Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. Australia and Indonesia led to the downside while China, Hong Kong, India and Japan led to the upside. Europe is currently mostly up. Belgium, France, London, Spain and Italy are leading the way. Futures here in the States suggest a moderate gap up open for the cash market.

The dollar is flat. Oil and copper are up. Gold is up, silver down.

In my eyes the market is very much split. The long term trend remains solidly up, the shorter term trend is down.

Some indicators suggest more weakness is coming. Others have hit extreme levels and now support a market bounce. And others still could go in either direction from their current level.

Sentiment has been neutralized. The Fed has been priced in. The market has done a pretty good job absorbing several negative news items lately.

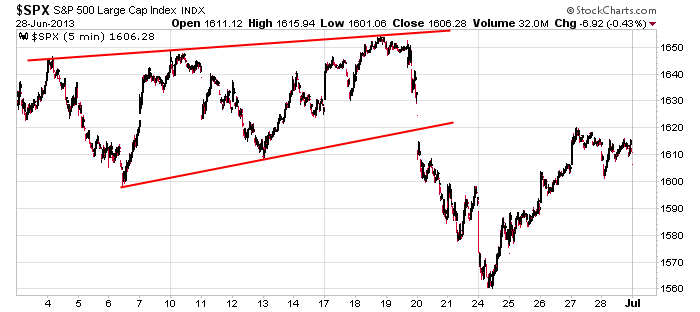

My fist S&P target (low 1600’s) has been hit, but now it gets tougher. The quick, vertical, post-Fed move down forecasted a quick, vertical move back up. Now the market will run into a block of overhead supply in the form of traders who would love an opportunity to get out even. Here’s the 5-min chart.

Keep in mind Wednesday is a half day, and Thursday is a day off. Friday is a full day, but the market will be dead. So after Tuesday we have a 4-5 day weekend.

Here are some stock-specific stories from barchart.com…

Tribune Company (TRBAA +0.18%) and Local TV jointly announced they have entered into a definitive agreement for Tribune to acquire all of Local TV’s 19 television stations for $2.725 billion in cash.

Marvell (MRVL -1.01%) was upgraded to “Buy” from “Neutral” at Lazard Capital.

Apple (AAPL +0.70%) was upgraded to “Strong Buy” from “Outperform” at Raymond James.

Jeffries kept its “Buy” rating on Tesla (TSLA -1.73%) and raised its price target on the stock to $130 from $70.

BlackBerry (BBRY -27.76%) was downgraded to “Hold” from “Buy” at Societe Generale.

Marathon Petroleum (MPC +0.01%) was downgraded to “Underweight” from “Neutral” at JPMorgan.

Pandora (P +1.32%) was upgraded to “Overweight” from “Equal Weight” at Morgan Stanley with a target price of $24.

Onyx Pharmaceuticals (ONXX +1.90%) surged 15% in after-hours trading after the Financial Times reported that Amgen (AMGN -0.33%) is looking to buy the company for $120 a share.

Huntington Ingalls (HII -0.19%) was awarded a $745 million U.S. Navy contract for the inactivation of the USS Enterprise.

Standard & Poor’s Ratings Service places Cooper Tire (CTB +0.61%) ratings on “Watch Negative.”

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 1)”

Leave a Reply

You must be logged in to post a comment.

This is not a week to trade stock although today’s gap up looks tempting to sell into or go short.

if on 100 to1 margin ,it should only be daytraded

the dax has already had 3 good vertical intraday moves in either direction

volitilty ,the daytraders delight