Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mixed. Australia, China and Singapore posted decent gains; there were no big losers. Europe is currently mostly down, but nothing is down a large amount. About 20 minutes before the employment numbers, futures here in the States point towards a down open for the cash market.

The dollar is up. Oil is down, copper up. Gold and silver are down.

Here are the employment numbers…

unemployment rate: 7.7% (it was 7.9% last month)

nonfarm payrolls: 146K added (90K was expected)

private payrolls: 147K added

average workweek: 34.4 hours (same as last month)

hourly earnings: $23.63 (up 4 cents)

After the numbers were released S&P futures jumped from being down 4 to up 8 and then it gave back a couple points.

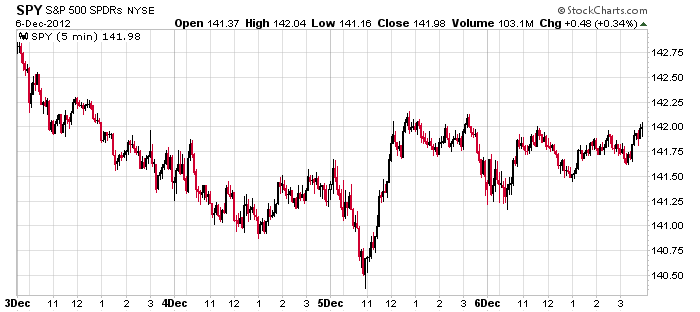

Heading into this week I was looking for a mini correction or at least some sideways movement to allow the charts to rest and some of the indicators to cycle against their extreme levels. Here’s what we’ve gotten so far; this is SPY, the S&P 500 ETF. Weakness early in the week was followed by a vertical rally on Wednesday. Then prices settled into a range. Since I was looking for a pause, I see nothing wrong with this action.

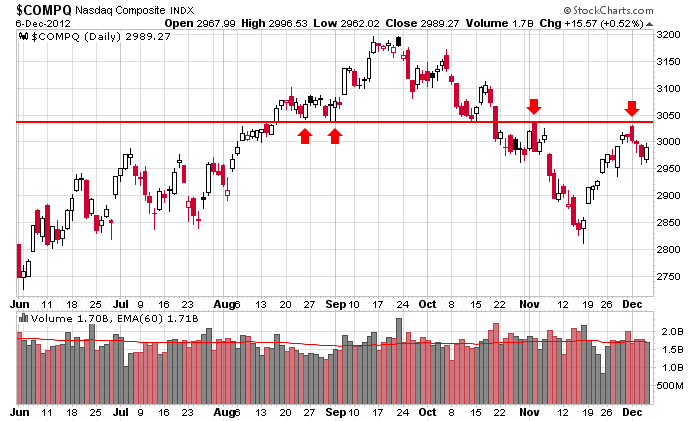

And I’m still watching to see if the Nas can take out the horizontal trendline shown below. A rally attempt that does not include the Nas will not go far.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 7)”

Leave a Reply

You must be logged in to post a comment.

Jason,

can we get a early look at the opts ex charts

seems to me a lot of the world knew the employment nos and peaked a day early

mostly at good strike prices for the quad witch–dax/xjo/n225/ftse ect

some are just held sideways

my dead cats gruesome/awesome have done their part with a nice fake out

of course they eat a apple a day -so i think the ndx will led the way down in line with the dax –sometime next week

with a vertical up for many a index and with the instos taking the opposite side to many a trade it will be interesting to see what the insto market makers do,quad witch time

with the earth/sun and center of the galacy lining up on the 21st dec there could be a confirmed trend change

those orders may come from the high command of the galactic federation of planets