Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. China rallied 1.2%; Malaysia and Taiwan dropped more than 1%. Europe is currently up across the board. Austria and Germany are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up about 1%. Gold and silver are up.

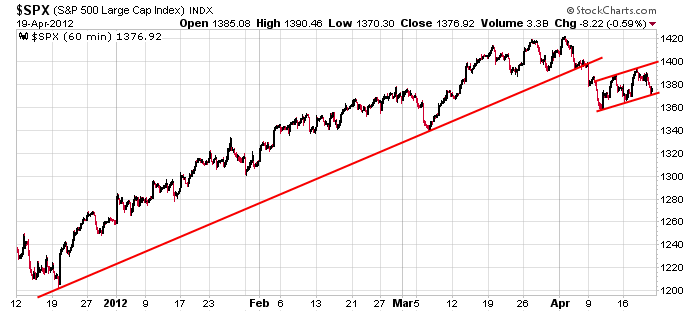

Here’s the 60-min SPX chart I’ve been posting all week. Allowing for a little wiggle room, the index remains in its rising rectangle pattern. Right now it has bearish implications, but if it lasts much longer, the pattern, relative to the “flag pole,” will be too big and therefore will be much more neutral.

Despite the increase in volatility, the market is flat over the last 8 days and also flat since the end of February. We’ve had some ups and downs, some scary days for the bulls and bears, big gaps in both directions and in the end there is very little net change. This isn’t a time to be super aggressive. Don’t churn your account while the market figures out what it wants to do next.

On the earnings front, many stocks are experiencing big moves after releasing their numbers. Be careful. Holding into a report is pure gambling. Look at IBM, INTC, QCOM – each got hit hard. Today RVBD and SNDK are getting clobbered before the open. On the other hand EBAY gapped up big. Today GE and MCD will gap up. Flip a coin.

I’m maintaining my defensive posture. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 20)”

Leave a Reply

You must be logged in to post a comment.

No need to fret with our savour Gen barnacle at the helm, paving our way with rose petals

Flipping coin >>>ting<<< Bullish! and the raising wedge is becoming more triangular (flatter top).

the sp has now spent 10 days between the 50 and 20. that ain’t no fqn wave it ain’t no fqn pattern its fqn FLAT

That’s on the ESM12 60d60m chart. I think the futures are more bullish in the short term.

Yo Brian! I wanted to short above SPX 1380, but the ability to hold the trendline from the OCT/DEC lows as well as the 50 day EMA leads me to stand aside for now. Today/early next week could be significant, IMO, i.e. if SPX continues to hold above the trendline/50day EMA we could be in a triangle wave 4 of C with a test of 1422 and new highs ahead. I’d rather short lower on a break of the trendline/50day EMA. The bears need to take control by early next week is how I see it.

Hey Pete! A triangle is a real possibility. I’m short here and debating about the stop at either a new high for the day or 1398, point of break in the previous wave pattern and the upper trend line of the current. Unfortunately and fortunately this is a risky and fun endeavor, respectively.

Speaking of the triangle idea, if we’re going to SPX 1340 before 1422, this could also turn out to be a triangle “b” wave (“a” down from 1422 to 1357). That’s my problem here. Do I take the risk and short above 1392 (or better yet, a reversal from .618 retrace at 1398ish)or wait for a break below the 50 day EMA? I guess I’ll have to see how today/early next week turns out.

When you have too much doubt, just stay out. Your arguments will only be resolved with time. I’m liking 1398 for a multitude of reasons. But, whether or not it gets there is just speculation. But, if it exceeds it with force, I’ll bail out for sure.

If our shakespearian actors can convince the blind masses europe is fine, the usd has plenty of room to drift down and stablize our market through the summer, but they have to figure out how to keep oil from rising as it does

the fed has figured out how to drag market movement and trading out. Like going to the grocery store and being locked in for 4 hrs. You buy more and don’t hurry back. Small

wonder e brokers have to give free trades and cash. This market has been heavily sedated