Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. India and South Korea dropped more than 1%; Indonesia and New Zealand rallied about 1%. Europe is currently mostly down. Belgium is down 1%; Stockholm, Spain, Italy and London are also down noticeably. Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

After the Dow dropped four consecutive days for the first time this year, the market bounced yesterday. Volume was stronger than the previous down day, and the internals were supportive of the move. It was a nice relief for the bulls but certainly doesn’t reverse the near term sentiment.

Some indicators have reached levels that would support a local bottom being put in place, but I’m not one for guessing. The market will do what it wants to do. Our job isn’t to guess what will happen. Instead we should identify the trend (if there is one) and decide how aggressive or passive we want to be.

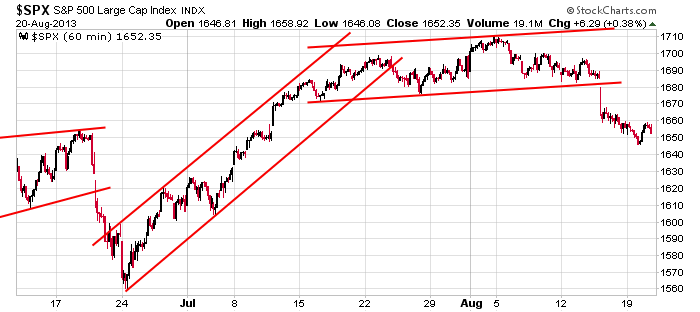

Here’s the 60-min SPX chart. There’s a thin area overhead between the high 1660’s and low 1680’s, and then there’s a big block of overhead supply. To the downside, there a lot thin air.

The near term is unclear. I could argue for an oversold bounce, but the internals would need to improve a bunch for a bounce to sustain itself. I could also argue for another immediate down leg because several indicators have not hit extreme levels yet. Lack of a clear picture tells us to trade cautiously in the near term.

Stock headlines from barchart.com…

Tupperware Brands (TUP +0.20%) was downgraded to “Market Perform” from “Outperform” at BMO Capital.

Target (TGT -0.42%) reported Q2 adjusted EPS of $1.19, well ahead of consensus of 96 cents.

Staples (SPLS +2.62%) reported Q2 EPS of 16 cents, lower than consensus of 18 cents, and then lowered guidance on fiscal 2013 EPS to $1.21-$1.25 from $1.30-$1.35, weaker than consensus of $1.32.

JM Smucker (SJM +0.04%) reported Q1 EPS of $1.24, stronger than consensus of $1.20.

Bloomberg repoted that PG&E (PCG +0.85%) CEO Tony Earley said that the company may be pushed to the brink of bankruptcy if California state regulators impose a proposed $2.25 billion penalty against the company related to a 2010 pipeline explosion.

Textron (TXT -0.18%) has been awarded a $640.79 million U.S. government firm-fixed-price contract for 1,300 cluster bomb units for foreign military sales to Saudi Arabia.

The WSJ reports that German Finance Minister Wolfgang Schäuble says that Greece will need a third bailout.

Lowe’s (LOW +0.94%) reported Q2 EPS of 88 cents, better than consensus of 79 cents, and also announced that CEO Mark Baker will resign.

La-Z-Boy (LZB +3.96%) rose over 1% in pre-market trading after it reported Q1 EPS of 18 cents, better than consensus of 15 cents.

Analog Devices (ADI +0.15%) reported Q3 EPS of 57 cents, better than consensus of 54 cents.

Intuit (INTU -0.44%) reported Q4 adjusted EPS of 0 cents, right on expectations, although Q4 revenue of $634 million was better than consensus of $622.95 million.

The Financial Times reported that Goldman Sachs (GS +0.59%) could face up to $100 million in losses after making erroneous trades across multiple options exchanges on Tuesday.

Earnings from seekingalpha.com…

Notable earnings before today’s open: AEO, EV, EXXI, LOW, MSG, PETM, SJM, SPLS,TGT, TOL

Notable earnings after today’s close: AFCE, HAIN, HPQ, LTD, SB, SNPS, VVTV

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 21)”

Leave a Reply

You must be logged in to post a comment.

Hey Aussie JS- How the Hell did you get accepted into Syd Uni Law ?? Your spelling is absolutely atrocious !! I was there for 2+ Yrs @ Syd Law (remember Prof Ted Wheelwright ? ) and would have been astonished that you would have been admitted into Aust’s most prestige’s Law Program !

Esp as you ventured into Locksmithing…..very odd and capricious !……

Jay,

im a genious –so they take a few points of for speling,if i get every thing else right im ok

but i was working for the high court of aust at the time and having to catch a bus down to phillip st law school for lectures, so if late i would go to the top floor pool room

well the game of pool /snooker got the better of me so i would just head for pitt st,crystal palace, pool hall instead of lectures

And Neal to answer your query,…..Perth is as far west and southern as is Townsville is as far North and Eastern, within the confines of Australia.

Why is is that Americian’s know SO LITTLE about Australia in relation to our knowledge of USA ??

if you turn america up side down,the way it should be then ammerica fits nicly into australia

with miami /townsvile far north east

and seatle bottom south west where perth is

august –i used to spend 3 months every year in florida starting august for the heat and hurricans–it was my winter vacation from cold winter sydney

The Fed lives! Beware the minutes and the meeting, without you know who. So, where are we headed for? I think 1269 by year end. No hope of peace in our time with Congress and Fed. Watch bonds, they might get a bid. TLT is the scared man’s play.

Where is Australia these days? I ran into it once sailing in the south Pacific and found it dumbed down version of California. If that is possible. No offense, just a little insight among friends.

Oh, did I mention the VIX is above 50EMA, which is a negative signal. So prepare for a correction. The NYSE is down and has net new lows. Excuse me, a continuation of the down trend.

“Some indicators have reached levels that would support a local bottom being put in place”

Great work. I am not too sure of a bottom. I hate to say it but the market “feels” like a big move is coming. I just wish I knew if i was right and which direction it was going.

what is the darn NASDAX 100 doing–its holding up the whole world bear campaign

dow and ftse are leading the way if not japan n225

but if we can move sideways here till end month,maybe a little push higher for a failed lower high we could have a all mighty crash for 6 months

weakly opts ex may be important here at least for nasdaq

Neal –do you have any red dow 1200 t shirts to infurryate the bulls

Just passing through. Neal- you are so correct & I would add that many youngsters can’t find the state they live on a USA map! We may b showing our age with comments like this.

no Neal

i was flat ,then short then long then short

and am still short the world going into asia open

what a wonderfull last 2 hours trading–things are heating up

yes i can pick intraday tops and bottoms –thats my job

i use preset piviot points ect

whos fiddleing with the euro

japan/china /interest rates—thats whats moving the markets

look at last 2 hours euro chart

the bears will buy them to taunt /tease the bulls,but only the 12,000’s

why do i have to trade the world futures rather than just one index

–its a mind set problem

i find that if i split my parcell size between 7 different world indexes

then it takes my mind of money and what would be a very large one index parcell on

only 0.5 % margin down

the world is run on leverage

does money die,,no it just gets deleveraged