Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up, but only South Korea (up 1.5%) moved more than 1%. Europe is currently up across the board. Austria, Germany, Norway, Stockholm and Greece are up more than 1%. Futures here in the States point towards positive open for the cash market.

The dollar is flat. Oil is up almost 1%, copper almost 2%. Gold and silver are up.

JP Morgan (JPM) is out with earnings. Their trading loss, which was originally reported as $2B and then revised up as high as $9B, ended up being $4.4B. The bank says they have put most of the problem behind themselves and can now focus on what they do best. The stock is up about 1% before the open.

Wells Fargo (WFC) is also out with earnings. They beat by a penny and said they benefitted from stabilization in the housing market, but the overall economic recovery is uneven. The stock is down before the open.

China’s GDP number came in line with estimates… this was somewhat of a relief.

Singapore’s GDP contracted 1.1%.

Moody’s cut Italy’s government bond rating two notches. Italy sold 3-year bonds at its lowest yield since May.

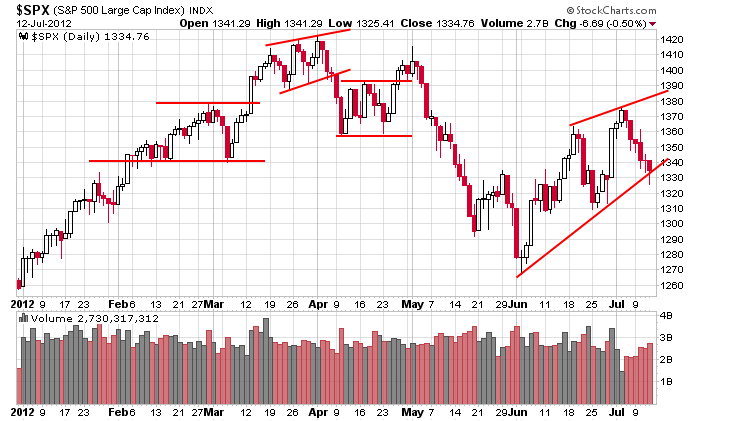

The market is in the midst of a 6-day losing streak which has brought the indexes to the bottoms of the wedges I drew last week. The overall action isn’t great, but it’s not terrible either. Here’s the daily S&P. The index is unchanged since the beginning of February and is still posting a 10% gain on the year. The last month has been tough to work with because the market has gone straight up, striaght down, straight up, straight down. There has been no pausing, just sudden reversals. If you prefer using a trailing stop, you likely gave back chunks of your gains. Instead you’ve needed to be ahead of the curve booking profits even though targets and stops were not hit. This is what makes trading hard. One month we’re able to sit back and let trades play out, the next we have to manage positions differently in order to keep our gains. Wall St. keeps us on our toes.

I’ve been in a defensive posture this entire week. Coming into the week the trend was up, but there were enough warnings to cause me to tone things down. For now I’m keeping my defensive posture and will see what the charts look like this weekend. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 13)”

Leave a Reply

You must be logged in to post a comment.

quack bounced off the 200dema yesterday