Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. Hong Kong and Japan did well; India, Indonesia, New Zealand and Taiwan lagged. Europe is currently mostly up. Belgium is down 1.2%; France, Amsterdam, Norway, Switzerland, Greece, Italy and Spain are doing well. Futures here in the States point towards an up open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are down.

As is typically the case, I don’t have much to say beyond what I wrote in the weekly report posted over the weekend.

The divergence between the large caps and the Nas and small caps is a little concerning.

And if the breadth indicators were in charge, we’d get some weakness right now, not strength.

But, the S&P is just a few points below its all-time high and nicely poised to bust out and rally. If the machines are in control, that’s what’s likely happen. Ignore the technicals, ignore the internals…just have a mind of its own and rally.

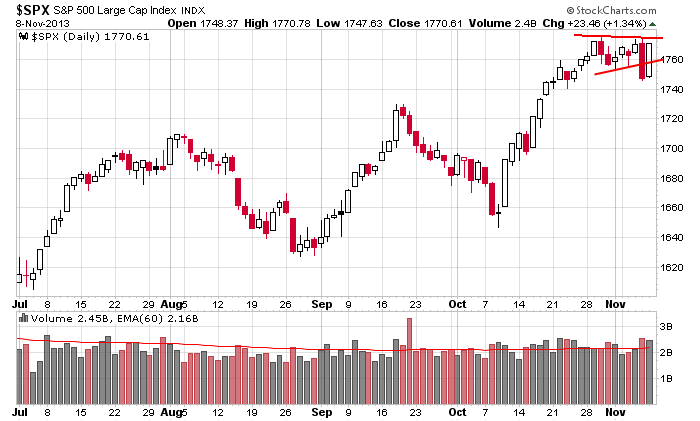

Here’s the S&P daily. After several months of “5 steps forward, 4 steps back,” the index has settled into a consolidation range. We got one big down day last week and a quick recovery. The breadth indicators may suggest some internal deterioration, but there is nothing wrong with this chart. The market is in good shape (this has always been the case, I never doubted the big picture). You knos the Wall St. adage…don’t fight the trend.

Stock headlines from barchart.com…

AP reports that Target (TGT +0.45%) is planning to open at 8 p.m. on Thanksgiving Day, an hour earlier than last year, with stores remaining open until 11 p.m. on Black Friday, and that Best Buy (BBY +3.72%) plans to open at 6:00pm nationwide on Thanksgiving Day instead of midnight to commence this year’s Black Friday shopping.

Applied Materials (AMAT +2.25%) Q3 earnings results likely to beat expectations, says RBC Capital.

Tata Motors (TTM +3.71%) was downgraded to ‘Neutral’ from ‘Buy’ at Nomura.

Best Buy (BBY +3.72%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS who raised their price target on the stock to $49 from $35.

TD Ameritrade (AMTD +3.43%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Raymond James.

DigiTimes reports that in the period between June and October, Samsung (SSNLF -10.34%) has placed 40% fewer notebook component orders than forecast and Apple (AAPL +1.57%) placed 50% less than last year.

Eli Lilly (LLY +1.24%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman.

American Tower (AMT -1.24%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Michael Kors (KORS +1.91%) will replace NYSE Euronext (NYX +1.54%) in S&P 500 as of the 11/12 close.

Moody’s Investors Service has raised its outlook on the Ba3 government bond rating of Portugal to stable from negative.

Southeastern Asset reported a 13.1% passive stake in Empire State Realty (ESRT -1.60%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

No events scheduled.

Notable earnings before today’s open: ABFS, CRNT, GOGO, PGNX, SLW

Notable earnings after today’s close: AGO, ALIM, BID, CRAY, FTEK, HOLX, IOC, RAX, SHO, SLTM, SPRD, VSAT

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 11)”

Leave a Reply

You must be logged in to post a comment.

g.m. would have been nice to mention the veterans day in the u.s. as a son of a veteran ,the menion goes along way with readers in the states , happy veterans day to all who fought in our wars some paid the ultimate price while others survived . thanks for serving , bob

You’re right Bob. Living abroad, I’m totally out of touch with things. I didn’t even know it was Veteran’s Day until I logged into Facebook and saw a bunch of related posts.

http://www.masteremail.com/Reports/AllCharts/$NYA_Daily_McClellanVolumeChart.bmp

Take a good look at NYA volume on last friday. Very unsupportive of the gain in the index.

The cloud over the markets is the budget deal (no going well as Senate’s Rep and Ryan in the

House are unable to send anything to the committees. The sequester lives on. Then the debt ceiling is smothering everyone. If it fails it becomes an admission that the Congress can not govern fiscal affairs. Downgrade may follow and dollar is discredited. Be a trader, keep some dividend stocks, and watch. The 2016 elections will make these two tasks nearly impossible.

Thanks for the chart.

Oh gosh, you’re not talking about 2016 already, are you? 🙂

SPX conquered Friday’s resistance. That means a lot to the boyz. Bullish.

Today’s two scenarios:

1. Could rise from the open and hit a short term target that developed Friday at 1774. If that happens, would expect a pullback, the size of which I do not know. Be aware that we do have the possibility of retracing a chunk of Friday’s move, which would take us down to mid 1750s.

2. The other scenario is that we retrace Friday’s move from the open, same level: mid 1750s. Anything lower than 1750, bulls have a problem.

One of those weird “holidays” today with the banks closed and the market open. Sometimes it’s quiet and sometimes they go wild.

Thanks, ES DE, for your comment.

Futures are subdued: +1 Dow, +.50 SPX, -4.0 Nasdaq.