Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Indonesia and Japan rallied more than 3%, Taiwan and India more than 2%, China, Hong Kong, Malaysia, Singapore and South Korea more than 1%. Europe currently leans to the downside. Belgium and Greece are up more than 1%; there are no 1% losers. Futures here in the States point towards a positive open for the cash market.

The dollar is down slightly. Oil and copper are up small amounts. Gold is down, silver is up.

Today marks the end of the week and month. As of now the S&P is down 17.5 points for the month, so absent a huge rally tomorrow, the first down month since October will be registered. But it’s up 20.8 on the week, so absent a big sell-off, the 2-week losing streak will be broken.

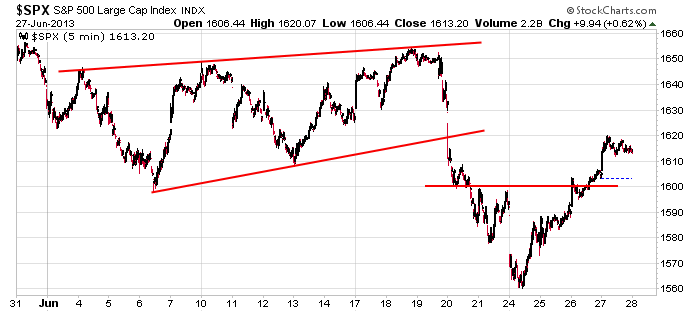

Here’s the 5-min chart covering this month. We got a move down, then up, then down, then up, then down big and now up pretty big. Rallies have gotten sold, dips have gotten bought. Not evident on this chart is the fact that the S&P is unchanged since Friday, May 3, so despite the Fed and China and the summer doldrums and all the ups and downs, the market is flat over the last two months.

I’ve had a defensive posture for several weeks. That means I trade less and have much lower expectations for moves. Instead of looking for 10-20%, I’m content taking a quick 5%. For this I have no regrets. In a given year, there are times I’m all in riding a strong trend and times I’m mostly laying low waiting for a trend to develop. Being a full time trader doesn’t mean trading all the time. It still means I pick my spots.

For what it’s worth, next Thursday is an off day (July 4), and Friday is a half day. Wednesday will be slow. So if the market wants to do something, it doesn’t have much time.

Here are stock-specific stories from barchart.com…

Bed Bath & Beyond (BBBY +0.21%) was upgraded at BofA/Merrill to “Buy” from “Neutral” with a price target of $82.

BlackBerry (BBRY -2.88%) plunged 16% in pre-market trading after it reported an unexpected Q1 adjusted EPS loss of -13 cents, weaker than consensus of a 6 cent gain.

Barclays reiterated its “Overweight” rating on Regeneron (REGN +2.55%) as a top-pick in large cap biotech with a price target of $305.

The NY Times reported that the Agriculture Department yesterday effectively banned the sale of sugary drinks and unhealthy snack foods in all areas of the nation’s schools.

Standard & Poor’s Ratings Services revised its outlook on Micron Technology (MU +1.13%) to stable from negative.

Pfizer (PFE +0.28%) rose 1% in after-hours trading after it announced that it will boost its share repurchase program by $10 billion.

Hewlett-Packard (HPQ +3.17%) was awarded a $321.69 million government contract for the Next Generation Enterprise Network.

Northrop Grumman (NOC +1.67%) was awarded a $490 million government contract for follow-on support for the Combat Air Force Distributed Mission Operations and Integration program.

Nike (NKE +0.76%) gained nearly 2% in after-hours trading after it reported Q4 EPS of 76 cents, better than consensus of 74 cents.

Accenture (ACN +0.83%) fell over 6% in after-hours trading FTER IT reported Q3 EPS ex-items of $1.14, better than consensus of $1.13, bur then cut its fiscal 2013 EPS ex-items view to $4.18-$4.22 from $4.24-$4.32, below consensus of $4.28.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jun 28)”

Leave a Reply

You must be logged in to post a comment.

Fed president’s day, again; Dudly did a great job on Thursday, anyway I for one feel better. This could be the start of the undoing of this advance. How much? Depends on the hedges. At the close yesterday several big ones made my Bloomberg leap with huge sell on close orders. If that picks up this AM it could mean the unwind has started. I am short. Short gold too, looking for 980 at least, at which time I will not buy much.

Wed is 1 pm close. Looks like Friday is a full day?

You are right. 🙂

Volume has been light on this bounce. I would be more aggressive short but small caps have out performed.

well done,Neal the daytrader–lol

did u go long the japan n225 index

my computer system using esignal has piviots already calculated inc previouse days close, low and high in psycodelicte colours,all prelowded and next days piviots arrive automaticly at midnite new york time on my charts

more countries indexes ect rely on them as the big boy instos spread their tenticles

today has many index rebalacings inc russell

will usa index futures hold y/days lows that they just bounced off

you are leaning if u are serious ,which i doubt

does a offencive lepord change its spots–i am not convinced

i changed from short to long –usa/europe at y/days lows piviot

closed longs now short

good quick trades are fun

closed everything gone flat going to sleep–its been a long day asia europe usa

have a big day sat

congratulations on ur cognition

now u dont have to be offencive to other traders