Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Singapore and Taiwan led while India lagged. Europe is currently mostly down. Italy, Spain, Amsterdam and London are down the most. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is down. Oil is down, copper up. Gold and silver are up.

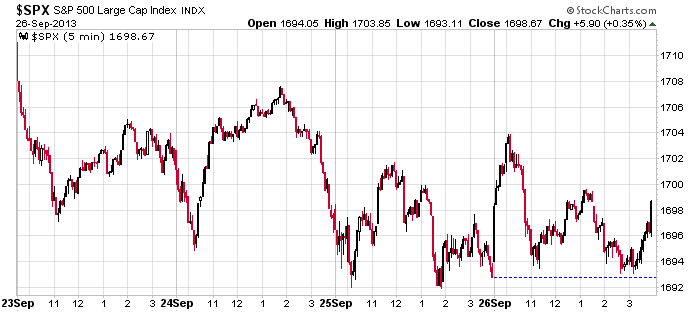

The S&P snapped its losing streak yesterday, but the character and personality of the market remains unchanged. Here’s the last four days – lots of up and down movement, lots of quick moves and sudden reversals…but no staying power. Nobody’s in control in the near term. When the week began, I felt the near term was unclear, and despite the index registering a loss 3 of the last 4 days, I still don’t sense either the bulls or bears are in control.

Charts of individual stocks look decent – definitely a lot more good long set ups than short, so my bottoms-up approach paints a positive picture. That’s the way I lean in the intermediate term. The debt ceiling talks can certainly influence things in the near term, but assuming Congress agrees on something at the 11th hour, the market should remain in good shape from a technical standpoint.

Stock headlines from barchart.com…

Bank of America (BAC -0.42%) and Goldman Sachs (GS -0.01%) wwere both downgraded to “Neutral” from “Buy” at Guggenheim.

BlackBerry (BBRY -0.75%) reported a Q2 adjusted EPS loss of -47 cents, a smaller loss than consensus of -49 cents.

Occidental Petroleum (OXY +0.72%) was upgraded to “Positive” from “Neutral” at Susquehanna.

Finish Line (FINL +0.45%) reported Q2 EPS of 54 cents, better than consensus of 45 cents.

The NY Times reports that the Justice Department has asked JPMorgan Chase (JPM +0.37%) to pay a higher fine for questionable mortgage practices than the roughly $7 billion that it has offered to pay.

Akamai (AKAM +1.32%) was downgraded to “Neutral” from “Buy” at B. Riley.

Arch Coal (ACI -1.52%) was downgraded to “Sell” from “Neutral” at Goldman.

KKR Fund reported a 28.4% stake in RigNet (RNET +3.43%) .

Thor Industries (THO -0.53%) reported Q4 EPS of $1.04, well ahead of consensus of 95 cents.

Nike (NKE +2.06%) rose over 6% in after-hours trading after it reported Q1 EPS of 86 cents, stronger than consensus of 78 cents.

PetSmart (PETM +0.76%) announced that it will increase its quarterly dividend from 16.5 cents to 19.5 cents per share beginning in the third quarter of fiscal 2013.

Accenture (ACN -0.33%) reported Q4 EPS of $1.01, right on consensus, although Q4 revenue of $7.1 billion was higher than consensus of $6.9 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Personal Income and Outlays

9:55 Reuters/UofM Consumer Sentiment

3:00 PM USDA Ag. Prices

Notable earnings before today’s open: AZZ, BBRY, FINL, MTN

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 27)”

Leave a Reply

You must be logged in to post a comment.

It is called volatility, but consumer spending is up again even though consumer income is down. That is called non-rationality. Then there is Congress and the President and the CR/debt ceiling. That is called nonsense. Be flat or be nowhere. Great football this weekend and its raining cold water in the NW. Jason lives in the sun to the south 4000 miles. Be happy if you can.

Why do I have the sudden feeling the market is about to go crazy?

Livermore tested his gut with numbers and in this case numbers don’t match my gut.