Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan dropped 1.6%. Australia rallied 1% while India also did well. Europe is currently mostly up. Austria, France, Germany, Amsterdam, Norway, Stockholm, Greece, Italy, Spain and the Czech Republic are doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is down, copper up. Gold and silver are up.

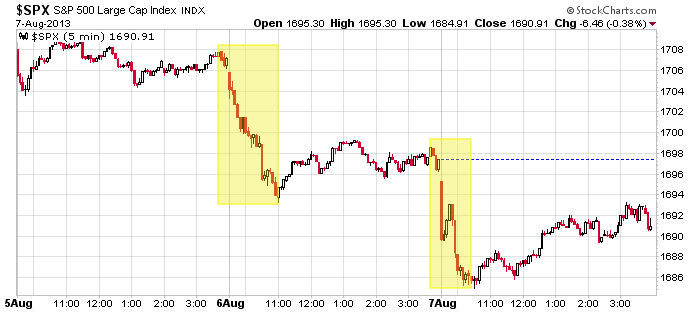

The market has dropped three straight days this week and is down about 1%, but most of the selling has taken place in a very small percentage of the time. In fact all the losses took place in about 2-1/2 hours. The market has been flat or slowly moving up the other 17 hours. Here’s an intraday SPX chart.

So the bears have been able to take control but only for short periods of time.

I’m thinking we might have a surprise big range day coming soon as opposed to the small range days we’ve been getting. The bulls have not hesitated to step up and buy, even when early selling pressure was semi intense. So perhaps we’ll have a surprise up day to crush the bears (for the millionth time since the 2009 bottom). Or, if the bulls can’t get much upside traction, they may hesitate to support prices during the next round of selling. If we hit a little air pocket, moderate early selling pressure can intensify. In either case, the range will expand, not stay the same. Be on your toes.

Here are stock stories from barchart.com…

Scripps Networks Interactive (SNI +1.13%) reported Q2 EPS of $1.08, better than consensus of $1.05.

Windstream (WIN +0.35%) reported Q2 EPS of 8 cents, weaker than consensus of 9 cents.

CenturyLink (CTL +0.58%) reported Q2 adjusted EPS of 69 cents, above consensus of 67 cents.

American Water (AWK +0.26%) reported Q2 EPS of 57 cents, below consensus of 61 cents.

Jack in the Box (JACK +0.27%) reported Q3 EPS ex-items of 41 cents, better than consensus of 38 cents, and raised guidance on fiscal 2013 EPS ex-items to $1.72-$1.78, above consensus of $1.65.

Arris (ARRS +2.02%) reported Q2 EPS adjusted EPS of 46 cents, well ahead of consensus of 26 cents, and said the order backlog at the end of Q2 was $534.9 million.

Mondelez (MDLZ -1.88%) reported Q2 adjusted EPS of 37 cents, stronger than consensus of 34 cents.

Matson (MATX -1.61%) reported Q2 EPS of 47 cents, better than consensus of 44 cents.

RealD (RLD -2.82%) signed an exclusive 10-year deal with Mexico’s Cinemex that calls for approximately 700 auditoriums across the Cinemex circuit in Mexico to be equipped with RealD 3D technology, including the removal of approximately 540 alternative 3D systems that will be replaced with RealD 3D within the next two years.

Prudential (PRU -1.68%) reported Q2 adjusted EPS of $2.30, stronger than consensus of $1.99.

Tesla (TSLA -5.57%) rose 7% in after-hours trading after it reported Q2 comparable EPS of 5 cents, well ahead of consensus of a -17 cents loss.

Green Mountain (GMCR -2.53%) reported Q3 adjusted EPS of 82 cents, better than consensus of 77 cents, and raised its fiscal 2013 EPS view to $3.19-$3.24 from $3.05-$3.15, higher than consensus of $3.18.

Here are earnings from seekingalpha.com…

Notable earnings before today’s open: AAP, AEC, AINV, AMCX, AMRC, APO, AWR, BCE, BCRX, BEAM, BR, CBB, CDE, CNQ, CNSL, CQB, CSIQ, CTB, DF, DNDN, FCN, FNP, FSYS, FUN, FWLT, FWM, GBDC, GLDD, GLP, GTN, HL, HSH, IQNT, IRC, KIOR, LAMR, LINE, MFC, MPW, NGPC, NVAX, NVO, OGE, OWW, PMT, RGLD, SNI, SPH, SRPT, SSYS, SWC, THI, TK, TMUS, VC, WAC, WIN

Notable earnings after today’s close: AGO, AIRM, AL, ALNY, AMRS, ANAC, ASYS, ATLS, AUQ, BCEI, BNNY, BRKS, CFN, CLNE, CPE, DAR, DATA, DV, ELON, ELX, FF, FXEN, GERN, GXP, IPXL, KTOS, LGF, MCP, MDRX, MDVN, MIDD, MNST, MRGE, NDLS, NES, NFG, NOG, NPSP, NVDA, OLED, ONXX, PCLN, PDLI, RAX, RICK, RNDY, SAAS, SF, SHOR, SLXP, UBNT, UNXL, YOKU, ZGNX

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Aug 8)”

Leave a Reply

You must be logged in to post a comment.

The Chinese have a good export report? So we are going to celebrate? This market is so thin you could cut it in two with an eye lash. In the meanwhile, The Fed wants to point out that buying fewer bonds does not mean that rates will vary from ZIRP. This means that financial repression is now a feature of the US economy. Like Japan SIRP avoids governing the social side of the budget, it just too political. In the end we get a phony allocation of resources and no jobs. OH yes today, we get the periodic blow off. Why? Axle Merk’s take follows.

Importantly from our standpoint, the

fundamentals are still very positive as many

parts of the world, including the U.S., are

burdened with too much debt and the path of

least resistance remains inflation and a gradual

debasement of the purchasing power of the

currency. In our assessment, the U.S. and

many other governments around the world

cannot support their bonds should their cost

of borrowing rise significantly. In that sense,

the sluggish recovery has been beneficial to

governments. Taper talk might be hazardous

to the price of gold, but ultimately, we

believe, the Fed will have to err on the side

of inflation, boosting the long-term prospects

of the shiny metal

Hello ,

Europe is OPEN !

😉

“I’m thinking we might have a surprise big range day coming soon as opposed to the small range days we’ve been getting.”

Bold but most likely very accurate.

you dont have the right mind set to be a daytrader

therfor you would not be allowed to vist

two issues —next weeks opts ex and do the insto market makers need more puts or calls to balence the books

and with todays down we may have finished a 5 wave impulsive,ready for neals dead cats

–gruesome and awesome to bounce

Well done Jason you nailed it. Can’t say I’m surprised keep up the great work!