Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. China, Hong Kong, India and New Zealand posted the biggest losses. Europe is currently mostly down. Austria, Stockholm and London are down 1%; Greece is up 1.5%. Futures here in the States point towards a down open for the cash market.

The dollar is flat. Oil is flat, copper down. Gold is up, silver down.

After seven straight up days, the market dropped yesterday, but losses were small. You still have to manage your positions wisely and know what time frames you’re trading. If you’re a longer term trader, a 50-point SPX drop should not bother you. If your goal is to play 2-4 week swings, then you may want to tighten stops and not give profits back should the market correct here. Stocks that were bought a couple weeks ago probably have decent gains. Stocks bought in the last couple days probably don’t. In all cases you must decide ahead of time how much wiggle room you’re going to give positions. You don’t want to panic and jump ship at the first down day; you also don’t want to give back your hard earned profits either. And if you’re a very short term trader, you’re in and out enough that it’s pretty easy to take profits and move on to your next set up. Have a plan. “Waiting to see what will happen” is not a plan.

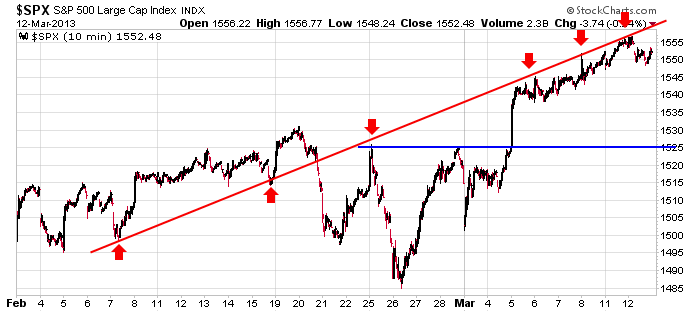

Here’s an update of the SPX chart I posted yesterday. The index tagged the line again and then dropped back. In the grand scheme of things, a drop to 1525 would be very minor.

Have a plan. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 13)”

Leave a Reply

You must be logged in to post a comment.

Neal

all our banks,but dividend buying is a trap

first u have to hold the stoch for 47 days to get the tax free fully franked credit

but in 47 days the stock could crash 20%

secound all our stocks are priced for artifical exhaustion highs that imo are not substainable

ok in a real bull market but i would not buy anything at these redicullouse prices any where in the world on the artifical highs

the high frequency traders came to our market some 3 months ago when they conned our stock exchange ,with the help of the pollies to change the rules

thats why im a day trader as i can leave my bias aside and take the up/downs of the intraday trend

top will come when instos are set at long term stike prices–short

look at ftse long term now at 6500 and dax 8000,spx 1550

trade the future—futures—not the past

but it was a good 4 year run if you had the guts to stick long throughout all the negativity

on high margin –i couldnt

as a matter of interest

people trading on margin is back up to all time 2007 highs just before a crash catching many longs on margin calls

Aussie JS

/Neal-You only have to hold equities 47 days IF your total Franking Credits EXCEEDS $5000 for the fiscal year only……..and aussie ,your spelling has improved markedly !!

Aussie Jay : }