Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Australia, Indonesia, Japan and New Zealand rallied 1%; there were no big losers. Europe is currently mostly down. Belgium, France, Germany, Amsterdam, Stockholm, Switzerland and the Czech Republic are down at least 1%. Futures here in the States point towards a large gap down for the cash market.

The dollar is up. Oil and copper are down. Gold is up, silver is down.

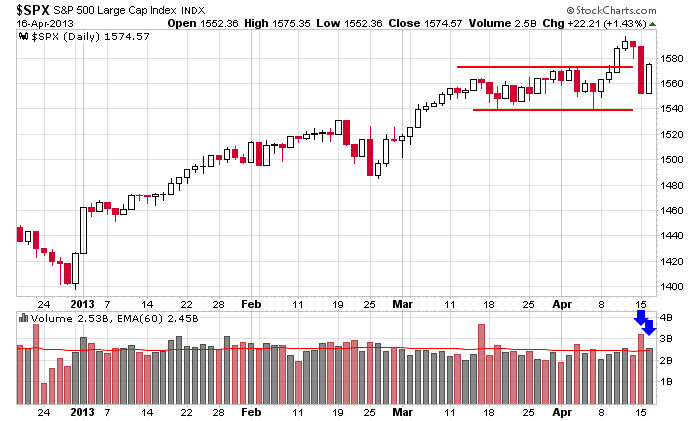

When this week began, I wasn’t convinced last week’s breakout was going to last. There were too many warning signs, so the market had some proving to do. After yesterday’s ligher-volume bounce, I’m still not convinced. Here’s the SPX daily. First we got a false breakout; then we got weaker volume on yesterday’s bounce than on Monday’s sell-off.

Throw in a host of other things, some of which were discussed in the video I recorded over the weekend, and there are enough reasons to be skeptical.

I was asked how I trade this kind of market. My answer is you don’t…at least swing traders don’t. If you’re a day trader, go for it. You can trade any market. But asking a swing trader how you trade this market is like asking a baseball player how to hit a split-finger fastball that drops off the table right before it gets to home plate. You don’t. You either don’t swing or you foul the pitch off to stay alive and then you try and get the next pitch. You can’t force your trading style on a market that has suddenly changed.

Big move down, big move up. Big gap up, big down. No thanks. Do what you need to do to survive (the equivalent of fouling pitches off or standing there with the bat on your shoulder), and when the market lines up with your style, you’re ready to go. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 17)”

Leave a Reply

You must be logged in to post a comment.

Big move down, big move up. Big gap up, big down. Thank you market. It is like like being a QB against the prevent defense in the first quarter. 10 yards a pop and cloud of dust.

Sell in April? The leaders including, GOOG, AMZN, AAPL keep the market nervous. The dead season, opening soon, ending in Oct ’13 is near. Do bonds, dividends and cash. Heroics result in dead bodies.