Good morning. Happy Wednesday. Happy Fed Day.

Today the FOMC is supposed to decide and announce what their target overnight rate is, but since they’re already pegged it between – and one-quarter percent, there is no suspense. This should be a nonevent, but you never know. They may say something unexpected in their statement.

Strong markets embrace good news and ignore bad news. Right now the market seems strong enough short term to be able to shrug off bad news. It may take a half day, but it should be able to do it. And besides, the FOMC rarely changes the market trend. They may cause some whippy action for a couple hours that extend into the next day, but overall, the market tends to do a good job taking the Fed in stride.

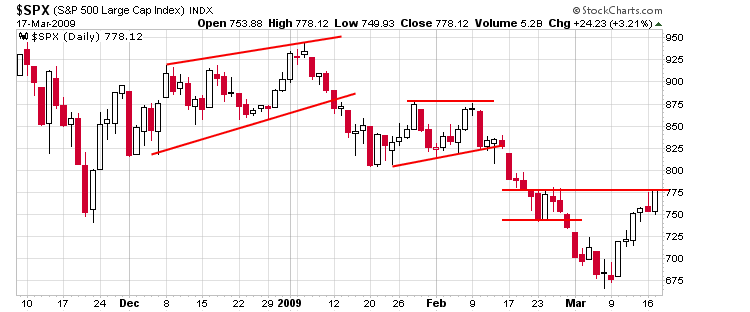

Here’s the daily SPX. Remember a couple weeks ago when 780 acted as stiff resistance? Well here we are again.

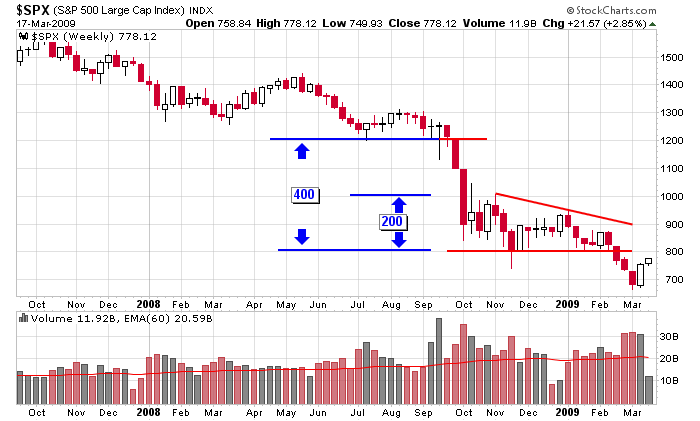

And here’s the weekly which suggests 800 is the level to watch.

But I actually think 825 is the key level. Look at the daily chart again. See that gap just under 825 and the big block of resistance between 825 & 875? That’s what I’m eyeing right now. But don’t get too giddy right now. It would make perfect sense to rally into options expiration (this Friday) to frustrate the hell out of those who bought put options on the way down and then correct next week.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases