Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. China dropped 1.7%; nothing rallied 1%. Europe is currently mixed. Greece is up 1.7%; otherwise there are no standouts. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down. Ag commodities, especially corn, are up.

I don’t have much to add to my weekend report. Last week was mostly negative, but then the loss from the first four days of the week was recaptured on Friday on light volume. I don’t consider this to be extremely bullish, but it was better than a down day and the pattern of higher highs and higher lows remains in place.

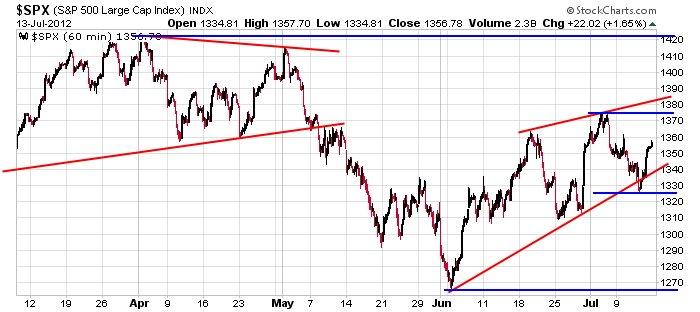

Here’s the 60-min S&P chart. The index penetrated the low of its rising wedge but quickly recovered. Now it sits very close to the middle of its most recent reaction high and low and also near the middle of it high and low going back several months.

A Chinese Premier said over the weekend “It should be clearly understood that the momentum for a stable rebound in the economy has not yet been established.”

Germany’s Constitution Count said it will rule on the constitutionality of the European Stability Mechanism (ESM) bailout fund on Sept 12, so the ESM will be delayed from going into operation for at least another two months.

Bernanke speaks both Tuesday and Wednesday this week in semi annual testimony.

Citi reported better-than-expected earnings.

France is bailing out its auto industry.

Visa and Mastercard have agreed to a $7.25 billion settlement with merchants.

GSK is buying HGSI.

I’ve been in a defensive posture for over a week, and right now I plan on staying there. That means smaller position sizes and quicker exits. I’m swinging mostly for singles and an occastional double because I don’t see this as an environment I can sit back and let the charts play out more after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 16)”

Leave a Reply

You must be logged in to post a comment.

the intraday charts are feeling like normal earnings chop with a bit of opts ex tossed in

no real trend,buy/sells or bulls and bears dominant yet

I guess china said the future is uncertain and germany says they want to wait until sept to

decide what they want to do.

I know what I want to do. bought some aci 5.60

sold 1/2 5.84. who can turn down 4%

had to sell the rest at 6 what can ya do

Boring !…God I miss Neal & Co !!