Good morning. Happy Monday. Hope you had a nice weekend.

First setting stage -> today and Tuesday should be fairly regular days. The market is open Wednesday, but it’ll be dead. It’s then closed Thursday for Thanksgiving, and Friday is a half day and will be dead again. So this is like a 2-day week.

The Asian/Pacific markets closed mostly up. Japan rallied 1.4%, South Korea 0.9% and Australia and Hong Kong 0.5%. Europe is currently mostly up. Greece is up 2.7%, Norway 0.6% and Switzerland 0.4%. Futures here in the States point towards a solid gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

Lowe’s (LOW) did well with earnings…the stock is up 4.2%.

Cisco (CSCO) is buying privately-held Meraki for $1.2B.

Tyson (TSN) is out with earnings…stock is up 2.2%. Q4 earnings rose 91%.

Illumina (ILMN) is down 8%…SINA (SINA) is up 7.6%…BioMimetic Therapeutics (BMTI) is up 81%.

Westlake Chemical (WLK) has declared a special $3.75/share dividend.

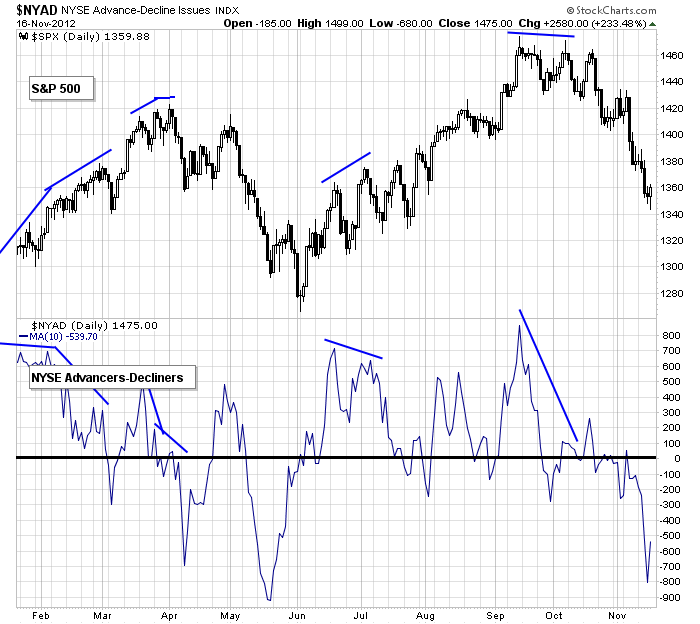

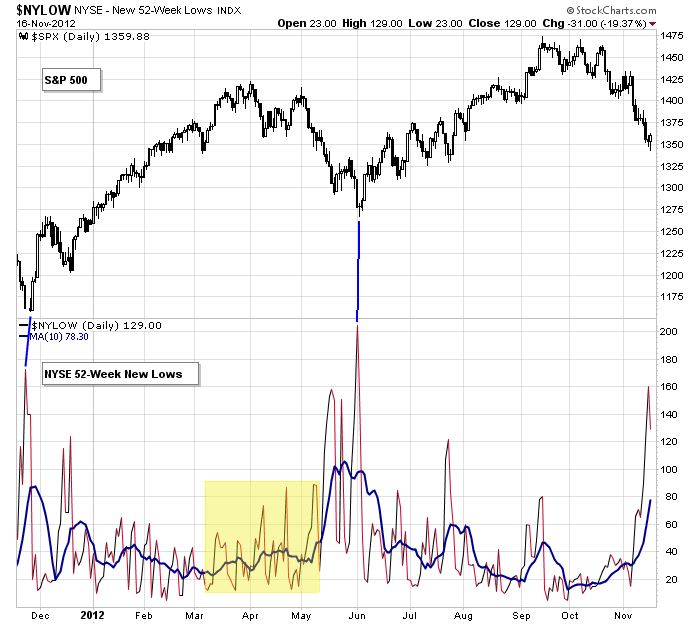

For 4+ days last week we got a continuation of the selling pressure which began right after the election and right after the ECB president said weakness in Europe had finally seeped over to Germany. Then the market went vertical. We weren’t surprised because we’ve been watching a couple key breadth indicators for signs of a washout. Both the AD line and new lows (see below) spiked last Thursday, so at the very least, tightening stops on shorts was the wise thing to do. We never know what will happen, but we can read the obvious signs and make decisions based on where things are leaning and what is likely to happen.

Some of the recent selling pressure is because of the fiscal cliff situation. If we continue to get good vibes from talks, the market should react positively – this is the “ace up your sleeve.” It’s the wild card that has the potential to change things.

For now, my short term bias is up, but on an intermediate basis I question the market’s ability to rally big. I’ll call it as I see it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 19)”

Leave a Reply

You must be logged in to post a comment.

is the A for this abc up correction in—–wave 4

or do we get a larger xmas rally—–wave 2

ill ask my deadcats gruesome and awesome–they control the dax/ndx

Keep us informed there AUZ – What your cats think. 😀 Heard on Bloomberg this AM – they will adjust the CLIFF – Making sure there will be a Xmas rally – Kicking a majority of the debt down the road till 2013 –

yes,they are calling it a bridge that will force short term bond interest rates through the roof like greece and bankrupt uncle ben that runs a inderpendant bank called the fed,that is owned by the other large banks

my plan for usa budget deficit

sack all public servants,politicans,state and fed and use marsian robots controled by the unemployed

closing my world longs since fri