Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. India, Indonesia and Singapore did the best. Europe is currently mostly up. London is down 0.5%, but Austria, France, Germany, Italy, Spain, and Czech Republic are doing well. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil is flat, copper down. Gold and silver are down.

For the first time in 17 years the government has partially shutdown. All nonessential employees (~ 800K) were told not to show up for work today. It’s not the first time, but it is the first time in a while. The longest shutdown lasted 21 days. The average is 7.

The market will be held somewhat hostage until Congress agrees on a budget. As I’ve said many times, Wall St is agnostic. It doesn’t take sides; in fact it routinely donates money to both parties. Wall St can handle anything thrown its way, but it doesn’t like to be left in limbo; it doesn’t like uncertainty. Until this mess passes, uncertainty is what we’ll have.

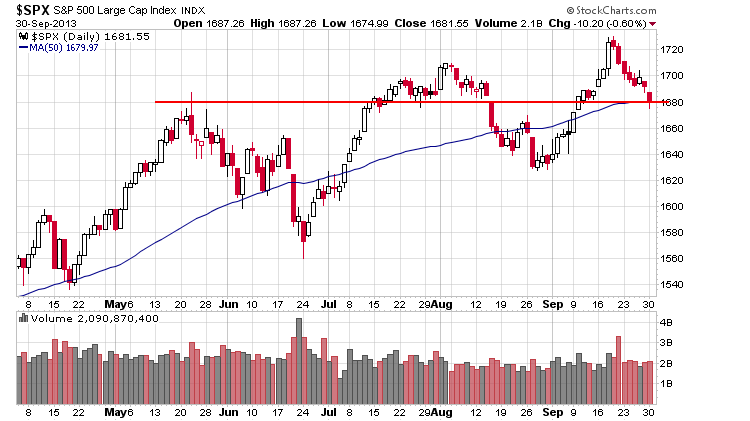

The technicals don’t matter as much right now, but let’s keep them in mind. The S&P is sitting right at my first target (1680). I still consider the recent action to be a normal pullback within an uptrend.

Long and intermediate term I like the market. Short term anything goes – especially with what’s going on in Washington.

Stock headlines from barchart.com…

Nike (NKE -1.36%) was upgraded to “Buy” from “Hold” at Argus.

Agilent (A -0.74%) was downgraded to “Hold” from “Buy” at Stifel.

T-Mobile (TMUS -0.38%) was upgraded to “Outperform” from “Perform” at Oppenheimer.

Walgreen (WAG -1.30%) reported Q4 EPS of 73 cents, right on expectations.

Wells Fargo (WFC -0.65%) announced that it will pay Freddie Mac (FMCC +0.80%) $780 million in a loan settlement that resolves all repurchase liabilities related to loans sold to Freddie Mac prior to Jan. 1, 2009.

The FDA approved the drug Brintellix, co-marketed by Takeda Pharmaceuticals (TKPYY +0.59%) and Lundbeck, to treat adults with major depressive disorder.

Pratt & Whitney (UTX -1.41%) was awarded a $2.5 billion government contract for various weapons systems spare parts.

Raytheon (RTN -2.12%) was awarded a $230 million government contract modification for operation and sustainment efforts of the X-Band radar in support of the Missile Defense Agency’s Sensors Program.

Clarcor (CLC +0.87%) boosted its quarterly dividend to 17 cents from 13.5 cents per share.

Mercury Systems (MRCY +1.94%) was awarded a $3.9 million contract from the U.S. Navy for advanced Digital RF Memory jammers.

Diamond Foods (DMND -2.57%) reported Q4 adjusted EPS of 9 cents, better than consensus for a -3 cent loss.

Paychex (PAYX +0.72%) reported Q1 EPS of 44 cents, better than consensus of 43 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

9:00 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

Notable earnings before today’s open: WAG

Notable earnings after today’s close: GPN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 1)”

Leave a Reply

You must be logged in to post a comment.

The core ETF portfolio, IWO, VBK, VT and BND is up 34% so far this year. The trading of individual equities is up only 13%. The buy and hold ETFs are becoming more interesting.

The shutdown could last to the Debt Ceiling show in mid Oct 2013. The secular trend may be shaky Jason, no one knows what is probable: be cautious, the Congressional inmates are running the economy.

We will open in the vicinity of the Long I spoke of y’day at (all # are SPX) 1678, which is valid down to 1666. As long as 1666 holds, TGT is 1757.

Resistance: 1689, 1693, 1696, 1702, 1710 then clear up to prev highs 1729.50. At each of these resistance levels expect a pullback, the severity of which tells you its significance. As a (or if a) level is cleared, repeat at next higher level.

“The S&P is sitting right at my first target (1680).” And the NASDAQ right now is less than 10 points off of a 13 year high? Strange?

Yep. The small caps, mid caps and Nas have done well. The old school, dividend paying S&P has lagged.

the german dax and nas have saved the gallexy

sell long only fat bulls