Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across-the-board. Indonesia dropped 3.2%, Hong Kong 2.5% and Australia, India, Singapore, South Korea and Taiwan more than 1%. Europe is currently down across-the-board. Austria, Spain and Italy are down more than 2%, and Belgium, France, Germany, Norway, Stockholm, Switzerland, London, the Czech Republic and Greece are down more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

Today is a half day. The market closes at 1:00 pm EST, and then tomorrow is a day off.

The last two days have been very similar…strong during the morning, weak during the afternoon. We’ve gotten some very good day trading signals, but swing trading remains challenging because moves aren’t lasting long before reversing.

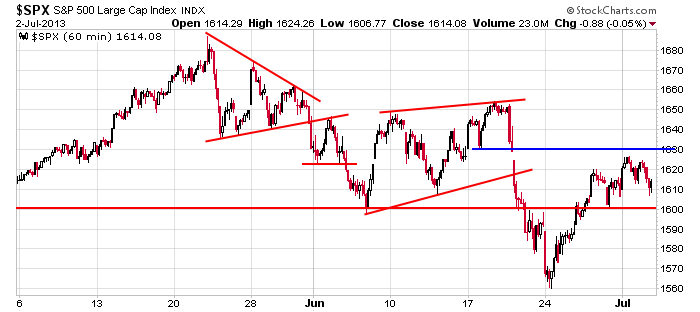

Here’s an update of the 60-min SPX chart. In my opinion, 1600 to the downside and 1630 to the upside are still key levels.

The bulls have done a pretty good job neutralizing the negative sentiment that quickly came into the market after the last FOMC meeting, but they are far from being able to relax. The intermediate term trend is still down, and until the S&P can rally to 1650-ish, I’m going to believe the bears have a slight upper edge.

Research reveals equal number of good long and short set ups, which is exactly what I don’t want. I want there to be an obvious direction to play – long or short – but this isn’t the case right now.

Play good defense. Summer is here, and other than Friday’s employment numbers, there are no major news items scheduled. The market may settle into a summer range.

Here are stock-specific stories from barchart.com…

Alcoa (AA -0.76%) was downgraded to “Neutral” from “Overweight” at JPMorgan.

Overstock.com (OSTK -0.37%) was downgraded to “Underperform” from “Buy” at BofA/Merrill.

Comerica (CMA +1.24%) was upgraded to “Neutral” from “Sell” at Citigroup.

In a post on the Treasury’s website, the Obama administration is announcing that it will provide an additional year before the Affordable Care Act mandatory employer and insurer reporting requirements begin.

Boeing (BA -1.71%) was awarded a $109.46 million government contract modification in support of the Royal Saudi Land Force Aviation Command in Saudi Arabia.

Lockheed Martin (LMT -1.54%) was awarded a $308.32 million government contract modification for the procurement of tactical missiles and launcher modification kits in support of Kuwait.

Standard & Poor’s Ratings Services lowered its long-term counterparty credit ratings on Barclays (BCS -1.33%) , Credit Suisse (CS -1.25%) , and Deutsche Bank (DB -2.02%) to ‘A’ from ‘A+ on its opinion of the increasing risks that Europe’s large banking groups active in investment banking face as regulators and uncertain market conditions continue to make operating in the industry more difficult.

Bloomberg reported that Apple (AAPL +2.27%) is near a deal with Time Warner Cable (TWC -1.33%) that would give Time Warner subscribers access to channels via Apple TV.

Hasbro (HAS +0.39%) and Electronic Arts (EA +1.47%) announced a new agreement under which EA will develop several of Hasbro’s best-selling gaming brands for mobile platforms globally.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 3)”

Leave a Reply

You must be logged in to post a comment.

Jason

I enjoy reading what you have to write daily.

Not much to add.

Paul

You are not a former naval officer?