Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Hong Kong and South Korea dropped more than 2%; Japan and Taiwan dropped more than 1%. Europe is currently down across the board, but London and Greece are the only 1% losers. Futures here in the States point towards a big gap down for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

San Bernardino has become the third California city to file for bankruptcy in the last couple weeks. Now that a couple have done it, the negative stigma is rapidly being wiped away. Many more will do it in the coming months.

The FOMC minutes revealed the Fed is open to more stimulus but the economy will have to get worse for there to be a consensus.

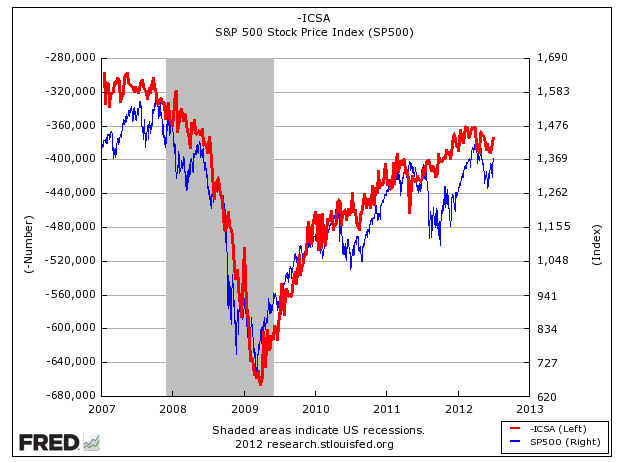

Initial jobless claims come out an hour before today’s open. The following chart has been making rounds on the internet. In blue is the S&P 500. In red is the weekly initial jobless claims number. The correlation isn’t perfect, but it’s close enough to get your attention. If the weekly jobless number starts to increase (move down – note the left side scale), the market isn’t likely to rally. It’s something to pay attention to – especially since the monthly unemployment rate is a joke.

SVU is getting clobbered in premarket trading. They suspended their dividend and are said to be mulling their options including possibly selling the company.

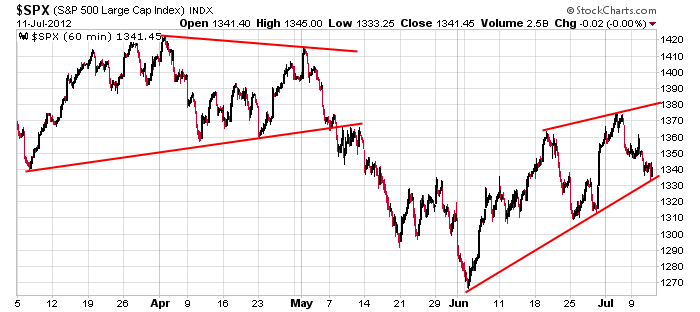

Here’s an update of the 60-min S&P chart. The index will open below support. That doesn’t automatically mean lights out, but added with the other warning recent warnings things are rapidly getting worse.

Be defensive out there. There are a few oil stocks that look good and the REIT group is nicely set up. Otherwise I have little interest going long. On the short side, in most cases it’s too late to go short. Stocks have fallen many consecutive days, so I wouldn’t want to chase them. Whatever the next trending move is, there will be lots of time to jump aboard. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 12)”

Leave a Reply

You must be logged in to post a comment.

ACI continues to rocnrol b 5.9 5.8 s 6 6.1 6.2

quack bounces off the 200dema again at 2838 2nd time in 3 weeks sometimes 3rd times the ticket