Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. Australia, China and Hong Kong did well, Indonesia and Japan lagged. Europe is currently trading mixed. Austria, Germany and the Czech Republic are down, Belgium and Greece are up. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are up.

I don’t have anything new to add to my weekend report. The market is in consolidation mode. It’s correcting with time, not price. This could change, but for now, this is the case. Most indicators are moving and pointing in the bear’s direction, and more time is needed before they reach oversold levels. From a trading perspective, there have been fewer good set ups to work with. This is just that way it’s been. Just like a hitter can’t force a pitcher to throw him a perfect strike, we can’t demand the market hand us good set ups. We either swing at what’s thrown our way or we stand there with the bat on our shoulder and be patient.

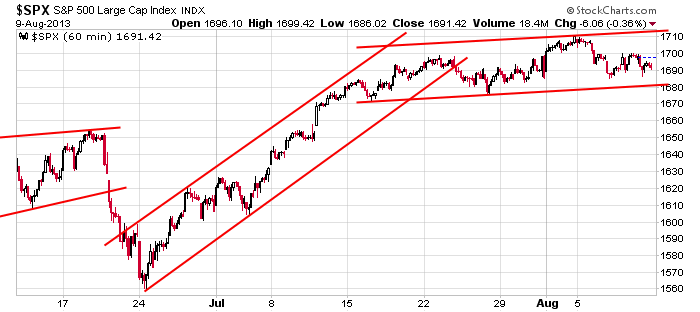

Here’s the S&P 60-minute chart. That lower trendline will be tested at today’s open. My target on a downside break is still 1650.

Overall the market is in good shape, so there’s no reason to believe the trend will not eventually continue to the upside. But in the near term things are much less clear. Do not force trades. A better environment is ahead.

Stock stories from barchart.com…

Tesla (TSLA -0.31%) was downgraded to “Neutral” from “Buy” at Lazard Capital.

Cablevision (CVC +0.67%) was upgraded to “Buy” from “Neutral” at Guggenheim.

Lowe’s (LOW -1.04%) was upgraded to “Hold” from “Sell” at Canaccord who also raised their price target on the stock to $48 from $28.

Broadcom (BRCM -0.91%) was downgraded to “Neutral” from “Buy” at Goldman.

Juniper (JNPR -5.60%) was downgraded to “Sector Perform” from “Outperform” at RBC Capital.

The U.S. Navy has awarded Northrop Grumman (NOC -0.13%) a $617 million contract for five full-rate production Lot 1 E-2D Advanced Hawkeye aircraft.

DaVita (DVA +0.62%) declares a two-for-one split of its common stock for stockholders of record on August 23.

Krispy Kreme (KKD +1.71%) upgraded to “Buy” from “Neutral” at Janney Capital.

Lazard reported a 5.22% passive stake in Advance Auto Parts (AAP +1.86%) .

Bloomberg reported that Apple (AAPL -1.42%) won a patent infringement suit against Samsung (SSNLF -3.25%) , with the U.S. International Trade Commission saying Samsung violated Apple’s patent rights and would be blocked from importing Samsung smartphones into the U.S. However, the ban is subject to a review by President Barack Obama on public policy grounds, which will allow Samsung to import phones during the review.

Cubist CBST reported a 27.5% stake in Trius Therapeutics (TSRX -0.29%) .

Health Management (HMA -0.15%) reported Q2 adjusted EPS of 7 cents, well below consensus of 16 cents.

Earnings from seekingalpha.com…

Notable earnings before today’s open: CRNT, GSS, PERI, SPR, SRT

Notable earnings after today’s close: ALIM, APP, HMIN, IAG, IOC, NQ, SINA, TRQ, WX

this week’s Earnings

this week’s today’s upgrades/downgrades

0 thoughts on “Before the Open (Aug 12)”

Leave a Reply

You must be logged in to post a comment.

consolidation in time, not price? Let the rest of the world catch up? With what? ‘Tis the beginning of the month of doubt as we enter fiscal months in Sept and Oct. Good to be in cash and waiting to see what can unfold. Probably a stand-off and a threaten shut down. Japan’s QE is not working out as hoped. China says all is well – for now. The EU is all happy talk until German elections. But Germany is doing well, and France says output is up. What were they so worried about? Meanwhile the CEO is vacationing.

“Lowe’s (LOW -1.04%) was upgraded to “Hold” from “Sell” at Canaccord who also raised their price target on the stock to $48 from $28.”

This insane bullishness. Time for a correction.