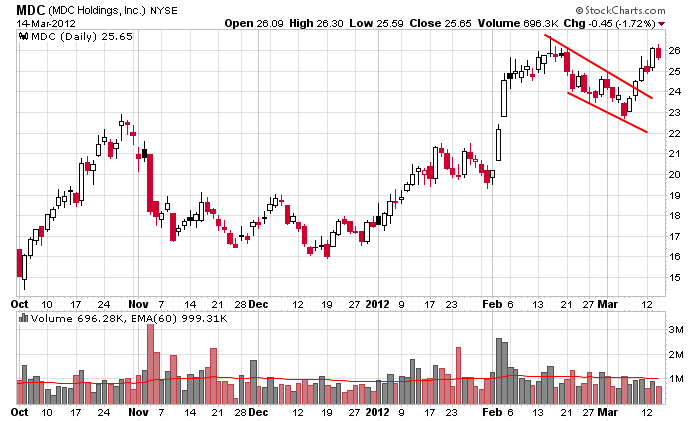

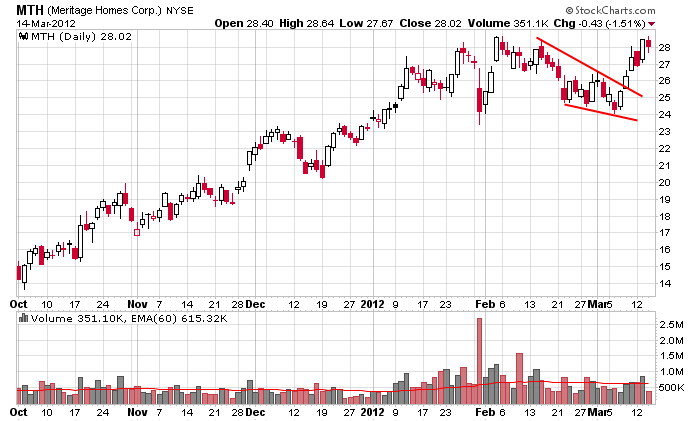

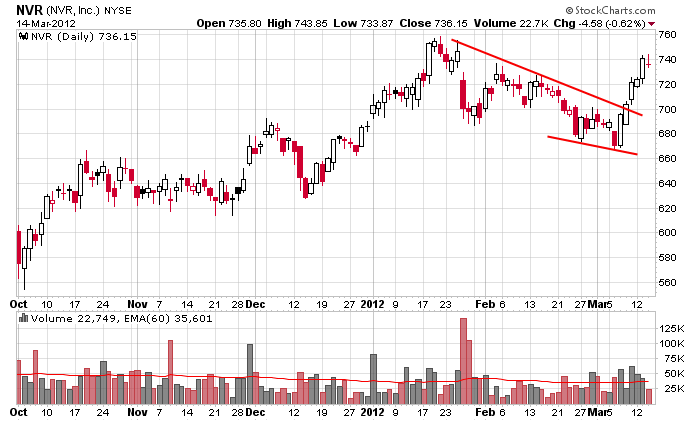

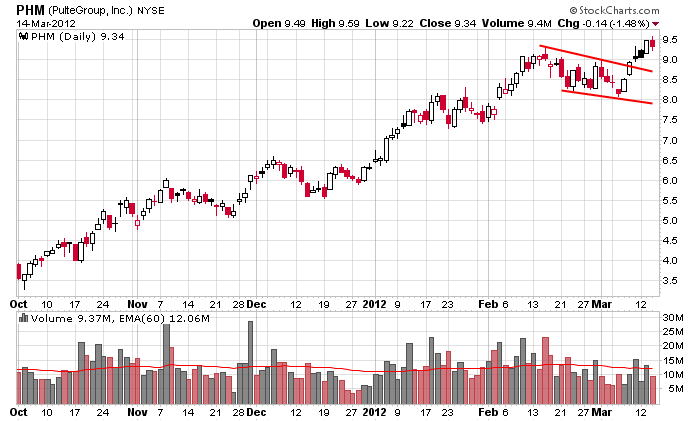

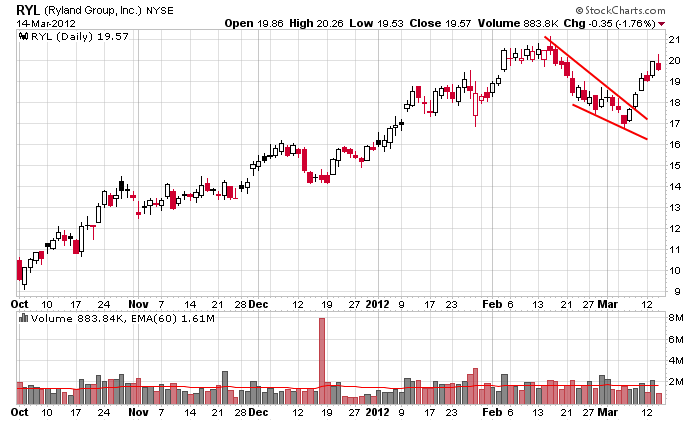

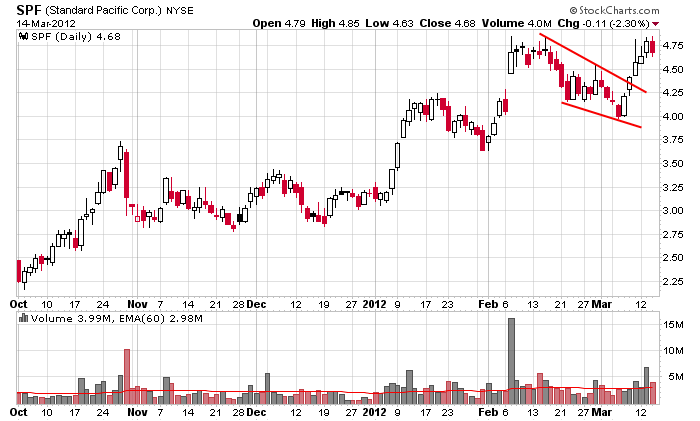

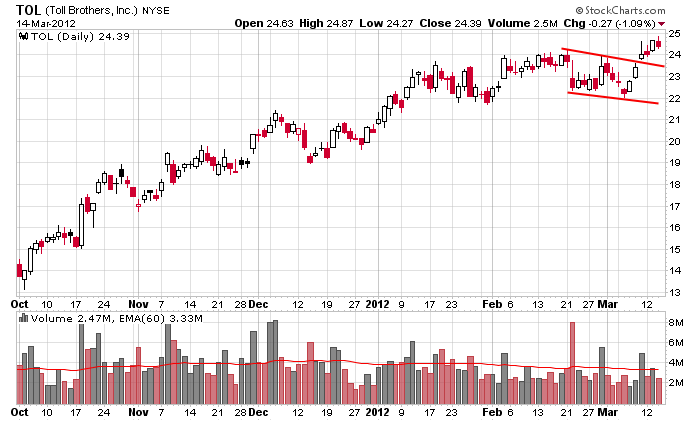

Last week I stated housing stocks were my favorite group. This is what they’ve done since…

0 thoughts on “Housing Stocks”

Leave a Reply

You must be logged in to post a comment.

Last week I stated housing stocks were my favorite group. This is what they’ve done since…

You must be logged in to post a comment.

Show-off! LOL Nice call!!! Are these stocks part of the massive Fed-induces short-squeeze since October low? or trading off 3-4% mortgage rates courtesy of Mr. Bernanke? My confusion originates from recent market performance not based on fundamentals but rather a few trillion in asset-inflating liquidity pumped into the game. MCD’s recent miss should be a huge warning signal but the market just keeps on chugging a la “short-squeeze-blow-off”. Your comments and opinion great appreciated!

Melvissss…conspiracy theorists never make money in the market….neither do cynical people. The housing stocks have been trending up for several months. You can sit on the sidelines and come up with all kinds of theories as to why they should not be going up, or you can jump in on the next dip and stop asking: why.

And I don’t care about MCD’s miss. That company is growing steadily all over the world, and I don’t think the stock is a good “tell” for housing in the US.

So you have a stock tradiing service. Today is the 14th….what day did you inform your customers ???

Thanks in advance

