Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. India, Indonesia and Japan dropped the most. South Korea moved up. Europe is currently mostly up. Spain and Greece are up 2%; Austria is up 1.2%; Germany, Switzerland and London are also posting decent gains. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is flat. Oil and copper are up. Gold is up, silver down.

I’m going to repeat comments I made after yesterday’s close…

My gut says the technicals are not in total control right now…that there are forces out there that could quickly push the market in one direction or the other. Ultimately the technicals will win, but in the very near term, I would not be surprised if we got a quick move in either direction. Be on your toes.

This week isn’t just a new week, it’s a new year. And a new year brings a new attitude and a lot of pent up desires (to buy and sell). Temporarily, the fact that it’s a new year trumps the charts, so despite the first three days of 2014 starting on a down note, resist getting too negative.

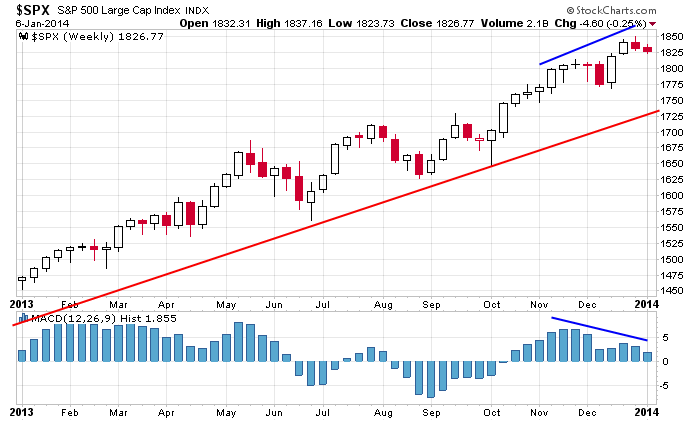

What are the technicals? First the overall trend is up.

But there’s a negative divergence on the weekly…

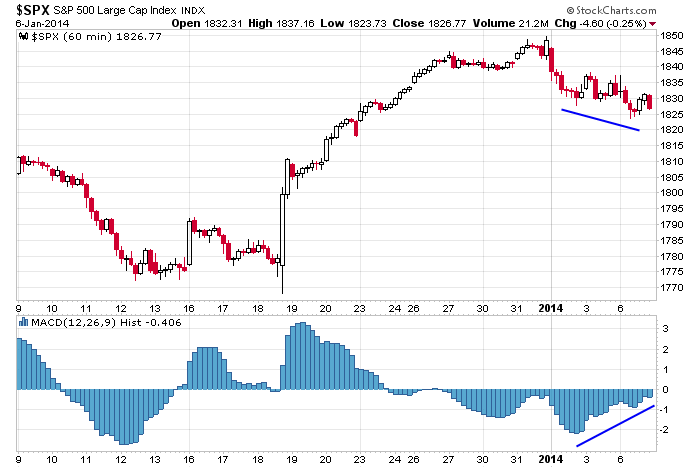

And within the weekly, there’s a positive divergence on the 60-min chart…

Long term I like the market, short term anything goes.

Stock headlines from barchart.com…

Capital One (COF -0.97%) was upgraded to a Conviction Buy at Goldman on expectations for 2nd-half 2014 card growth and higher margins and capital returns.

IHS Inc.(IHS -0.46%) reported Q4 adjusted EPS of $1.46, higher than the consensus of $1.27. Management said that fiscal year 2013 financial expectations “remain unchanged.”

Eli Lilly (LLY +0.84%) provided guidance for fiscal-2014 EPS of $2.77-2.85, near the consensus of $2.78.

Epizyme (EPZM -0.34%) rallied more than 20% in after-hours trading after reporting that it made milestone payments in its collaboration efforts with Celgene (CELG -4.23%) and GlaxoSmithKline (GSK +0.38%) and after raising guidance for its year-end cash position.

North American Palladium (PAL +12.50%) rallied 10% in after-hours trading after increasing its fiscal year palladium production guidance.

Palo Alto (PANW +0.70%) rallied 6% in after-hours trading after acquiring cybersecurity firm Morta Security.

Sonic (SONC -2.38%) rallied 4% in after-hours trading after reporting in-line earnings and providing guidance for fiscal-year 2014 earnings growth of 14%-15%.

Uni-Pixel (UNXL +0.21%) fell 7% in after-hours trading after announcing that manufacturing of its InTouch Sensor product line will be delayed until Q2.

Corinthian Colleges (COCO -4.02%) fell 7% in after-hours trading after disclosing that it received a notice from the Consumer Financial Protection Bureau that legal action may be brought against the company.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:30 International Trade

8:55 Redbook

1:00 PM Results of $30B, 3-Year Note Auction

Notable earnings before today’s open: CMC, IHS

Notable earnings after today’s close: APOL, MU, TCS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 7)”

Leave a Reply

You must be logged in to post a comment.

Mesh sends the Saxo bank economist’s forecast for 2014. He sees more problems than most can think about. The best is Japan simply “deleting” its debt when It becomes unmanageable. Hope that Yellen does not hear about this new QE move. Lawyers will view this as fraud, if they have such things in Japan.

We are happy looking forward to the Labor report on Friday. Today the trade deficit fell as oil imports fell. Of course the middle east producers are not too happy. Long thru Friday at least.

Tapped area of support Monday at the lows, about 11am. Tgt still ~~ 1862 as long as 1819 is not violated.

Resistance starts at 1836 and runs to 1841. If broken, expect a pullback before going higher.

Futures moved steadily higher overnight, reached +8. Now +6.25

Would not be surprised to see a pullback if we gap higher at the open.

Today’s gap is holding and even adding to the gains. For months gaps lasted an hour at best. Surprising. Bullish.