Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China dropped almost 2%, Taiwan 1.2%. Japan rallied 1.2%. Europe is currently mixed. Most indexes are close to home; Italy is down more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up.

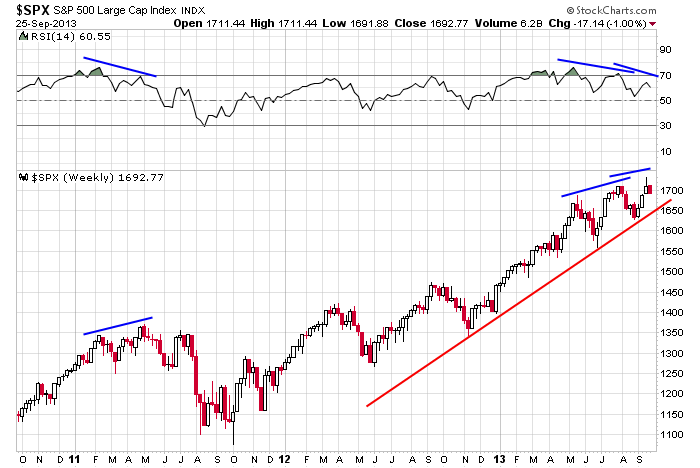

For the first time this year the S&P has fallen 5 straight days. Should we be concerned? Well, you gotta take note, but in the grand scheme of things, the long term trend remains solidly in place, and I’d characterized the selling as being orderly and healthy for a strong market. Things could change, especially as the debt ceiling talks heat up, but for now, overall I still like the upside.

Having said this, the S&P is still dealing with a negative RSI divergence…

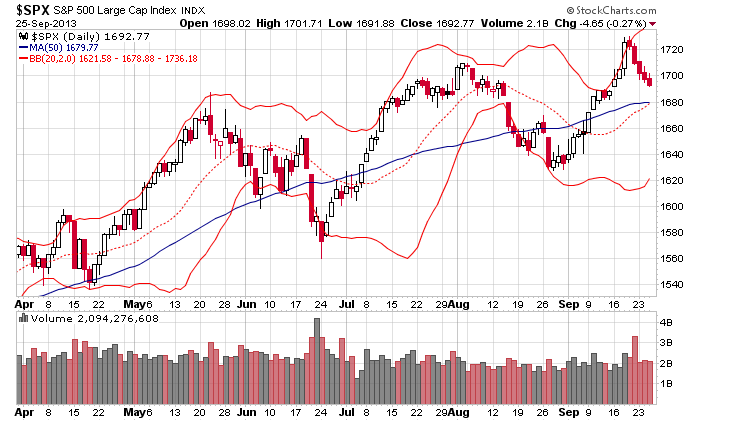

And although my downside target has inched up to the high 1670’s, this chart tells me moderate support doesn’t come into play until the 50 and middle Bollinger Band get tested.

There’s lots of stuff going on in the near term. Play it safe.

Stock headlines from barchart.com…

AmBev (ABV -1.13%) was upgraded to “Outperform” from “Neutral” at Credit Suisse.

AP reports that Nissan (NSANY -0.53%) recalled 908,900 vehicles for defective accelerator sensors that could cause the engine to stall.

Diamond Foods (DMND -1.08%) was upgraded to “Buy” from “Hold” at BB&T.

Jefferies kept its “Buy” rating on Facebook (FB +2.08%) and raised its price target on the stock to $60 from $37.

Grainger (GWW -0.41%) was upgraded to “Neutral” from “Sell” at Citigroup.

Hertz (HTZ -0.12%) lowered guidance on fiscal 2013 adjusted EPS view to $1.68-$1.78 from $1.78-$1.88, below consensus of $1.89.

McCormick (MKC -0.76%) reported Q3 EPS of 78 cents, slightly below consensus of 79 cents.

H.B. Fuller (FUL -0.47%) reported Q3 adjusted EPS of 74 cents, stronger than consensus of 67 cents.

Bed Bath & Beyond (BBBY -0.79%) rose over 4% in after-hours trading after it reported Q2 EPS of $1.16, better than consensus of $1.15.

SYNNEX (SNX -0.78%) said it sees Q4 EPS of $1.14-$1.18, below consensus of $1.18.

Jabil Circuit (JBL +1.22%) slid 5% in after-hours trading after it reported Q4 EPS of 56 cents, better than consensus of 54 cents, but then said it sees Q1 EPS of 50 cents-60 cents, below consensus of 63 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 GDP Q2

8:30 Corporate Profits

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

9:15 PM Fed’s George:U.S. Economy

Notable earnings before today’s open: FGP, MKC

Notable earnings after today’s close: ACN, NKE, THO

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 26)”

Leave a Reply

You must be logged in to post a comment.

First time claims down 5K and 3.5% growth rate(which is BS but nice to see they fib big when it matters politically). Bonds have strength up to about 138 when they may be met with a long term trend line and 35 years of lower rates, If the rates turn up watch out. Short bonds, and expect trouble in equities.

The modified CR will probably pass the Senate and get accepted by the House, but a shut down could still happen. We have had 24 of government shutdowns in my life time and we go on. But, be concerned over the debt ceiling. The President is playing cool, but debt ceiling concessions are well known in recent history. Time to talk about his health care gambit. Stocks? who knows, Jason likes the trend, so do I but I am the owner of puts. So no need to be loyal to a trend, be loyal to your wealth and stay cautious until the smoke clears.

i wanted nice fat strong bulls to eat on my return from china

but what do i find but confussed weak uncertain bulls that are annarexic

a failure here to make a new high should feed the bears all winter

of course there is no such thing as bulls n bears

just instos gaming each other and hedge funds on a derivitives day trading basis

daytradeing is still the only game in town

If the government were to really shutdown the market would be falling.

Jason RSI I like it. Bollinger Bands….. Not my indicator. Not in any model I have ever used.