Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across-the-board. Australia, China, Hong Kong, Indonesia, South Korea and Taiwan each dropped more than 1%. Europe is currently down across-the-board. Austria, Belgium, London, Czech Republic and Italy are down more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is flat. Oil is up, copper down. Gold and silver are up.

I have felt like a broken record the last couple weeks…an rightfully so. The market has done nothing. The S&P is range bound, and other than a move down last Thursday and a quick recovery Friday, the market has traded very quietly and methodically. The S&P typically moves 20-25 points each week. That’s been the range the last three weeks. It is what it is, and it’s why I’ve been laying low and not very interested in the market. Well, that and the fact that there have been very few very good set ups. Sure if I look hard enough I can find a few, but trades work best when I find 100 good ones and then can pull out the 10-15 best. This isn’t the case right now. I have a hard time finding 20 good one, let alone 100.

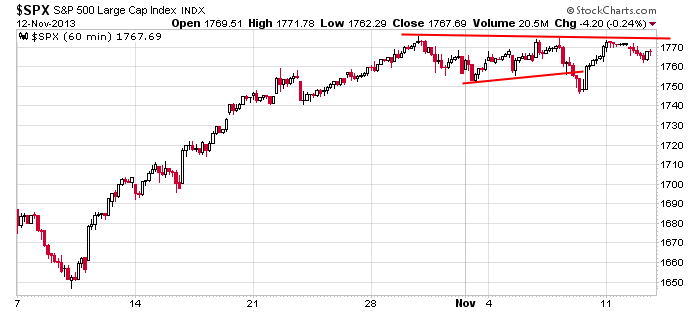

Here’s an update of the 60-min chart. A huge rally has been followed by a consolidation pattern. Simple as that. Don’t read too much into it.

Stock headlines from barchart.com…

Health Management (HMA -0.08%) reported a Q3 EPS loss of -1 cent ex-items, well below consensus of a 15 cent profit.

Transocean (RIG -0.42%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim.

Qualcomm (QCOM +1.32%) was upgraded to ‘Conviction Buy’ from ‘Buy’ at Goldman with an $80 price target.

Western Refining (WNR +9.15%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Dean Foods (DF -7.66%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

PetroChina (PTR -1.46%) acquired Petrobras (PBR -2.61%) assets in Peru for approximately $2.6 billion.

U.S. Steel (X -0.66%) rose nearly 3% in pre-market trading after Morgan Stanley upgraded the stock to ‘Overweight’ from ‘Equal Weight.’

NGL Energy Partners (NGL -1.28%) reported a Q2 EPS loss of -5 cents, weaker than consensus of a 5 cent profit.

Bloomberg reported that Johnson & Johnson (JNJ -0.77%) will pay over $4 billion to settle more than 7,500 suits filed in federal and state courts against its DePuy unit by patients who’ve already had recalled hip implants removed.

SAC Capital reported a 5.0% passive stake in Vitamin Shoppe (VSI +2.58%) .

Babcock & Wilcox (BWC -0.47%) reported Q3 adjusted EPS of 57 cents, better than consensus of 55 cents, although Q3 revenue of $774.8 million was below consensus of $851.45 million.

YUM! Brands (YUM -0.35%) reported itsOctober same-store sales declined an estimated 5% for the China Division.

Woodward (WWD +0.20%) reported Q4 EPS of 76 cents, stronger than consensus of 70 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

1:00 PM Results of $24B, 10-Year Note Auction

2:00 PM Treasury Budget

7:00 PM Bernanke Press Conference

Notable earnings before today’s open: CSIQ, EJ, ELOS, IKGH, M, MTOR, PF

Notable earnings after today’s close: AFCE, ANW, CSCO, EGLE, KGC, MM, NTAP, NTES, PNNT, SEAS, TTEK, WGL, XONE

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 13)”

Leave a Reply

You must be logged in to post a comment.

Today’s gap down will be well worth watching. No bounce could mean a long coming pullback. A snap back to yesterdays levels could mean more bullishness ahead. Regardless it is time to stay away from the market.

Yellen gets to stir the water. Meanwhile the fears over the EU grow, and China may be faking it on reforms, or at least does not have much any time soon. Caution.

SPX 1766 broke on Tues. Overnight, futures moved down. They hit the targeted area of mid 1750s.

We should bounce, and the nature of that bounce will tell you a lot after meeting resistance which is at 1763 up thru 1765-66.

Two scenarios:

1. if 1765-66 breaks, we could proceed to 1778. A small pullback first.

2. if 1765-66 holds, we could proceed to low 1750’s.

At 9:10 SPX futures -8.75 and Dow futures -85. Both had been lower 30 mins ago.

Mike… Great call!