Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. Hong Kong (up 1.7%) was the only 1% mover. Europe is currently mixed. France, and Amsterdam are down more than 1%. Futures here in the States point towards a relatively small gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

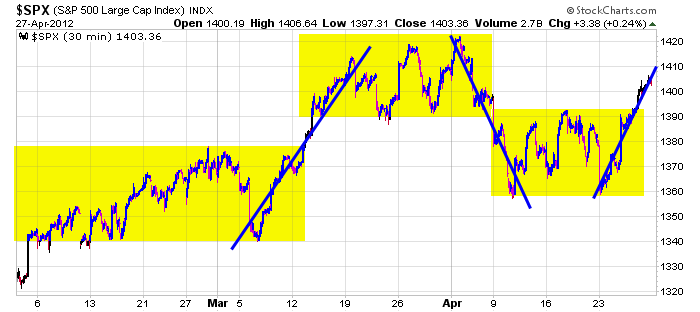

I don’t have anything to add to my weekend report. The long term trend remains up – this has been the case for several months. The intermediate term trend is neutral – as of the middle of last week the indexes were mostly flat over the previous two months, and other than a rally at the beginning of March and a sell-off at the beginning of April, it has been range bound since the beginning of February. The short term trend is up but getting over extended. Since last Monday’s open, the market has moved up five entire days.

Important groups improved a bunch last week, and many leading stocks did the same. There was also improvement from the breadth indicators. All in all it was a good week. Instead of the market being in a dangerous spot and investors being very nervous, at the very least, the market built itself a cushion, and the bulls can relax a little.

Trading has been difficult lately because we have not always had an obvious and dominant trend to cling to. Rallies have gotten sold and dips bought. No move has lasted long, so unless you were ahead of the curve taking profits, you didn’t make nearly as much as you could. The market changes, and you have to change with it. Here’s a chart showing what I stated above. Other than a couple short-lived directional moves, the market has been range bound.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 30)”

Leave a Reply

You must be logged in to post a comment.

On the long again

Just can’t wait to get on the long again

The life I love is making money with my friends

And I can’t wait to get on the long again

Todays tivia question – where did that little french bastard fibonacci steal the sequence of numbers known as phi, from?

Donald Trump

lol correct! good job

here’s another one. how did the brooklyn dodgers get their name?

ps it was a frenchman that made up that devinci code crap also

Yo Brian! I held onto my short position put on at THURS’ close only because I thought I saw a potential completion of 5 waves on the hourly chart (from 1359ish) during FRI’s trading. The question for me is, did the move up from 1359 begin a new up leg and have we just competed 5 waves up for wave 1 of a larger advance, or was FRI’s high the completion of wave B of an eveloving ABC decline from 1422? Regardles, with that in mind, I’d expect to at see a dcline here to at least 1393 to perhaps as low as 1377 and then evaluate the pattern of the decline.

What are your thoughts?

I held my short as well. I’m going with b ended on Friday until proven otherwise. That puts a stop about 10 points above here.

sideways moves are always the most treturouse for everyone and probably for EW’s

yes even for daytraders too

today on my tick ind has been more bearish than bullish

but imo the long only mutuals are still in control playing their end of month lier window dressing–the insto bank hedgies havnt shown their hand yet–we will know when

this is a different card game than even mr fiborarchi or mr elliott was used to

with black box computers as the dealers controling more than 60% of the fun and volume

the big world ponsi will end soon and who will be left holding the bag–we world central banks

and joe six pack will have to bail them out

buy ur chinesse yaun for the conclusion to the world currency wars

when the end of the world does come many big banks inc morgans will not survive

but they will have the last laugh in their bankruptcy because they will be short the world

and make massive profits

ESM12 5d5m: volume picking up.