The Asian/Pacific markets closed with a bullish bias. Movement was mostly tame, but China and South Korea put in decent days. Europe is currently mostly up. Norway is down, but Belgium, France and the Czech Republic are doing well. Futures here in the States point towards an up open for the cash market (albeit two hours before the open).

The dollar is up slightly. Oil and copper are down. Gold and silver are down.

Last week closed with most of the indexes at new highs, but volume had fallen off (mostly likely due to the approaching snow storm on Northeast coast). I’m not one for guessing or predicting tops. I’ve made plenty of money over the years staying long while the bears repeatedly attempted to cement their place in history by accurately predicting when the market would turn around. But I do watch for warnings that a turn may come, and when I get a few signals I lighten up and manage my positions a little differently. Here are three warnings that jumped out at me this weekend.

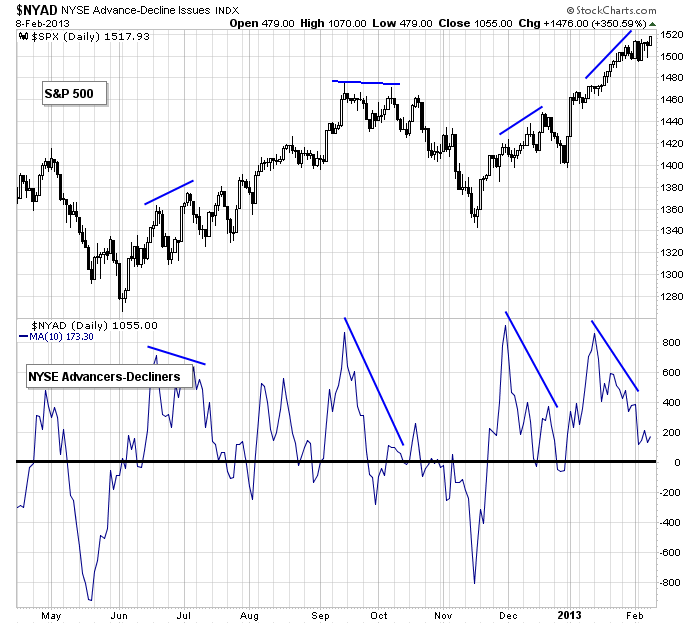

The AD line has been lagging.

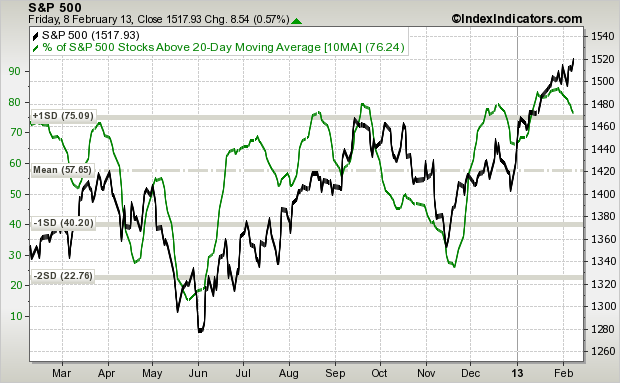

The % of SPX stocks trading above their 20-day MA declined last week.

The % of SPX stocks at a 20-day high also declined last week.

None of these suggest a top is being established, but they all hint at a need for a mini correction in the near term.

Meanwhile, Goldman has cut it near-term estimates to neutral. Here’s a note from MarketWatch.

Goldman Sachs has grown cautious on global equities in the near term, cutting its recommendation to neutral from overweight over a three-month basis. They said the equity market needs time to digest recent gains and the potential for a strong rally from here is likely to be limited as U.S. equities are already trading above their estimates of current fair value and European equities only have upside to fair value. “While we have strong conviction in our longer-term view we are more uncertain about the near term. Asset prices have moved a long way and are now very close to our 3-months targets leaving unusually low cross-asset dispersion in our 3-month return expectations,” said Goldman in a note that published Feb. 8.

If you’re bearish, it’s not hard to find a source that agrees with you. If you’re bullish, same things. It’s not my intention to cherry pick a story. I’m just posting this because it’s more significant than the random upgrade or downgrade.

My stance remains the same. Overall I like the market, but in the near term I’m cautious. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 11)”

Leave a Reply

You must be logged in to post a comment.

I am a lot better at finding bottoms than tops but there is no way I would be long into this.

I still say the first of the year gap needs to be filled. At that point we shall see but I suspect it will be long or be wrong. Looking too far ahead.

Paul

the feb is a small fish and needs the help of china/japan/europe pumping money in

and that support is waning after massive global money printing

there has been a massive amount of energy to get us to dow 14000 and europe has said enough

we are hurting with our euro this high

technicals are less reliable —but what ever spikes up -crashes down

but opts ex will play a part

there is always a bull and a bear to every trade

instos take the opposite side to the bull retailers /pension funds and feds

the german dax has rolled imo as have others but politely wait for others to follow

nasdaq most at risk of crash

—–goldmans now has offices in australia with high frequency traders now alowed in –front running orders—-a more controled market i have never seen –yuk