Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Only Taiwan posted a sizable loss (down 0.7%) while Hong Kong and India posted decent gains. Europe is currently trading mixed. Greece and Italy are down the most; Amsterdam, Stockholm and London are up the most. Futures here in the States point towards a gap down open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold is up, silver down.

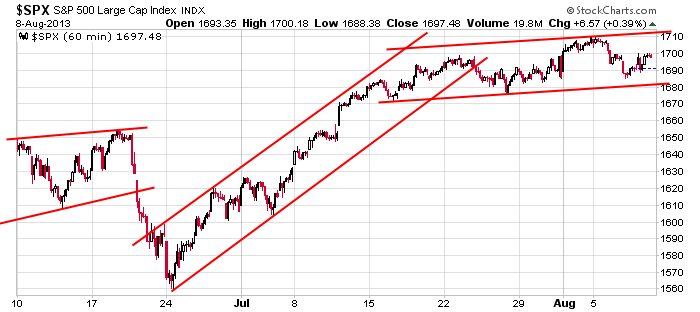

Barring a decent gain today, the market will post its biggest weekly loss in eight weeks. But the market isn’t trending down. Here’s the 60-min SPX chart. A steep slope has flattened out, but the overall trend is still up.

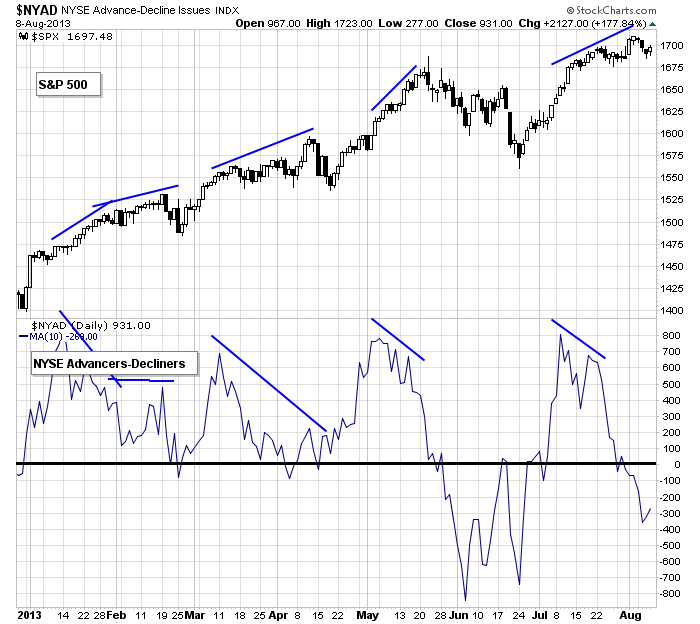

I don’t see an obvious near term trade. The overall trend is still solidly up, but there are many indicators which need to cycle down and reverse. One is the NYSE AD line shown below.

Don’t force trades right now. There are conflicting forces that need to work themselves out, and the market is in consolidation mode anyways.

Stock stories from barcharts.com…

Deere (DE +1.64%) was downgraded to “Sell” from “Neutral” at UBS who also lowered their price target on the stock to $72 from $96.

Foot Locker (FL -0.47%) was downgraded to “Neutral” from “Buy” at Goldman who also lowered their price target on the stock to $37 from $41.

Cisco (CSCO +0.54%) was upgraded to “Neutral” from “Underweight” at JPMorgan who also raised their price target on the shares to $26 from $18.

NRG Energy (NRGP) reported Q2 EPS of 32 cents, double expectations of 16 cents.

Great Plains Energy (GXP -0.67%) reported Q2 EPS of 41 cents, better than consensus of 40 cents.

Larry Feinberg reported a 19.99% stake in Hansen Medical (HNSN -2.31%) .

Lehigh Gas (LGP +0.19%) reported Q2 EPS of 36 cents, below consensus of 37 cents.

Gabelli reported a 5.11% stake in Keynote Systems (KEYN -0.05%) .

NVIDIA (NVDA +0.68%) reported Q2 EPS of 23 cents, well ahead of consensus of 13 cents.

Monster Beverage (MNST +1.62%) fell nearly 5% in after-hours trading after it reported Q2 EPS of 62 cents, weaker than consensus of 64 cents.

Fiserv (FISV +0.19%) announced that it will buy back an additional 10 million shares, or 8% its outstanding shares, as part of its stock repurchase program.

Allscripts (MDRX +1.00%) reported Q2 EPS of 5 cents, well below consensus of 10 cents.

priceline.com (PCLN +0.67%) climbed over 5% in after-hours trading after it reported Q2 EPS of $9.70, well ahead of consensus of $9.36.

Roundy’s (RNDY -2.83%) reported Q2 EPS of 30 cents, lower than consensus of 33 cents, and cut its guidance on fiscal 2013 EPS to 77 cents-83 cents, weaker than consensus of 92 cents.

The Gap (GPS +1.38%) raised guidance on Q2 EPS to 62 cents-64 cents, better than consensus of 59 cents, and said Q2 same-store-sales were up 5%, although July same-store-sales were up only +1.0%, below expectations of +1.6%.

Earnings from seekingalpha.com…

Notable earnings before today’s open: ABFS, DRH, EBIX, EGY, EVEP, HNR, JRCC, MEA, MGA, MHR, NRG, PGNX, TPC, VTG, WWAV

Notable earnings after today’s close: ZOLT

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Aug 9)”

Leave a Reply

You must be logged in to post a comment.

A pig in the poke is always a great short.

A little research does wonders. JC Penny stores have nothing on the shelves and the employees are down and looking elsewhere.

Greasy Macs have gotten dirty. The lines are long and not moving.

GM is building more big vehicles and oil is rising. They had to cut the price on the Volt to sell it.

Sell high buy lower.

Friday in the summer, with lots of BS being passed around. The little gold spat that started yesterday may reflect the lack of confidence in the market. Meanwhile your Congress is planning a stand off or a sell out, hard to tell which since they do both so well. Over at the Fed the rumor is that Obama wants Summers because he needs easy money to win in’14. Keep your cash and avoid the SE Asian stockmarkets – no one knows if China is telling the truth about its exports, but they are buying gold, confusing. Cheers.