Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Japan rallied 2.2%; China and South Korea also did well. India and Indonesia dropped more than 1%. Europe currently leans to the downside. Norway, Stockholm, Spain, Czech Republic and Greece are down the most. Futures here in the States hint at a slight down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

Here are the comments I made in yesterday’s report…

There seems to be two opposing forces at work right now. 1) The internal breadth indicators suggest some weakness is needed to work off some extreme levels. This is perfectly normal for a healthy market. The indicators oscillate up and day and generally do a pretty good job warning us if the underlying trend is strong or in need of a rest. 2) Despite the indicators, the S&P is close to an all-time high, so it seems there may be an invisible hand at work, a hand that wants the market to move up regardless of other factors. If this is true, if the powers that be want the market move up, we could be on the verge of the mother-of-all melt ups. One of those moves that makes little sense and therefore doesn’t have a high-participation rate, but one that takes place nonetheless.

So which will it be? Correction to allow the indicators to cycle or a sudden surge that catches many traders off guard?

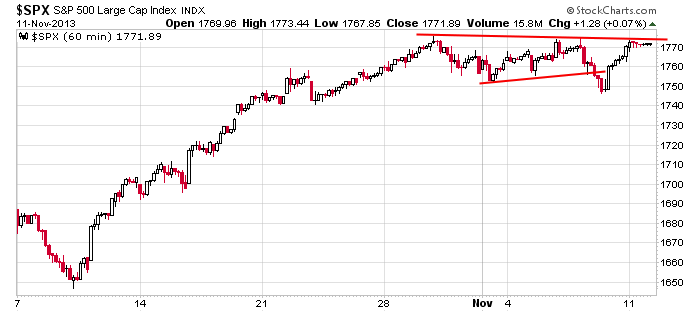

Here’s an update of the 60-min SPX chart…consolidation within a solid up trend. Support was taken out but was quickly recaptured. Now the market is near resistance and could easily bust out and run.

Nobody likes this rally. Lots of people are in denial. This is exactly the environment surprise rallies emerge from.

Stock headlines from barchart.com…

FedEx (FDX -0.04%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Cowen.

Costco (COST +0.20%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS due to valuation.

Cinemark (CNK +1.43%) was upgraded to ‘Buy’ from ‘Neutral’ at Janney Capital.

DISH (DISH -1.55%) reported Q3 EPS of 68 cents, much better than consensus of 44 cents.

DR Horton (DHI -0.44%) reported Q4 EPS of 45 cents, better than consensus of 40 cents.

NRG Energy (NRG -0.99%) reported Q3 EPS of 54 cents, well below consensus of 80 cents.

Northern Tier (NTI +2.60%) reported Q3 EPS of 30 cents, well below consensus of 43 cents.

BGR reports that Tesla (TSLA +4.89%) looking at recalling Model S due to fires.

T-Mobile (TMUS -2.57%) dropped over 2% in pre-market trading after it filed to sell 66.15 million shares of common stock.

Hologic (HOLX +3.90%) reported Q4 EPS of 39 cents, better than consensus of 37 cents, but then lowered guidance on fiscal 204 EPS to $1.32-$1.38, well below consensus of $1.64.

News Corp. (NWSA -1.02%) dropped 4% in after-hours trading after it reported Q1 adjusted EPS of 3 cents, below consensus of 5 cents.

Rackspace (RAX +1.59%) reported Q3 EPS of 11 cents, weaker than consensus of 16 cents.

Vipshop (VIPS -2.08%) reported Q3 EPS of 26 cents, stronger than consensus of 21 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

1:00 PM Results of $30B, 3-Year Note Auction

Notable earnings before today’s open: ACM, AG, AMED, ARIA, DF, DHI, DISH, DM, DNDN, EVEP, FVE, GTXI, HNR, MEA, NRG, NS, PERI, RDA, ROC, SATS, SCLN, SNMX, SNSS, SRPT, SWC, YGE

Notable earnings after today’s close: BWC, CDXS, DIOD, GNMK, HMA, MBI, MDVN, MWE, NQ, PBPB, PEGA, RLD, SINA, SUPN, WX, YRCW

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 12)”

Leave a Reply

You must be logged in to post a comment.

Jason’s invisible hand theory driving the market is historically touching French 1700th thinking, but it is wrong too. In fact it is the Fed FOMC and the investor expectations that its liquidity is the rule for sometime to come. No attention to the fiscal mess in WashDC,or the unfortunate confusion in the EU which is going into a disinflation until it becomes deflation. Then in China the New policy of letting the markets lead is just nonsense in a state where no one can vote unless invited into the party. David Kotock of Cumberland says buy stocks. Why? We are today on the edge of the budget and debt ceiling, or dancing along the cliffs. No thanks, I’ll let it unfold and decide then.

After 10 am, yesterday was a big yawn. Not much changed as a result.

A little better-defined support developed however. As long as we hold 1766, expect a move up to 1776-77. If this happens, expect a pullback after hitting the target.

If we break 1766, expect that we could proceed down to mid 1750s.

Jason

This market does not make sense. Given the events of the last two trading days I am ready to change my outlook from bearish to bullish. The numbers tell me so and price action does as well.

When a bear becomes a bull you know what happens to the market.

We know the new bull loses his stake. When people like you become bullish, run. But! its your money right? Will, have fun.