Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Australia rallied 2.6%; Japan, New Zealand and Singapore also did well. Indonesia dropped 1%. Europe is currently mostly down. France, Germany, Switzerland and Greece are down the most. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil is up, copper down. Gold is up, silver down.

The market moved up yesterday (mostly thanks to a big opening gap up), but it closed well off its high. Volume was light, and it most likely will be even lighter today because tomorrow is a half day and Thursday is a day off.

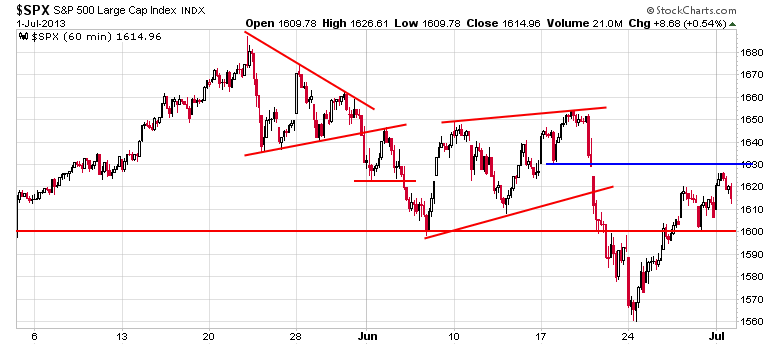

Key SPX levels I’m watching right now are 1600 to the downside and 1630 to the upside.

It will be an important accomplishment for the S&P to hold 1600. Lower highs and lower lows remain in place, and the current bounce off last week’s low is a pretty typical bounce within a downtrend. But if 1600 can hold, the bearishness that has existed over the last six weeks will be neutralized even more. Here’s the chart.

Two things to consider. 1) This is a holiday-shortened week. Volume, price movement and volatility aren’t likely to be robust. 2) We are in the heart of the summer doldrums. If the market can resist legging down again, the odds of a summer range continue to climb.

Here are stock-specific stories from barchart.com…

Newmont Mining (NEM +0.77%) was downgraded to “Underperform” from “Hold” at Jefferies.

DaVita (DVA +0.29%) was downgraded to “Market Perform” from “Outperform” at Raymond James.

JPMorgan (JPM -0.57%) was upgraded to “Strong Buy” from “Outperform” at Raymond James.

CME Group (CME +0.74%) was downgraded to “Market Perform” from “Outperform” at Raymond James.

Las Vegas Sands (LVS +0.08%) was upgraded to “Buy “from “Neutral” at ISI Group.

DigiTimes reported that Samsung (SSNLF +8.57%) will launch a mini version of its Galaxy S4 in Q3.

Transocean (RIG +0.60%) was downgraded to “Neutral” from “Buy” at Citigroup.

Rowan Companies (RDC +1.03%) was upgraded to “Buy” from “Neutral” at Citigroup who raised its price target on the stock to $42 from $36.

Achillion (ACHN +2.20%) plunged nearly 20% in after-hours trading after the FDA placed a clinical hold on development of Achillion’s drug sovaprevir after elevations in liver enzymes were noted in a Phase 1 healthy subject drug interaction study.

Lockheed Martin (LMT -0.37%) was awarded a $295 million government contract modification to provide system engineering and program management services to continue development of the Aegis Ballistic Missile Defense System.

Nielsen Holdings (NLSN -0.92%) will replace Sprint Nextel (S +0.71%) in the S&P 500 after the close of trading on July 8.

A. Schulman (SHLM +3.77%) reported Q3 adjusted EPS of 50 cents, well below consensus of 65 cents.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 2)”

Leave a Reply

You must be logged in to post a comment.

The crush of numbers this week is overwhelming investor decision making. Technically the volume behind the recent move up is terrible, except for R2K. The IWM move yesterday was interesting and strong. If the new economic numbers move the market I will fade the move. 1530 is the probable first leg down as the CD wave of the ABC down works it will into Sept ’13.

Car sales are looking promising Chrysler up 8%, Factory orders expected to be up, the Yen is above 100 per dollar. During H2,13 health costs will raise hell with employment and personal costs. This could be hard for employment and stocks well into the fall of ’13. Short or cash is the coward’s play, that is me. We should sell Midway it is a navigation hazard.

http://blog.kimblechartingsolutions.com/wp-content/uploads/2013/06/joefridayemotipointliningupdowjune28

A picture of where were are in market history.

Holiday or not this market is floating up on low volume. At this point I am as bearish as the black bear in my trash last night. Be short or do as I had to do this AM and clean up the mess

I am tempted to wait with my 12 GA double pipe out for that big boy.