Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down. Indonesia and Japan dropped > 2%; Australia, Hong Kong, India, New Zealand and Singapore fell > 1%. China is currently down across the board. Belgium, France, Germany, Stockholm, Italy, Spain and Greece are down more than 1%. Futures here in the States point towards a big gap down open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are down.

It’s all about the impending government shut down. Simple as that. Unless Congress compromises today, a partial shutdown will take place at midnight tonight, and nonessential employees (about 800,000 of them) will be told not to show up for work tomorrow.

News trumps the charts, so throw out everything I stated over the weekend in the weekly report. Until the circus in Washingon ends, the market will be paralyzed and held hostage.

There is an option for Congress to pass legislation that would cover government financials for a few extra days to give the sides more time to negotiate. In my opinion, this is the worst of all worlds. They’ve had plenty of time to negotiate. The pressure needs to be kept on.

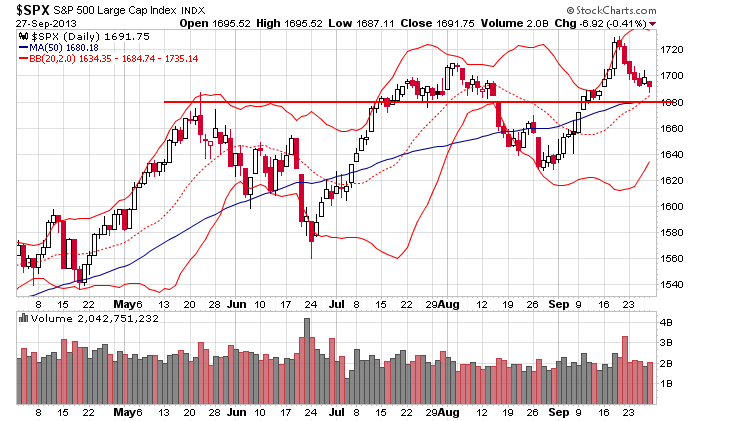

When the fiasco in Washington ends, my first downside S&P target is 1680 (via the daily chart),

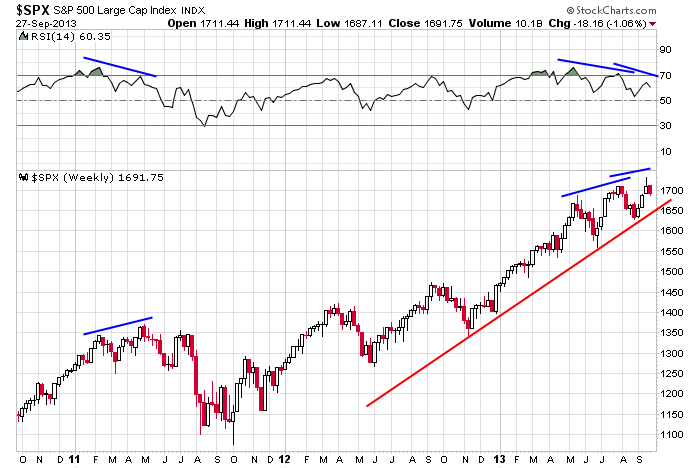

and then 1650 (via the weekly chart).

Stock headlines from barchart.com…

Johnson Controls (JCI -1.07%) was downgraded to “Underweight” from “Overweight” at Morgan Stanley.

Morgan Stanley upgraded Colgate-Palmolive (CL -0.76%) to “Overweight” from “Equal Weight.”

Cal-Maine Foods (CALM -1.09%) reported Q1 EPS of 36 cents, right on consensus.

Piper Jaffray reiterated its “Overweight” rating on Regeneron (REGN +0.04%) and raised its price target on the stock to $360 from $336.

J.M. Smucker (SJM -0.85%) was upgraded to “Buy” from “Neutral” at Citigroup.

Honeywell (HON -0.56%) was awarded a $485.46 million government contract to perform acquisition and sustainment for the Embedded Global Positioning System Inertial Navigation System.

Northrop Grumman (NOC -0.12%) has been awarded a $795.92 million contract modification to a previously awarded contract for contractor logistics support services in support of Air Mobility Command aircraft.

Raytheon (RTN -1.33%) was awarded a $243.48 million modification to a previously awarded contract for procurement of 89 Standard Missile-6 Block I All Up Rounds, spares, containers, and round design agent services.

Lockheed Martin (LMT -0.47%) was awarded a $3.41 billion government contract modification to a previously awarded contract for Low Rate Initial Production Lot VII F-35 Lightning II Joint Strike Fighter aircraft production.

Eminence Capital reported a 5.4% passive stake in Aeropostale (ARO -0.83%) .

Reuters reported that Vietnam Airlines will buy 19 Boeing (BA -0.54%) Dreamliners, a deal with more than $4 billion at list price.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

9:45 Chicago PMI

10:30 Dallas Fed Manufacturing Outlook

Notable earnings before today’s open: CALM

Notable earnings after today’s close: DMND, PAYX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 30)”

Leave a Reply

You must be logged in to post a comment.

The current cyclical uptrend began in March 2009: duration of 54 months. the bull from 2009 is long overdue for termination and it will likely be followed by a violent overbought correction. The economy is weakening and disinflating and unlikely to take much more from Congress and the President. Government shut down might be the trigger for a correction. Be humble, keep some cash, and try to enjoy life a little. Jason is taking the sun in the south. I am headed for my hideout in Mexico.

Guys and Gals, Been sidelined due to illness.

Seems the reversal which usually happens the day after an FOMC got momentum to the downside. Back on Sept 19th.

The gap down in futures (ES) last night triggered a long level which is valid down to about 1660 SPX (I’ll refine that later after I see what the delta is between the ES contract and SPX this morning). Obviously only for the very brave. Target is mid 1700s SPX. Will refine that also.

As Jason says, the market is held hostage til DC releases it. Be strapped in when word comes out, could be a very wild ride.

More later.

UPDATE: Long is valid down to SPX 1666. If it holds, tgt is SPX 1757.

nothing to do with insignificant washington

london runs the show

THE JAWS OF DEATH -BROADENING PATTERN IS COMING TO GET YOU

it will eat up the world

its started–follow the dow jones euro stoxx 50–$stox5e

the only hope is if the dax can save the world

The NASDAQ is down a whopping 1 percent on news of a certain Government shutdown. Tells me the whole thing is a show.

exhaustion tops are valid when hit, and they reverse fast when hit and only take a lower high /low for confirmation–we all probably remember silver

dow/spx may have already peaked –only hold out is ndx/dax

unless already short i wouldnt touch anything till high noon and europe closes

longs are to risky even for the ndx unless for a quick long countertrend scalp ,snipper action