Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mostly up. China, Hong Kong, India, Japan and South Korea rallied more than 1%. Europe is currently mostly up. Greece and Italy are down. Amsterdam and Norway are leading to the upside. Futures here in the States point towards an up open for the cash market.

The dollar is flat. Oil is up, copper down. Gold and silver are down.

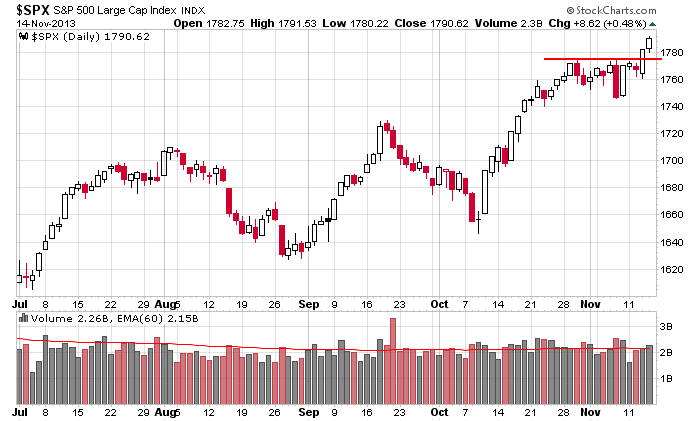

It’s been a breakout week for the S&P. Here’s the daily. A 120+ point rally settled into a 2+ week consolidation pattern which has resolved up the last two days. It doesn’t get more textbook than this…although I would have preferred a pullback. Now the index is trying to build gains on top of gains.

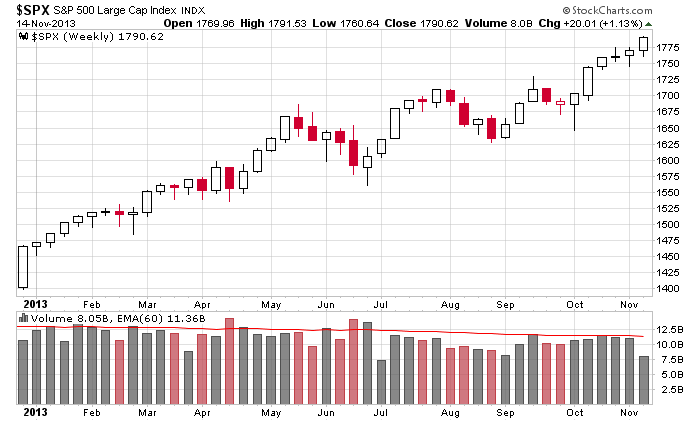

Here’s the weekly. Barring a massive sell-off, this will be the 6th consecutive up week for the market – a feat that hasn’t been accomplished since January.

Don’t fight the trend. Don’t fight the Fed. Don’t over-analyze or think too much.

Stock headlines from barchart.com…

Morgan Stanley reiterated its ‘Overweight’ rating on Amazon.com (AMZN +3.14%) and raised its price target on the stock to $404 from $380.

TransDigm (TDG -2.21%) was upgraded to ‘Buy’ from ‘Hold’ at KeyBanc.

Kellogg (K +1.33%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Barclays.

JPMorgan Chase (JPM +0.48%) reported October net credit losses of 2.82% vs. 2.63% in Sep and October delinquency rate of 1.60% vs. 1.57% in Sep.

Travel Centers of America (TA +0.37%) announced that it has agreed to acquire 31 convenience stores with retail gasoline stations for $67 million.

Reuters reported that Comcast (CMCSA +0.63%) is planning to begin selling movies for download and streaming through the cable operator’s set-top boxes and its Xfinity TV website.

Kimberly Clark (KMB +0.80%) climbed nearly 7% in after-hours trading after it said that it is pursuing a spin-off of its health care business.

Agilent (A -1.29%) reported Q4 adjusted EPS of 81 cents, stronger than consensus of 76 cents.

Nordstrom (JWN +0.08%) reported Q3 EPS of 69 cents, higher than consensus of 66 cents.

Applied Materials (AMAT -0.62%) reported Q4 adjusted EPS of 19 cents, better than consensus of 18 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Empire State Mfg Survey

8:30 Import/Export Prices

9:15 Industrial Production

10:00 Wholesale Trade

Notable earnings before today’s open: MMS

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 15)”

Leave a Reply

You must be logged in to post a comment.

We have not had a significant pullback in a year. The indicators have reset themselves. The PC ratio is still about .8 which means the market is free to run higher. I look for a PC ratio of .65 or less before I will short.

Mixed performance on the indexes yesterday. The Yellen effect is going to be notable: first up then confusion on the down side and she will think she is doing it all. But not so, only budget and fiscal peace will lead to another rally.