Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up, but there were no noticeable movers. Europe is currently mostly down, but there are no big movers there either. Futures here in the States point towards a flat open for the cash market.

The dollar is down slightly. Oil is flat, copper is up. Gold and silver are up.

It’s been a heck of a weak…huge gap down Monday based on a lot of negative news from Europe, but the low of the day and low of the week were established in the first 45 min of trading, and it’s been mostly up since then. Yesterday’s big gap up (thanks to AAPL) helped of course, and now the S&P is just a couple points from last week’s high and less than 10 points from filling the post employment numbers gap down.

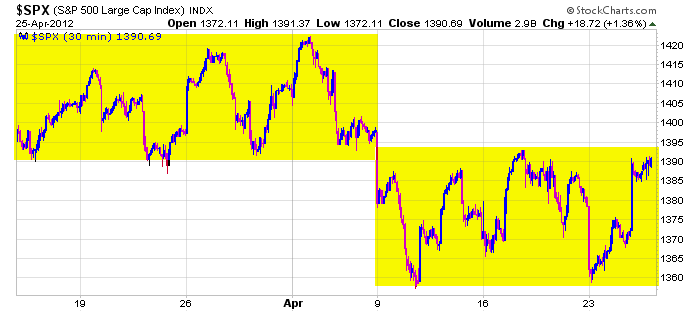

Here’s the 30-min S&P over the last six weeks…from one range to another. There’s a big block of resistance between 1400 & 1420, and it looks like strong support is being formed at 1360. With yesterday’s close at 1390, the index is smack in the middle.

Some indicators have started moving up, but some key stocks are struggling. Throw in a continuation of earnings season which has been whipping stocks all over the place, and I think a defensive posture should be maintained. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 26)”

Leave a Reply

You must be logged in to post a comment.

the 1st week of march the sp was at 1378. the 50d and shorts would have covered and taken profit at 1320. the market bounced at 1340, 20 pts short.

this whole month support and shorts would have covered and taken profit at 1340. the market bounced at 1360, 20 pts short.

THIS IS EXACT AND SPECIFIC CONTROL. THIS IS THE ONLY DATA AND FORMATION THAT MATTERS.

You have to be flexable and quick to adjust to be a trader, not pig headed trying to MAKE your old ideas and methods work. The fact you guys cannot adjust even when things are pointed out to you makes you poor material to be traders

point taken – thanks for the insight

yeah, we pig-headed old-fashioned inferior-fiber guys all suck, whoever we are 😉

Prove it. Post your SPX calls.

http://www.healthyplace.com/psychological-tests/

RutRoh, Beware the stressor or my personality will beon the next Criminal Minds. Wow! I just made up another four letter word, beon.

Isn’t it wonderful to be able to share trading thoughts and ideas in a mutually respectful manner? Of course, depending on whether you’re a daytrader, swing trader or longer term trader, some TA analysis may work in some time frames and not in others. For eaxmaple, a longer term trader may have gotten long SPX at the DEC low around 1202 and wouldn’t give a rat’s butt about looking to go short since then. The swing trader would probably be standing aside as Jason suggests and looking for a favorable entry point – long or short. The daytrader would do what he/she usually does – be long and short intraday. Regardless of trading technique, all would do the most important thing – exercise good money management by trading the right size and limiting loss on any trade. That would apply regardless of the TA favored and even if the markets are controlled, IMO. And I say that with all due respect. Best wishes to all in their trading.

Pete, thank you for sharing your perspective without anger, ridicule or attempting to initiate a diatribe.

Pete,i was hoping u might give us ur wave count–the bounce looks imo to large to be a triangle,but could be –also bounce in euro broke some resistance

without prejustice my trading style lends me to more intraday observations,with 2 large monitors open and world indexes and futures open on 1 -5 -10 minute charts

imo the markets are controled –but not necessarily by the fed or central banks

the 90 pound gorillar is the instos,without whos help the fed is dead

now we know 60% or more of the volume is computer insto black box trading

we know instos dont use retailer indicators but have their origins in the old ticker tape trading,now replaced by pit trader piviots ect

just food for thought

my tick ind today sugests instos selling into strength

derivitives and opts strike prices imo have a role too

Any reversal in SPX around 1398+/- 3 pts may be a low risk short position with a tight stop loss above 1402, IMO. I’d like to see some impulsive downside action if that reversal occurs looking for at least a test of of 1385.

I like it PeteM short and to the point.

Thanks Pete

I’ll short a close in SPX below 1400 & close the trade above 1402 tomorrow.

Looks like they’re buying the close.

Looks like Hawaii is selling. Good call PeteM.

Hey Pete, I gather you are short now? I may be brain dead, but I’m still short even though 1398 was reached in the Jun contract (1398.25 was the high today and 1399 in after-hours). My line not to cross is 1399.5. Your entry may turn out very well. We’ll see soon. I will hang on if I see selling pressure soon. Honestly, I thought the premarket high was the end, an obvious inaccurate assessment. We are definitely riding the ‘engine that could’ train.

yes, getting some selling pressure 😉