Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and with a bearish bias. Australia, Japan and South Korea dropped more than 1%. India rallied 1.5%. Europe is currently mostly up. Greece, France, Norway and Switzerland are posting the biggest gains. Futures here in the States point towards a gap up open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are down.

The market got hit hard yesterday. I said it yesterday, and I’ll say it again now. The market is walking a very fine line here. So far, the drop off the high is very acceptable in terms of duration and points. But if it lasts much longer or drops much further, it will be a different type of drop. Instead of being a pullback within an uptrend, it’ll turn into a full-blown correction.

I’m all for a correction. I still like the market for 2013, so in my opinion, lower prices will allow us to buy stocks at lower prices. Nothing wrong with that.

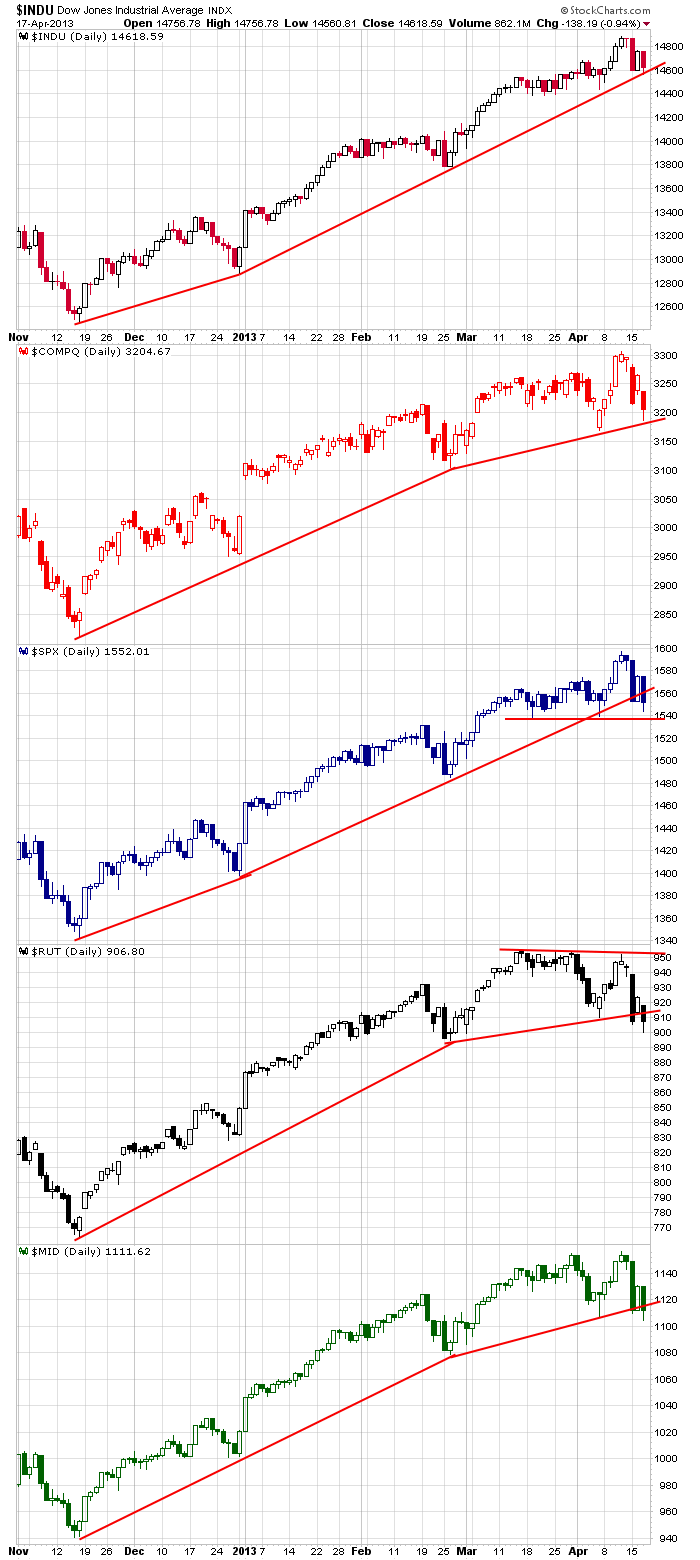

Here are the daily charts. We got a warning last week when all the indexes hit higher highs but the small caps failed to match the movement. Now the Russell small caps and S&P mid caps are breaking support and making lower lows.

All signs point towards more weakness. The lagging small and mid caps. Leaders are not leading. Key groups are lagging. Key breadth indicators suggest internal weakness. There isn’t much for the bulls to hang their hats on. From a technical standpoint, I don’t like the current situation.

Preserve capital. Don’t be a hero. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 18)”

Leave a Reply

You must be logged in to post a comment.

The first time claims for last month suggest that circulation of unemployment at a high level(350-375,000) has become a feature of the US economy. That suggests that structural unemployment is the key issue. If true, technology companies, software and more information systems will do well as firms substitute technology for untrained labor. The US labor force has 50% unemployable youth.

Also appears that health care, pharma, reits in retirement homes, and consumer goods are all likely attractive investments. But not right now, wait for a correction as Jason suggests then buy a core position. In the meanwhile, sell in May seems prudent.

Jason

This is a great market. I am just waiting for a buy signal sell my shorts and start getting long. My models show we are at least a day from a playable dead cat and a few weeks from a nice washout.

Let us know when your models tell us to back up the truck and go long. 🙂