Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mixed. China, Japan and Taiwan did well; there were no big losers. Europe is currently mostly up. Belgium is up 2%; Austria, France, Germany, Stockholm and Prague are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The big news is AAPL. They easily topped earnings expectations, and the stock is being rewarded with a 10% gap up – a massive move for such a big company. The stock had dropped 10 of 11 days, but today’s open will recapture the losses from the last week.

Apple is 15% of the Nas 100, and tech is 23% of the S&P 500, so AAPL single handedly will boost the market today. Then the Fed will do their thing. Rates won’t change, but because economic numbers have softened since their last meeting, the statement may change. Some governors probably want to play it safe and do QE preemtively to stave off a recession. Others will want to the economy to weaken much more before the Fed acts. Perhaps the last line of their statement, which tells us the number of dissenting votes, will be just as important as the statement itself.

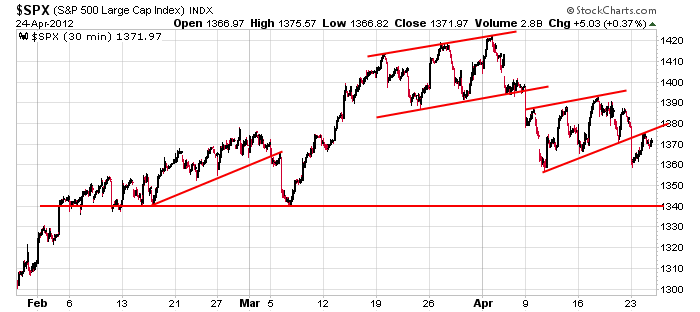

Here’s the 30-min SPX chart. The indexes will gap up to about 1382 – in the middle of its range and a couple points above “support turned resistance.”

Trading has not been easy lately because we haven’t gotten much follow through. Be defensive. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 25)”

Leave a Reply

You must be logged in to post a comment.

up on bad durable goods. back to flat and locked for the day. tell me if you’ve seen this before. europes up celebrating being in a recession. printing presses smoking. anyone remember howie mandel holding his hands out and asking “what?” thats bernanke’s new posture.

analyze that

Should China buy U.S. companies? Since China is doing so well, should they own, manage, etc. U.S. capitalism?

they have resources, production and consumers. they’re collecting gold, usd’s and euro’s…

and their govt actually acomplishes something. they’re on the rise… we’re going the other way because we have no leadership… just bickering

I think the fed has put some kind of restrictions on banks proprietary trading to limit volitility. I’m making a lot less money. Thats why I’m so pissed off. The only consolation is

I hope its helping the country and not screwing it up

A FOREX newsletter suggested the USD would be up at years end because the EUR will be down and China is investing/buying U.S. firms. That’s what brought about the question. It seemed rather ironic.

greed is so dominant in our govt and business world they would sell our organs. bring on the hunger games

Yo Pete! I’m not yet ruling out a triangle, probability goes up if the Jun ES contract rices above 1390, otherwise my primary count is that b of 4 completed on 4/19 at 1390 and we just completed 2 of c of 4 this morning at 1387. If so, 3 of C is getting its legs. I’m still bailing at 1398 because neither count is likely if it rises above that point.

Yo Brian – I’m still leaning to the idea that wave “b” is still in progress as long as SPX 1398 (.618 retrace of wave “a”) isn’t exceeded. From MON low of 1359ish, I see 3 waves up and likely 5 waves will form soon on houly chart. If so, it could complete a smaller “flat” pattern from 1357 for wave “b”. Beyond 1398 puts that in doubt. If I see a reversal in the 1392-1398 area, it could be a low risk place to get short.

he just said… and I quote “commodity price behavor which has been well CONTROLLED”

he said the fed purchase’s securities and has a 3T balance sheet

The combination of AAPL’s blowout earnings and Ben’s tightrope act (maybe he’ll ease again & maybe he won’t but nevertheless do not fear, he’s on the case) has averted downside follow through in the stock indices. Now, we’ll find out whether the bulls can take control again an follow through. For me, AAPL above 620 means a test of 644 and would boost NDX, SPX et al.