c porth…I brought the group to their attention last week. We have a Message Board where our members chat during the day and discuss stocks and groups, and we also have a Market Window where I post comments during the day. And of course our official trading lists are updated daily.

There is no doubt that new residential construction is picking up. Long way to go though.

Thanks for your replies. I’m BAC from $5, NLY, CIM, Cat from $82 and a few shares of AAPL so I’m not avoiding the market. My question is simply are the housing stocks moving on fundamental expectations OR are they trading on a sugar-high from all the Fed’s money printing? That’s all…

Melvissss, I agree with Jason. Let the charts decide your short term profits. The big banks recently were told to ciugh up 25 billion to help certain mortgaees. That was actually good news, imo. It offers some closure to this whole bank mess.

To digress a bit, some of the bankers and some of the politicians belong in jail for letting this debacle happen. However, the builders need the banks to heal and the sentiment is that’s exactly what is happening.

I am connected to the building industry and it is very evident that builders are starting more new homes. I’m in the Detroit market that was the first to be hit with a bad economy and will likely be the last out of it. New residential construction was non existent. I have seen more blueprints in the last 3 months than I saw in the last two years. It all starts with lending and more people are getting loans and in turn are satisfying a reasonable pent up demand for new homes.

We have a long way to go but I have been in BAC and PHM for 4 months. Get on the wagon before we run out of gas. Nothing goes up forever.

http://www.dwmmag.com/index.php/nahb-reports-99-housing-markets-show-improvement-in-march/