Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Japan dropped 3.1% and Australia 1.5%. China rallied 0.9%. Europe is currently mostly down, but only Greece (down 1.5%) is down much. Futures here in the States point towards an up open for the cash market.

The dollar is up slightly. Oil is up, copper is flat. Gold and silver are down.

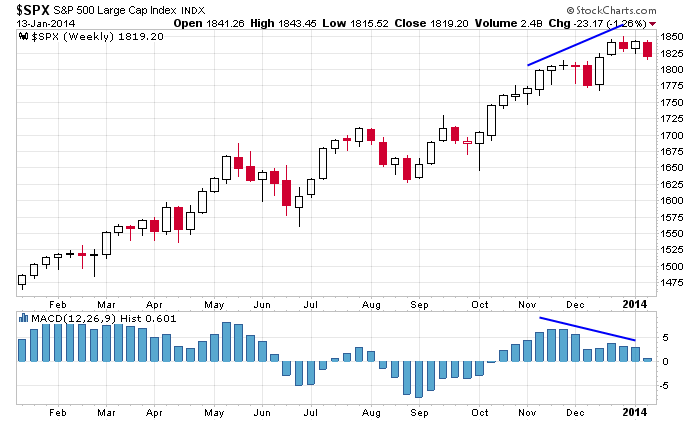

After many slow days, the negative divergence I’ve been posting finally asserted itself yesterday. Here’s the weekly…

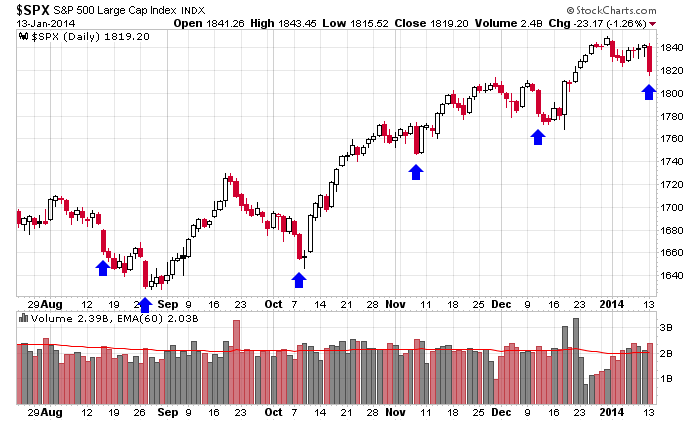

But before you freak out and assume the show is over and a downtrend is inevitable, check out the other big down days over the last six months. Only the mid-August drop followed through much; the others reversed soon after.

Pullbacks happen. They are normal and necessary, so don’t panic just because they happen. It’s like getting a bad pitch to hit. No biggie. Keep the bat on your shoulder and wait for the next one. Except in this case the next one might not be for a couple days or couple weeks.

On a short term basis, the biggest reason for concern is the declining breadth indicators. They’ve been moving down for a couple weeks (as I’ve noted in the weekly report).

On a longer term basis, the biggest cause for concern is the growing assumption the market is going to do well during the Q1, do poorly during the Q2 and Q3 and then rally into the end of the year. Maybe it happens, but in order for the market to do well during Q1, people have to buy. They can’t just sit and wait for others to buy. If everyone assumes the market will move up, who is left to buy?

Play it safe here. More after the open.

Stock headlines from barchart.com…

JPMorgan Chase (JPM -1.35%) reported Q4 EPS of $1.40, better than consensus of $1.37.

Stanley Black & Decker (SWK -1.56%) was upgraded to ‘Buy’ from ‘Hold’ at KeyBanc.

Nokia (NOK -2.44%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Raymond James.

Family Dollar (FDO -3.68%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Barclays.

Jabil Circuit (JBL -2.53%) was upgraded to ‘Conviction Buy’ from ‘Neutral’ at Goldman.

Qualcomm (QCOM -0.88%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Raymond James.

Intel (INTC -0.12%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan with a $29 price target.

Danaher (DHR -1.97%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

General Mills (GIS -0.97%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Morgan Stanley.

WellPoint (WLP -1.25%) raised guidance on fiscal 2013 adjusted EPS to $8.52 from ‘at least’ $8.40, above consensus of $8.51.

Standard & Poor’s Ratings Services placed its ratings on Sears Holdings (SHLD -3.41%) on CreditWatch with negative implications following Sears’ earnings guidance update that results for Q4 ending Feb. 1 will be much weaker than expectations.

Yum! Brands (YUM -2.15%) gained 1% in after-hours trading after it reported that December same-store sales increased an estimated 2% for its China Division, but then reversed and fell over 1% after it reported its Q4 same-store sales declined an estimated 4% for the China Division.

Google (GOOG -0.64%) climbed 1.3% in pre-market trading after announced that it has entered into an agreement to buy Nest Labs for $3.2 billion in cash.

Bloomberg reported that Charter (CHTR -1.61%) offered to buy Time Warner Cable (TWC -0.72%) for about $132.50 a share, but then the Time Warner Cable board rejected the Charter offer, calling it ‘grossly inadequate.’

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:30 Retail Sales

8:30 Import/Export Prices

8:55 Redbook Chain Store Sales

10:00 Business Inventories

Notable earnings before today’s open: CBSH, JPM, LEDS, SJR, WFC

Notable earnings after today’s close: LLTC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 14)”

Leave a Reply

You must be logged in to post a comment.

As Jason says, pullbacks happen.

Yesterday’s looks bad unless you see what “the boyz” were targeting. Yesterday’s low was one tick above the absolute low they could take it for that layer of support to remain valid.

And so for today, we have our line to watch: yesterday’s low. If they hold 1815 (today and into the future), it projects a target to 1865.

If 1815 is broken, it will mean that 1780 is likely target.

Futures range -2.25 to +5.00 a few moments ago. +4.50 ATT

Two more lower closes of more than 1% down total and I have a buy signal. They have been very rare since November of 2012. That said they have been very very correct.

Jason

I am with you yesterday was just a very normal pullback.

Goldman’s call for a pullback in the markets is a problem, citing the S&P 500 now trades close to fair value and further P/E expansion will be difficult to achieve. Probably right, but there will be winners and losers. You know, like it used to be before the great Fed levitation started.

lots of happy talk. Consumers are not sure of their income future. Taper means a few dollars less to the stock market, but not much less. Overall, nothing to run from yet. But stops may be wise. Hawaii is not paradise this year more trash NW of the main island every year. Hotels aging, food ok, but costly, and the Japanese tourists are not buying houses anymore. Shortly we leave for California – there is a state to tie up to!

A one day pull back and now were back to setting records.