Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed down across the board. Hong Kong, India and Singapore dropped more than 1%. Europe is currently down across the board. Amsterdam is down 4%, Stockhom 3%, Austria, France, Germany, Norway more than 2%. Switzerland and London more than 1%. Futures here in the States point towards a large gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

The reason for today’s weakness is Europe. Election news in France…a failure to agree on budget cuts in the Netherlands…a German manufacturing number that shrank at its fastest pace in almost three years…debt held by the 17 euro countries hit its highest level ever since the adoption of the Euro…Spain is officially in a recession…Italian consumer confidence dropped to its lowest level in 15 yeras – all have added to the selling pressure.

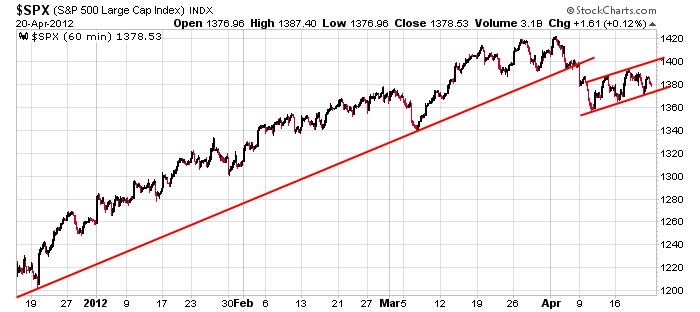

Here’s the S&P 60-min chart I posted all last week. The week began and ended with the index in a rising flag pattern. Today’s open will be below the two most recent lows (both established last week) but not below the low of the pattern. My next support level is 1340…after that, 1310.

I’ve had a defensive posture for a couple weeks. A combination of lagging breadth indicators, some weakness from key groups, even more weakness from some key stocks, an inability of either the bulls or bears to be in complete control – added up, the next near term move was not clear, so I believed it was wise to not be aggressive. This has served us well.

Trading is not hard when “the coast is clear,” but at times like this when sentiment has shifted and there are so many major unknown factors outside our control, it can be very hard. Don’t push it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 23)”

Leave a Reply

You must be logged in to post a comment.

I love the smell of napalm in the morning

not sure if the bulls may put up one last fight

but with spanish debt,there may never be a bull fight again

bulls will now be used for consumption and quite possibly become extinct

I love the smell of roast beef

put apple in this pigs mouth and throw it in the pit as well. I’d love to see 2900

In reality these are people you’re roasting.

they shouldn’t have went to hawaii

Calling the stupid, stupid? Who led them to Hawaii? Stupid sheep.

not to worry nank to the rescue. saved your bacon

by picking my pocket.

brother ben to save the bacon–no

but the market intra day seems to say maybe–wed fed meeting

and tues the apple to report–rumours apple may be in merger/aqusition talks

could be why recent weakness in the apple—tues may settle that to

we hit so key support areas and now a bit of a bounce up,that looks corrective

europe was well down and starting to look impulsaive–china in trouble

still not sure if the down has started or small sideways triangle

Pete ,will know

maybe have to wait for french ellection in 2 weeks

one party wants to succede from europe

so we could have some nice whipsaws for the benifit of the daytraders

crack the whip as we go in/out

half way to 2900 and slam the brakes on. we can not go down too fast. we cant have panic selling. that would never do. to much money would be lost to rougue traders like taz

if the hats didn’t have their finger in the dike, we’d be down 500 pts

Maybe SPX has to backtest the important trendline break that occurred today and fail before testing 1357 and eventually 1340. Leading sectors like xlk, xlf, xlv are looking vulnerable. If AAPL disappoints after tomorrow’s close (either earnings or future expectations) …..

Jesus Christ

The reason for today’s weakness is Europe. Election news in France…a failure to agree on budget cuts in the Netherlands…a German manufacturing number that shrank at its fastest pace in almost three years…debt held by the 17 euro countries hit its highest level ever since the adoption of the Euro…Spain is officially in a recession…Italian consumer confidence dropped to its lowest level in 15 yeras –

yeah we hear all that nonsense Jason… but we’re lookin at this here triangle thingy hahahaha

Hi Pete…I value your e-wave & TA insights, please keep them coming.