Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed down across-the-board. China, Japan and South Korea dropped 1%. Europe is currently mostly down. Austria, France, Norway, Czech Republic and Spain are down the most. Futures here in the States point towards a flat open for the cash market. This of course can change when the employment numbers are released.

The dollar is flat. Oil is up, copper down. Gold is up, silver flat.

Yesterday the market suffered its worst daily loss since the June meltdown. While TWTR had a spectacular first day of trading, the bears were out in full force otherwise. Besides the 27-point drop off the high, the S&P is now down 14.5 for the week. Barring a big rally, it’ll be the first weekly loss of the last five.

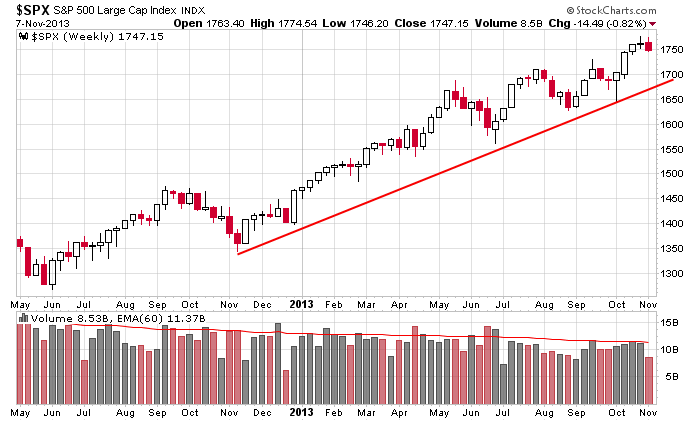

Here’s the weekly. There is nothing wrong with the long term technical picture. Sure the S&P can fall another 50 points, but overall there’s no reason to believe the uptrend will not continue and new highs not made.

Here are the employment numbers…

unemployment rate: 7.3% (was 7.2% last month)

nonfarm payrolls: +204K

private payrolls:

average workweek: unchanged at 34.4

hourly wages: up 2 cents to $24.10

labor participation rate 13.8% from 13.6%

Sept job gain raised to 163K from 148K

Aug job gain raised to 238K from 193K

As long as the Fed is data-dependent, the jobs numbers are a catch-22. Bad numbers imply weakness (bad) but no tapering (good for Wall St.). Good numbers imply the opposite.

The numbers don’t look that bad to me (at least compared to the recent past). And I’m sure the government shutdown had a negative effect.

But it doesn’t matter. The futures quickly moved down, and that’s all that matters.

My stance remains the same. Long term I like the market. Near term it’s muddled and unclear.

Stock headlines from barchart.com…

The NY Times reports that the White House is supporting a bill that would raise the federal minimum wage to $10.10 an hour.

Whole Foods (WFM -11.18%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

DigiTimes reports that Samsung (SSNLF -10.34%) will launch smartphones with 64-bit CPUs starting in 2014.

Peabody Energy (BTU -0.64%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Covidien PLC (COV -0.43%) reported Q4 EPS of 91 cents, better than consensus of 90 cents.

NVIDIA (NVDA -2.35%) rose 1% in pre-market trading after it reported Q3 EPS of 26 cents, better than consensus of 20 cents.

Disney (DIS -2.68%) reported Q4 EPS of 77 cents, stronger than consensus of 76 cents.

CareFusion (CFN -0.98%) reported Q3 adjusted EPS of 44 cents, better than consensus of 39 cents.

The Gap (GPS -0.71%) reported October net sales up 6% y/y and October Same-Store-Sales were up 4% and then said it sees Q3 EPS of 70 cents-71 cents, above consensus of 66 cents.

Monster Beverage (MNST -1.25%) fell 2% in after-hours trading after it reported Q3 EPS of 53 cents, below consensus of 57 cents.

Salix (SLXP -2.37%) will acquire Santarus ({=SNTS for $32 per share in cash or $2.6 billion.

Groupon (GRPN -5.09%) rose almost 2% in pre-market trading after it reported Q3 EPS of 2 cents, double consensus of 1 cent, but then said it sees Q4 EPS at 0 to 2 cents, well below consensus of 6 cents.

Roundy’s (RNDY -1.93%) reported Q3 adjusted EPS of 7 cents, well below consensus of 13 cents.

Priceline.com (PCLN -3.32%) reported Q3 adjusted EPS of $17.30, well above consensus of $16.15.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Nonfarm Payrolls

8:30 Personal Income and Outlays

9:55 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: AINV, COV, CVC, DRH, EBIX, EGO, HALO, HMSY, LGF, NTWK

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 8)”

Leave a Reply

You must be logged in to post a comment.

1. Non-Farm Employment Change is out at 8:30 AM EST. This is major.

2. Unemployment Rate is out at 8:30 AM EST. This is major.

3. Average Hourly Earnings m/m is out at 8:30 AM EST. This is not major.

4. Core PCE Price Index m/m is out at 8:30 AM EST. This is not major.

5. Personal Spending m/m is out at 8:30 AM EST. This is not major.

6. Personal Income m/m is out at 8:30 AM EST. This is not major.

7. Prelim UOM Consumer Sentiment is out at 9:55 AM EST. This is major.

8. Prelim UOM Inflation Expectations is out at 9:55 AM EST. This is major.

9. President Obama Speaks at 1:10 PM EST. This is major.

9. Fed Chairman Bernanke Speaks at 3:30 PM EST. This is major.

People who love their capital, keep stops under their stocks. The payroll today was from crack heaven 260K including a revision. and unemployment down. Your turn to do the numbers next month, you will need a coke bottle to spin. Today is elevator day,when the numbers hit the futures fell, the boyz really hate the smell of good news even if its a fairy tale.

The caveat yesterday “assuming the bullishness persists” — it didn’t. The pullback turned into a waterfall. As Jason says, good numbers are bad news and vice versa.

That gives us a lot of levels to watch.

Downside: if spx 1735-36 does not hold, we could travel down to 1710-11, Jason’s trendline. That 1710-11 is significant.

Upside: resistance at multiple levels. 1751 is first test, more at 1759 up thru 1764. About 20 futures points from this moment. Could be done. Never get too bearish or too bullish. Not saying it will, just saying don’t say it won’t.

Futures, despite a very negative reaction to the nonfarm payroll report, have recovered most of their loss. SPX futures ES are -1.0 and were -9. Actually, they just went positive +1.25.

Jason

Looks like we diverge in our opinions here. I am a chart watcher and number cruncher. The market just dropped off of the table yesterday. No bounce no nothing. It looks like we are in for at least a week of bad days for the bulls. I do see support for the NASDAQ at 3780. Even then I want to see CBOE PC over 1.2 along with other factors before I am convinced to go long / close shorts.

Futures have been all over this AM. It shows fear. We have not had a pull back in a year. Odds favor a downturn.

It takes a lot more than one down day for me to change my long term view. 🙂

Dear Jason:

I enjoy your analysis and it is an automatic for

me to refer to every morning. Also, the comments

of Whidby and Mike are very present. Es De

Thanks.