Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed and with a bullish bias. There were no big winners or losers. Europe is currently trading mixed and with a bullish bias. Austria, France, Norway, Stockholm and Prague are up 1% or more. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

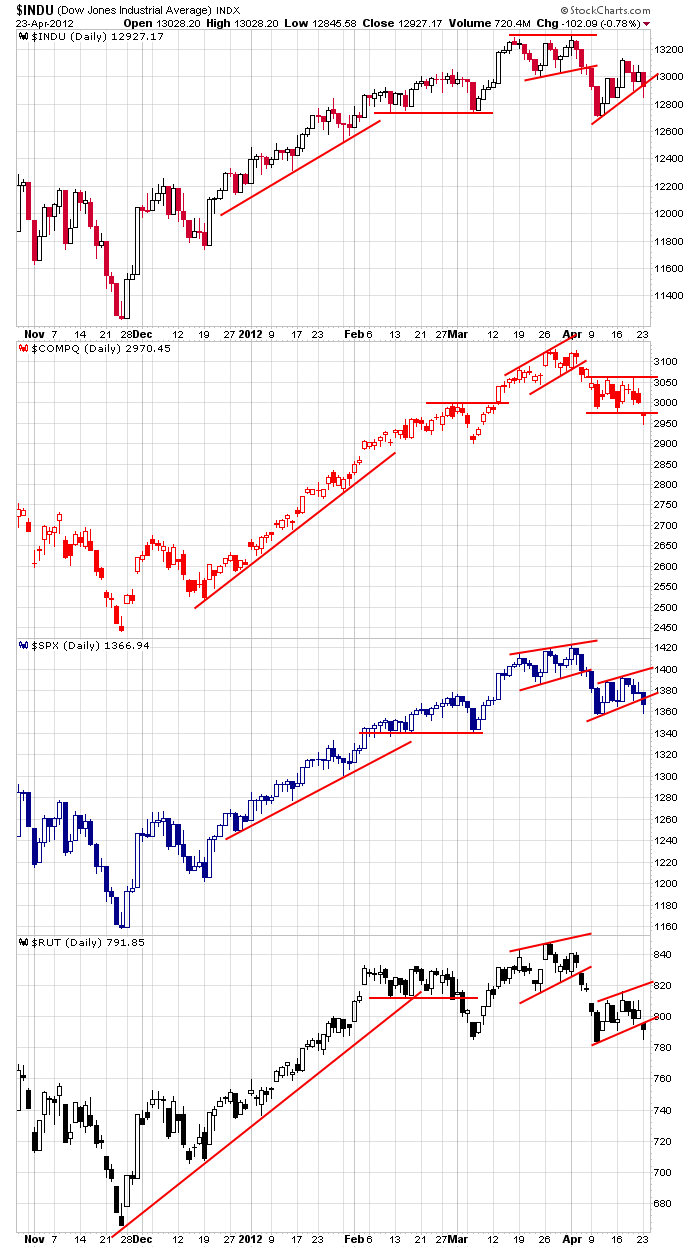

Yesterday the indexes gapped below support of their rising patterns, but there was virtually no follow through. Their intraday lows were established in the opening 45 mintues, and the rest of the day was characterized by prices slowly moving up. Here are the dailies. Only the Nas made a lower low. The Dow, S&P and Russell held the lows of their patterns.

Trading has not been easy lately. We have equal number of decent long and short set ups, so there isn’t a clear dominant near term trend. We’re also getting a lot of large opening gaps which render many set ups unplayable. This is definitely not a time to be super aggressive. There’s nothing wrong with having a defensive posture and laying low.

There’s lots of housing data out today…Case-Shiller 30 min before the open, new home sales & housing price index 30 min after the open. AAPL has earnings after today’s close, and tomorrow is a FOMC day.

There’s lots of “stuff” going on. Sometimes the market has a mind of its own and ignores all the stuff. Other times the stuff is very important. Such is the current case. News once again is controlling the market – or at least the open. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 24)”

Leave a Reply

You must be logged in to post a comment.

Hey, Russ! Pay attention. I read your late afternoon comments yesterday.

You’re a non-believer. I read your ramblings on how manipulated the stock market is and the apparent uselessness of TA. I get it, but frankly, I’m not interested. You can understand.

To be clear, I don’t comment in order to preach to you or try to convince you, or anyone else for that matter, that TA works. You already know about TA. You either believe in or you don’t. Let’s leave it at that.

When RSI’s went above 70 and stayed there, it became apparent TA doesn’t work anymore. This market is being controlled and managed.

To continue to talk about TA is like a little girl at her pretend tea party. Pete… there’s nothing in the cups

Italy, spain and france up 2%

Please continue to post Pete. I believe that you have a very good handle on your TA/Ewave observations. I am anxious to read them.

SPX has now moved back over the 50day ema. What are your thoughts? My portfolio is tilted slightly short at the moment.

Thanks

Chris – From an EW perspective, it still appears that we’re in a corrective pattern from SPX 1422, i.e. wave “a” down to 1357, wave “b” in progress or completed at 1393. If wave “b” is completed at 1393, then wave “c” would = wave “a” at 1328.

EW aside, I still view the break of the OCT low/DEC low trendline as important and we may be seeing a backtest at 1377ish which is also a Fibo .618 retrace of the decline from 1393 to yesterday’s 1359 low. I also note that INDU, NDX & RUT or at or below the important 50 day EMA. Speaking of RUT, the daily chart may be showing a potential H&S top with the 10, 20 & 50 day EMAs forming the right shoulder resistance. All in all, I think the indices are susceptable to a rapid decline this week and AAPL’s earnings report results today combined with Benny and the FED’s FOMC meeting tomorrow could be the catalyst. So, for now, 1357 & 1340 (down to 1328) are the downside targets near term based on what I see.

Pete, your input is always appreciated by me – keep it coming.

Brian – your triangle idea (for wave “b” ?) would fit nicely into this week’s FOMC and last weeks options expiration as the cause for consolidation.

as a daytrader of the world indicies with pos 6 -8 indexes open possitioned at one time i cant trade with ew on all but only with horizontal s/res,piviots ,mas,tick inds ect

i look for the strongest or weakest index and over weight that

but i too appreciate your EW,Pete

speaking of funny mentals,imo the instos use fundamentals/news items to trap the retailers

atm a third of the world has monthly opts ex this week and usa has weekly opts ex

i keep hearing this rumour about apple in t/o mode

that aside europe controls usa markets to midday,then usa instos take over and atm ndx 100 is the weakest

good scalping