Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

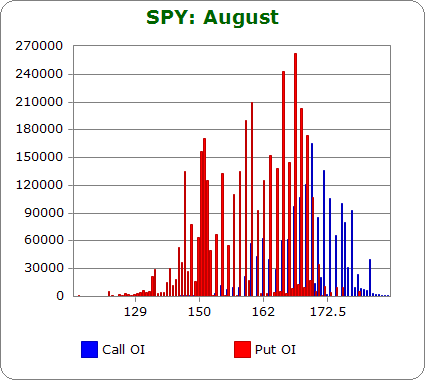

SPY (closed 169.11)

Puts out-number calls 2.1-to-1.0 – slightly more bearish than last month.

Call OI is highest between 167 and 178 with the highest spike being at 170.

Put OI is highest at 170, and it stays pretty strong all the way down to 150.

Puts dominate, and although there’s some overlap in the 167-170 area, it’s pretty clear a close around 169/170 will cause the most nubmer of calls and puts to be worthless. Today’s close was at 169.11 – exactly where it needs to be. No movement is needED by Friday’s close to achieve max pain.

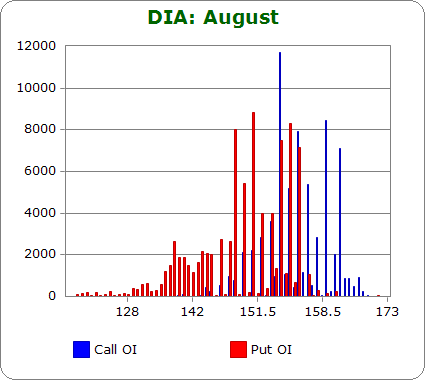

DIA (closed 154.03)

Puts out-number calls 1.3-to-1.0 – slightly more bearish than last month.

Call OI is highest between 154-159.

Put OI is highest between 149-156.

DIA open-interest is tiny compared to SPY, so these numbers don’t matter much. Here they are anyways. There’s overlap between 154-156, and with put and call OI being close to equal, a close in the middle of the range would cause the most pain. Today’s close was at 154.03 – basically where it needs to be. No movement or a slight move up will cause max pain.

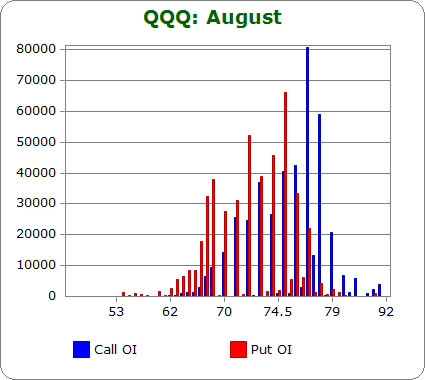

QQQ (closed 76.67)

Calls out-number puts 1.4-to-1.0 – same as last month.

Call OI is highest at 77 and 78 moderately strong between 73-76.

Put OI is highest between 72-75 and is moderately strong between 68-71 and at 76.

There’s a lot of overlap between these numbers, so someone is going to make money. I’d estimate a close at 76 would cause the most pain. At that level, the three highest call strikes would be out of the money, and the 4th highest would only be one strike ITM. And all the highest put strikes would be OTM. Today’s close was at 76.67 – exactly where it needs to be. No movement is needed to cause max pain.

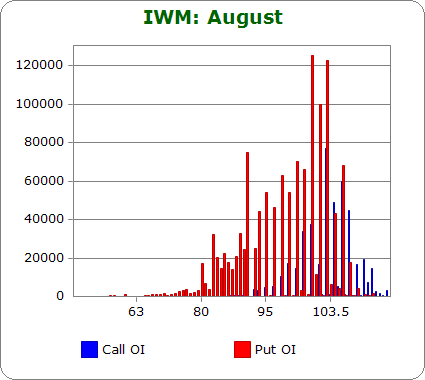

IWM (closed 104.59)

Puts out-number calls 2.0-to-1.0 – much less bearish than last month.

Call OI is highest between 103-105 and for one or two strikes above and below this range.

Put OI is highest at 101, 102 and 103 and then it tapers down below 101, and there’s a mini spike at 105.

It sure looks like puts out-number calls by more than 2-to-1. A close at 103 would cause all the highest put and call OI strikes to be worthless (except the put spike at 105), so that’s a good place if the invisible hand of the market wanted to cause max pain. Today’s close was at 104.59 – a little above ideal. But closing at 105 lets a few call owners profit while additional put owners lose everything – a wash. In my opinion, this is close enough. No movement is needed, but a slight move down would be fine.

Overall Conclusion: I can’t remember a time when all the ETFs where pretty much exactly where they need to be to cause max pain, so this week is a rarity. The market has been in consolidation mode, and if these numbers play out, it’ll stay in consolidation mode at least until next week. No movement is needed to cause max pain.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

have you ever monitored these numbers throughout opex week to see how they shift? i’m wondering if there is sufficient covering of puts/calls to move the point[s] of max pain.

I have not monitored the numbers during the week. My experience is the market has already done what it needs to do by the beginning of the week, so I should write this report a week earlier. 🙂

see what i mean? how likely is it, after thursdays selloff, that the p/c ratios didn’t chage? we are nowhere near where we were when you completed your analysis suggesting little or no movement? thoughts?

but intraday can be still quite volitile with large swings up and down

usually ending at close about the same

let the market makers have some fun

One of your best offerings. I find it helpful when Bernanke is speaking (always an event) and the economic data to come. It is a tribute to the power of the derivatives over the market and in a thinly traded summer it is overpowering to other events probably. NO change of significance is expected. Thanks,

Just when things are lined up …. surprise. I do agree there is not much wind for change. A shocking news event could send the market dropping.