Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across the board (except for New Zealand). Australia, China, Indonesia, Japan and Singapore dropped more than 1%. Europe is currently mostly down. Austria, Switzerland and London are down more than 1%. Futures here in the States point towards a big gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are getting hit hard.

Markets around the world are melting down. Nowhere to run, nowhere to hide. Everything is getting hit. Six trading days ago the S&P hit a new high and was less than 10 points from a multiyear high. Now, after dropping 4 of 5 days, it’s dropped more than 50 and is at a 2-month low. Things change quickly. Several months of progress wiped out in a very short period of time.

News from Europe is the same. There’s fear Greece will get kicked out of the EU, and Spain’s banks are in trouble. With 434 of the 500 S&P companies having reported earnings (80% beat expectations) and a lack of news here, Wall St. has nothing to focus on except Europe.

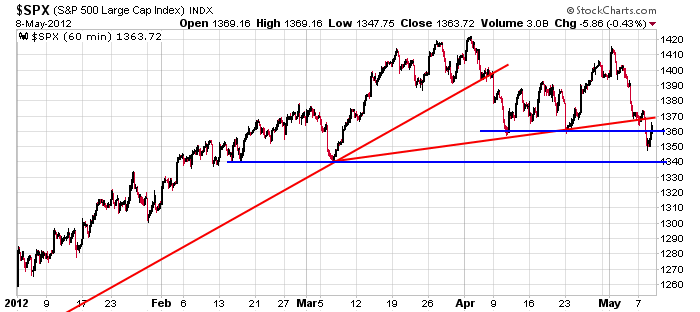

Here’s an update of the 60-min S&P chart. The index took out 1360 yesterday but rallied to close above it. Today’s open will be slightly above 1350. My next target is 1340 and then the 1275-1300 range.

The path or least resistance remains down, and when we wake up every morning and see the futures down 5-10 points, it’s not even worth it try an oversold long for a quick bounce. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 9)”

Leave a Reply

You must be logged in to post a comment.

Remember this is 2012 (the Mayan’s predicted this to be the year the world ends).

I keep it simple (no elliot waves, no fibs) just trade ranges and adjust when necessary; however, I do have a small long position and a small short postion in some common stock. I’ll ring the cash register on these soon and just stick with range trading.

Long JASO

Short WGO

Hey Pete! Shaping up to maybe a descending triangle – looks like one, that is.

in the futures that is, since sunday night, 6 min bars. But, the base of the triangle is being threatened now with selling. BTW, I covered my short this morning in anticipation of an e wave bounce – might not get it.

Brian – The question for me (regarding SPX) is, was yesterday’s low the end of wave 3? If so, the rally into 1366ish followed by today’s action could be part of a frustrating wave 4 taking us into next week before a wave 5 down below 1340. Another alternative is an ending diagonal (for wave 5)playing out over the same time frame. I’ll be watching some downward trendlines in the meantime & may take a stab at a short position if 1366 provides resistance.

I’ll say this – if SPX starts trading below the 200 day EMA (1313 and turning sideways), the case for larger wave C having ended at 1422 (or even 1415) would seem to get stronger, i.e. instead of this 5 wave downward sequence from 1415 being wave c of 4, I’d have to allow for this move down from 1415 being only the early stages of a bear move. It seems to me that we’re running out of time if we’re going to see a new high beyond 1422, so SPX needs to find a bottom above 1313ish, IMO.

Seems a bit ambiguous at the moment. The low this morning was too low for a d wave. Scrap the contracting descending flat triangle. I’m thinking I’m looking to reestablish my ES short around 1364 based on price action.

I’m short a position from just above SPX 1360. Still working on the assumption we’re in wave 4 with wave 5 down ahead. I won’t stay around if 1353 can’t be broken or we start trading above today’s high.

Brian – I assume you never got short today. I covered my SPX short position at 1358 after a failure to trade below 1355 on a few occasions. I’m still thinking we’re in wave 4 of the down move from 1415 as long as SPX stays below 1374-76. If trading gets above that, we may have seen wave 5 completed today. In that event, whether the advance from today’s low is 3 or 5 waves up should clarify things further.

Right you are. And, now it is retreating. Fun for all.

3rd round trip on arch coal ACI in 3 days. todays was worth 8%. I call them tides lol comes in goes back out. leaves the cash in my acct

LOL, now we know what geithner was doing in china. he sold them a fkn bank

did the chinesse buy the fed

what is the date for the end of the known world

do we have time to collect some more bulls

was todays low the start of a upward distribution

or has the end of the world started and zero by end year

please don’t distract me, we’re trying to count these fkn waves

on the 1 -5 min charts ive been geting glimpse of impulsive up buying in europe/usa

but nothing substained,however noting dax closed up and ftse impulsive up at close

having hit important support levels as was spx at 1343

this sideways up/down is indicitive of a toping market

weather it develops into a crash will depend on merkell and the ecb

but we have french resistance and a change of political mood

there is atm no substained buying or selling

but cheif crazy horse and general custard are taking scalps