Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across the board, but Hong Kong (up 1.75%) was the only 1% mover. Europe is currently mostly up. Austria (up 1.6%) is the only 1% winner. Futures here in the Stats point towards a moderate gap up open for the cash market.

The dollar is flat. Oil and copper are up. Gold and silver are up slightly.

Yahoo has tapped long time Googler Marissa Mayer for CEO. More than anything, this means Yahoo wants to be a tech company, a product company, not a media company.

Moody’s downgraded 13 Italian banks yesterday.

Spain sold 1-year notes at a yield significantly lower than last month.

JNJ reported in line resorts but then cut guidance. The stock is down a buck before the open.

GS easily beat expectations. The stock is up 2.32 before the open.

KO is up almost a buck in premarket trading…earnings related.

The European Commission, the EU’s executive body, has opened an investigation to find out if Microsoft has kept its antitrust commitments it made in 2009 and warned non-compliance would be severe.

Bill Gross says when measured by employment, retail sales, investment and corporate profits, the US is approaching a recession.

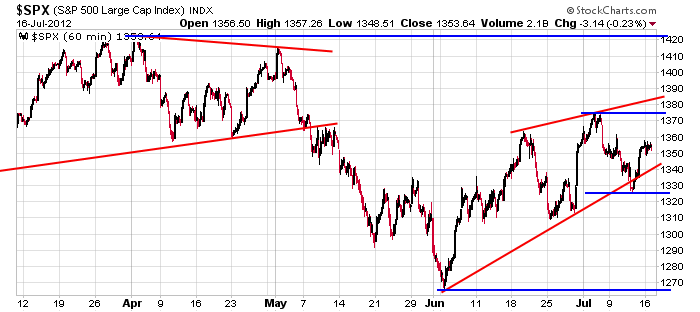

Here’s an update of the 60-min S&P chart. Since the index only dropped a couple points yesterday, the picture didn’t change. The market is still sitting near the midpoint of it most recent high and low on both a short and intermediate term basis. Higher highs and higher lows remain in place since the beginning of June, but I’m more neutral than bullish – even though we have some decent set ups on the Long List.

INTC and YHOO report after the close. I’m staying defensive.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 17)”

Leave a Reply

You must be logged in to post a comment.

patience

the next world index boom industry

buying and selling ”whipsaws ”

good times for contraians. I love the up and down

timeout to show the world the fed approved of itself today. does anyone believe ws

is buying because of lowered guidance? how about recession? or is it a walrus on a mike

More like a Walrus on a Tightrope !…..