Good morning. Happy Thursday.

The Asian/Pacific markets closed up across-the-board. Japan rallied 2.1%, Indonesia 1.55 and Singapore, Hong Kong, China and Australia also did well. Europe is currently mostly up. Italy, Spain and Austria are down while Belgium, Germany, Norway, Stockholm, Switzerland, London and Greece are doing well. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil and copper are down. Gold is down, silver is up.

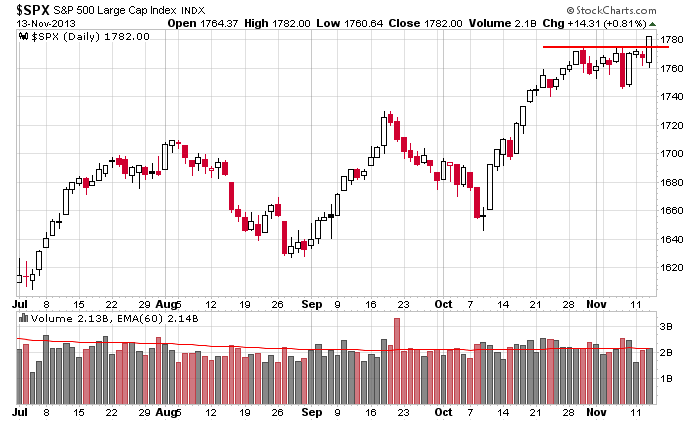

After a couple weeks of consolidation, the S&P busted out yesterday. Here’s the daily chart. It’s a beauty. The index rallied 120+ points, rested for 2+ weeks, and then broke out. It doesn’t get more textbook than that. The index corrected with time instead of price. Oh well. I would have preferred a pullback to allow the charts to re-set at lower levels. Obviously I don’t always get what I want.

Janet Yellen has her confirmation hearing in front of the Senate Banking Committee today. I’m assuming her prepared remarks are already public because I’m seeing some quotes in the media. Here are a couple…

”We have made good progress, but we have farther to go to regain the ground lost in the crisis and the recession.”

“labor market and economy [are] performing far short of their potential”

Yellen is known to be more dovish than Ben Bernanke, so it’s no surprise she comes right out and implies QE will continue – even though 1) it has only bailed out Wall St, while very little of the money has flowed through to Main St and 2) it has had diminishing returns. Nevertheless, she’ll argue to keep the punch bowl spiked. I remember taking econ in college. The professor acted as if econ was a science – that there were causes and effects, etc. As an engineering major I rejected the notion that econ was a science, and the activity of the Fed proves my point. In science, you start with a hypothesis. Then you formulate a plan. Then you execute. If the plan works, you keep going. If not, you stop and do something else. The data rules. The economists at the Fed keep following their plan even though it’s not working.

Whatever. We’re traders. Let’s just make money. Today is important. Follow through or a false breakout. We’ll see.

Stock headlines from barchart.com…

Wal-Mart (WMT +0.24%) reported Q3 EPS of $1.14, higher than consensus of $1.13.

Kohl’s (KSS +1.15%) reported Q3 EPS of 81 cents, weaker than consensus of 86 cents, and then lowered guidance on fiscal 2013 EPS view to $4.08-$4.23 from $4.15-$4.35, less than consensus of $4.23.

Viacom (VIAB +1.23%) reported Q4 EPS of $1.55, well ahead of consensus of $1.44.

Helmerich & Payne (HP +0.31%) reported Q4 EPS of $1.47, better than consensus of$1.40.

Sally Beauty (SBH +1.02%) reported Q4 EPS of 38 cents, less than consensus of 39 cents.

Cardinal Health (CAH +1.48%) was awarded a maximum $1.02 billion government contract modification for prime vendor medical and surgical supplies.

Kinross Gold (KGC +1.63%) reported Q3 adjusted EPS of 5 cents, higher than consensus of 4 cents.

Tetra Tech (TTEK -0.30%) reported Q4 EPS of 39 cents, better than consensus of 36 cents.

BorgWarner (BWA +0.46%) announced a two-for-one stock split to all shareholders of record as of the close of business on December 2.

SeaWorld (SEAS +2.82%) reported Q3 EPS of $1.33, mauch better than consensus of $1.21.

Cisco (CSCO +1.14%) tumbled 11% in after-hours trading after it reported Q1 adjusted EPS of 53 cents, higher than consensus of 51 cents, but then lowered guidance on fiscal 2014 adjusted EPS to $1.95-$2.05, below consensus of $2.10.

NetApp (NTAP +2.71%) fell 3% in after-hours trading after it reported Q2 EPS of 66 cents, better than consensus of 63 cents, but reported Q2 revenue of $1.55 billion, below consensus of $1.6 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 International Trade

8:30 Jobless Claims

8:30 Productivity and Costs

9:45 Bloomberg Consumer Comfort Index

10:00 Janet Yellen speech

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

1:00 PM Results of $16B, 30-Year Note Auction

4:30 PM Fed Balance Sheet

4:30 PM Money Supply

Notable earnings before today’s open: AMBC, BRKS, DANG, DCIX, GIB, GLOG, HP, KSS, PAAS, SBH, SPH, TDG, TYC, VIAB, WMT

Notable earnings after today’s close: A, AMAT, HMIN, JWN, YOKU

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 14)”

Leave a Reply

You must be logged in to post a comment.

If we ever thought the gov’t does not run the economy yesterday should change minds: just the promise of more liquidity reversed the markets to UP after a very fretful day DOWN. We are in trouble its called a Pavlof response. Say the word and the traders so nuts. Yellen is a labor theory of GDP economist. She will push on debt purchases and forcing unemployment down while lecturing Congress on spending on more domestic projects. We are in trouble because that is not going to happen,the House will block more spending exceeding the sequester levels. Train Wreck as we economist say. Probably a US credit downgrade comes by March 1st.

The First time claims were down 2K, if anyone cares. Now listen to Yellen as she romances the Senate into putting their stamp on her as the least evil of the devils on the list of possibles.

Anticipate a move down to SPX 1780, should hold 1778, from which we should bounce.

If we break 1778, next support @ 1773 down thru 1769.

If those levels are held, expect a move (today or later) up to 1790, possibly 1795.

If we don’t hold 1769, next area of support is 1761.

With Ms Yellen testifying at 10 eastern, markets will be paying close attention, but as Jason has said, she’s pretty much telegraphed that the party will continue.

Futures at 9:20 SPX +2.25 Dow +10 Were higher overnight.

Thanks, Daddy Paul, for your comment. Hope I’m able to help Jason help you make money.

looks like a false break PONSI to me

Trading today is like forcing the ball into triple coverage with two LB’s in your face.

It is definitely much harder when the market just keeps going up and up and up and doesn’t pull back much.

True