Good morning. Happy Friday.

The Asian/Pacific markets closed mixed; there were no big movers. Europe currently leans to the upside. Austria is up 2.2%, France and Stockholm are up about 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil is flat and copper is up. Gold and silver are nearly flat.

Standard & Poor’s has cut Spain’s sovereign credit rating to BBB+ from A. Spanish unemployment moved up to 24.4% in March – worse than the 23.8% expected.

Italy’s borrowing costs are inching towards 6% again.

AMZN is up almost 17% after earnings. PG, MRK and F did well with earnings, but PG is taking a hit in pre market trading.

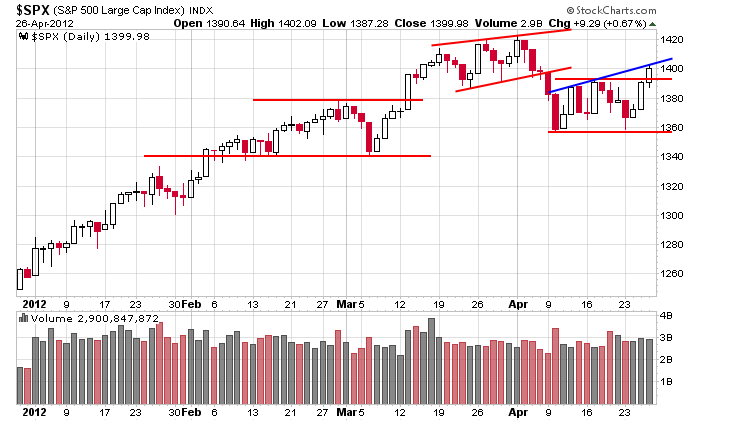

A week ago I argued the market was trading in a bearish wedge or flag having just moved through a longer term trendline (not shown below). Not any more. With the successful test of the low from two weeks prior and the forceful move up the last two days, the overall pattern has been neutralized. 1400 is still a level that needs to be dealt with, but the combination of the last couple days has been a step in the up direction.

I’ve had a defensive posture for a couple weeks. It’s mostly kept my stress level very low. If you’ve been bearish, you’ve seen paper profits either wiped out or significantly reduced. If you’ve maintained a bullish stance, you’re breathing easier now, but you felt a lot of heat for a couple weeks. And if you held into an earnings report, you’re nuts. Big moves have been the norm after companies have released this season.

Since the overall trend remains up and the intermediate term trend has neutralized, I’ll have a bullish bias heading into next week – assuming nothing major happens today.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 27)”

Leave a Reply

You must be logged in to post a comment.

Hey Pete! The futures got nothing more than a 3 wave correction last night.

no s#it? isn’t it time to go suk on a wine cork?

I would if I liked the taste of cork.

ESM12: 5d5m: Looks like this dip is being bought. Should reverse at 1396 or 1392, but I don’t like this morning’s 8:30 ETZ bars.

Decent down volume so far. But, if the past is a good predictor, it will be received as a buying opportunity. We will see as we approach 1392.

A 61.8% retracement of the recent rise (from this mornings early low at 1386.5 to the high of 1403) brings us to 1392.8 – just touched 1393. Let’s see if that holds.

Retrace, that is.

Looking good so far. Needs to go thru 1396 and hold.

Out. It’s sucking on long-nicks.

is that a small brodening pattern –jaws of death i see on Jasons chart

russ if u dont like retailer indicators ,i suggest u get ur self some big boy insto inds

my tick ind is neutral indicating sideways chop—not good for a daytrader

well the instos servived another week of opts ex with a bit of help from verbal nonsence of

uncle ben and the big ponsi continues until a couple of central banks go bust and the ponsi pyrimid fails

what about if the australian central bank provids some liqidity and we have a kangaroo ponsi

What are insto inds?

pit trader piviot points–tick indicator—-internals ects

I look at the trin and tick as well as everything else. nothing speaks as loud as the look

on geithners face when he talks about his and obamas markets. did you see him yesterday?

little prick. reminds me off weenies in school that never got any respect, then get a little power as an adult

look at the slow stoch on the vxo. this is ridiculous.

http://stockcharts.com/h-sc/ui?c=$VXo,uu%5bw,a%5ddaclyiay%5bdd%5d%5bpb50!b200!f%5d%5bvc60%5d%5biLb5!Lh8,3%5d&pref=G

0 volitility? really? I feel like I’m in the twilight zone

is the china/usa conspiracy continueing —buy ur yaun now

i love yams

Which conspiracy?

Brian – I’ve been out on service appointments today. I got short on the SPX close yterday and have not yet covered. If SPX can’t move & stay below 1398 this PM, I’ll cover. The hourly chart seems to be in a 5 wave advance since 1359. If it can’t start a meaningful decline from today’s high, I wouldn’t fight it.

You know, sometimes I could swear Neal is still around – or one of his relatives.

Who is Neal?

Neal is a woman with a deep sultry voice who trades naked. We all miss her voice.

Looks like we are on the wrong side of the trade. Pull backs are clearly corrective, IMO.

there were prob a lot of bets on apple and others on the weekly opts

your uncle ben is a giant put that cant be paid

the world is run by derivitives

some are devient derivitives

Looks like the close is a shake out.

RichE—the gaint conspiracy with obarma blessing is where china ,lets the yaun float and takes over as world reserve currency –squashing the usd thus saving usa from default,but causing tremendous usa inflation,poverty

Russ i agree with some of what ur saying and its good that leavitts have a forum that one can express those without bitterness

now lets step out side the box–trading is 90% mind set

with my negative totally bearish outlook i could only be a bear is i was a long term trader,

but i would get destroyed

therefore the trading that best suits myself is as a daytrader with the intraday having its own trend –this suits my mind set and i can approach it with out bias

and i take full responsibility for any mistakes i may make

you only have to answer to your wallet