Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Indonesia dropped 3.2%, Japan and Hong Kong more than 2%, Malaysia, Singapore and South Korea more than 1%. Europe is currently down across the board. Spain and Greece are down more than 2%; Austria, Belgium, France, Amsterdam and the Czech Republic are down more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are down. Gold is up, silver down.

The market dropped yesterday for the 4th consecutive day marking the first time this year the Dow has suffered such a losing streak.

In all cases, the long term trends remain solidly up, but things have definitely taken a turn down in the near term.

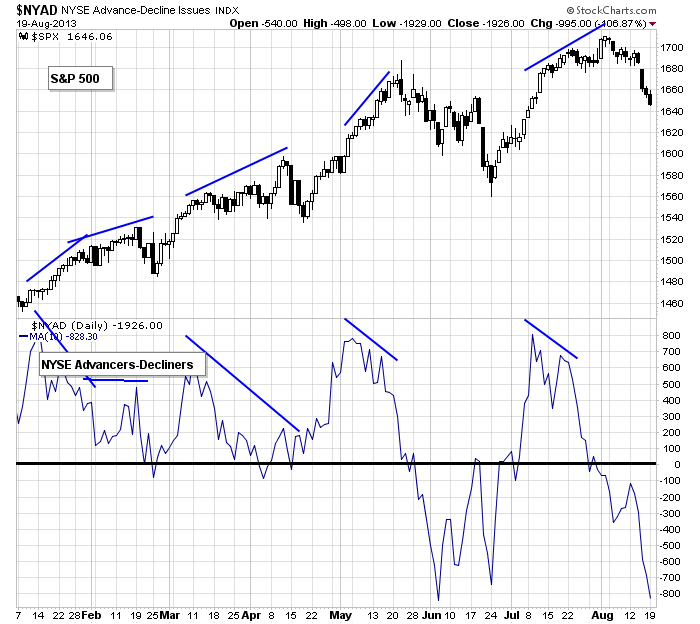

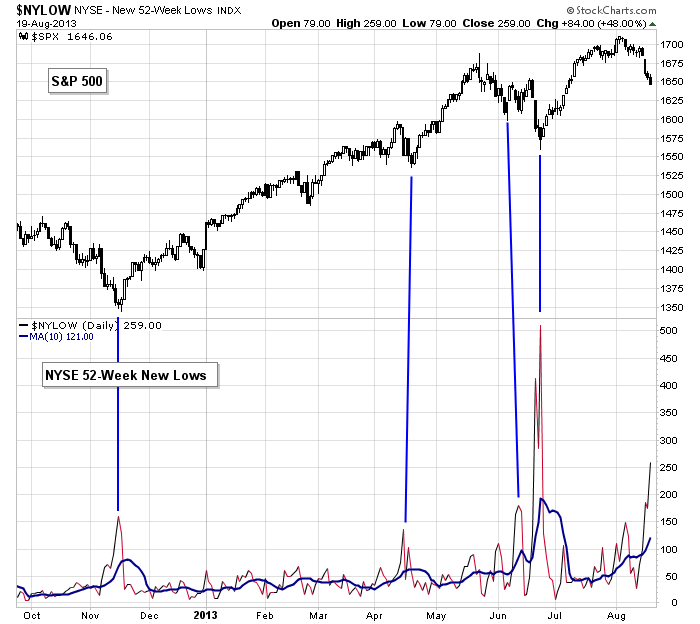

A week ago the market was correcting with time, not price. The indicators we falling, and price was holding up. But now prices are catching up with the internal deterioration.

Several indicators are moving to extreme levels. The NYSE AD line, for example, is at a level that has produced bottoms in the past (see first chart below). The NYSE new lows is spiking. It could certainly spike further, but we need to at least recognize a bottom is likely approaching (see second chart below).

If the market does not bounce soon, I’m afraid we could hit a little downside air pocket causing the market to plunge. This would entail the S&P dropping 80-100 points in just a couple days. Said another way, if the bulls aren’t motivated to step up and buy stocks at these lower prices, look out below.

Stock headlines from barchart.com…

Target (TGT -0.50%) and Wal-Mart (WMT -0.72%) were both downgraded to “Neutral” from “Positive” at Susquehanna.

Dick’s Sporting (DKS +1.20%) reported Q2 EPS of 71 cents, weaker than consensus of 74 cents.

JC Penney (JCP -1.34%) reported a Q2 EPS loss of -$2.16, a bigger loss than consensus of -$1.01.

Best Buy (BBY +1.19%) jumped 11% in pre-market trading after it reported Q2 EPS of 32 cents, well ahead of consensus of 12 cents.

Home Depot (HD -0.23%) reported Q2 EPS of $1.24, better than consensus of $1.21.

Robert Kopple reported a 19.99% stake in Cardero Resource (CDY +13.33%) .

Perfect World (PWRD +2.49%) reported Q2 adjusted EPS of 33 cents, better than consensus of 30 cents.

Aegean Marine (ANW +1.11%) reported Q2 adjusted EPS of 13 cents, below consensus of 17 cents.

Facebook (FB +1.97%) was initiated with a “Buy” at Janney Capital with a price target of $50.

Urban Outfitters (URBN +0.45%) rose nearly 7% in after-hours trading after it reported Q2 EPS of 51 cents, stronger than consensus of 48 cents.

Bob Evans (BOBE -0.36%) reported Q1 EPS ex-charges of 58 cents, better than consensus of 57 cents, and raised its quarterly dividend to 31 cents from 27.5 cents.

Earnings from seekingalpha.com…

Notable earnings before today’s open: BBY, BKS, DAKT, DKS, GLOG, HD, JCP, MDT, TJX, TSL

Notable earnings after today’s close: ADI, GSM, INTU, LZB, VELT, VNET

Other

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 20)”

Leave a Reply

You must be logged in to post a comment.

JC Penney (JCP -1.34%) reported a Q2 EPS loss of -$2.16, a bigger loss than consensus of -$1.01

And the stock is through the roof today.

I am looking at the vxn for signs of a bottom. At this point I do not see one. I think the gap up today will not last but not worth betting on.

Opinion only with the weakness in small caps and other factors I see a weak few months. I will let Jason tell me the trend is down and wait a few weeks then look for a bottom.

only with telepathy can u pick the minds of the instos for top and bottom piviots

but plenty of money to be made trading the intraday up /down swings

the casino is open—investors and long onlys not allowed

I don’t make predictions. I look at the sign posts and gauge the odds of different scenarios.