Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan rallied 2.5%, India, New Zealand and Indonesia more than 1% and Australia, Singapore and Taiwan also did well. Europe is currently up across the board. Germany, Greece, Italy, France, Stockholm and Austria are doing the best. Futures here in the States point towards an up open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are down.

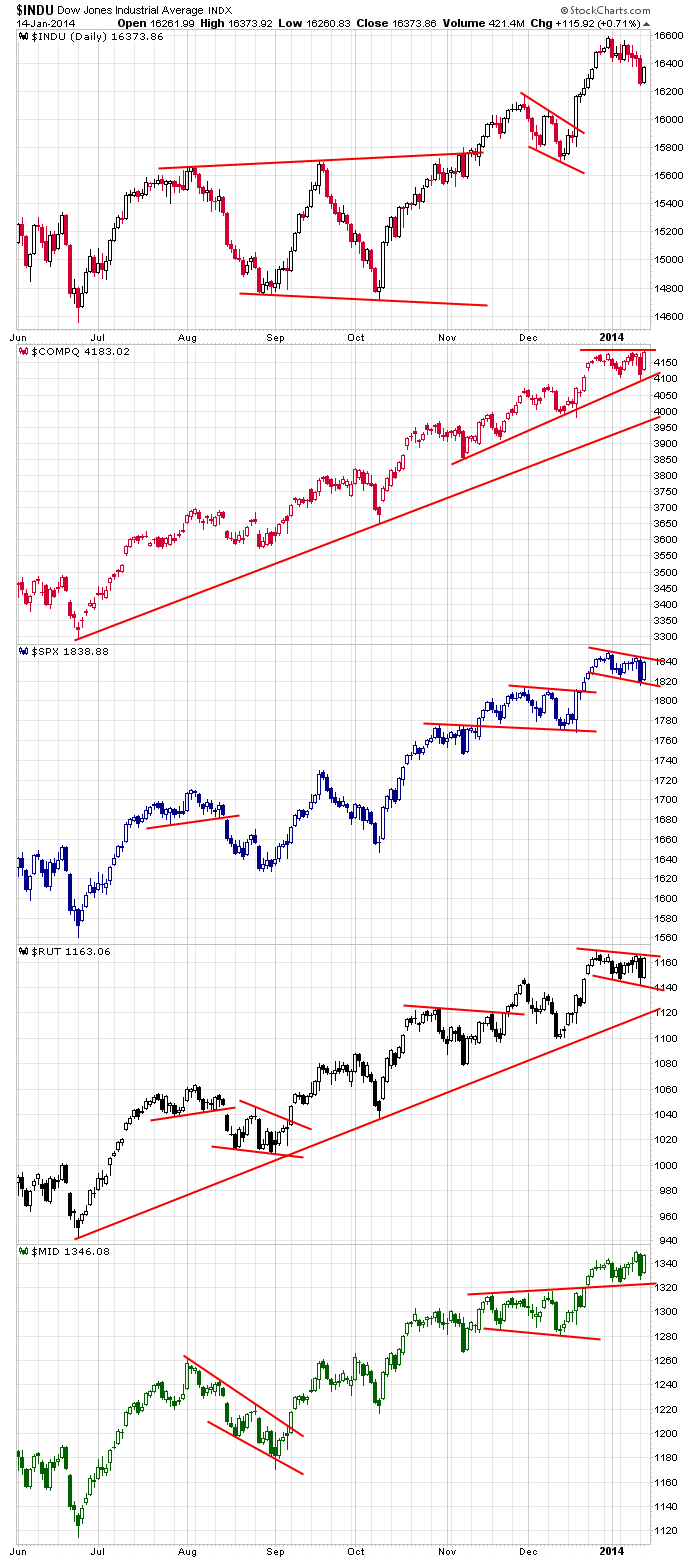

The market moved down big Monday and then moved up big on Tuesday. This has put most of the indexes right back in their consolidation ranges. Here are the daily index charts. The Dow is lagging some, but this is fine. It went vertical the last two weeks of December. The Nasdaq closed at a new high. The S&P 500 and Russell 2000 are trading in similar consolidation patterns within steady uptrends. The S&P 400 isn’t far from the new high it established last Friday. As I’ve said, there’s nothing wrong with these charts.

There’s no shortage of people out there with strong opinions about the market. I’ve seen everything from “the market is going to crash twice this year” to “the market is going to rally another 15% this year” and everything in between.

I’m not sure why people need to predict what will happen far into the future. Take the daily chart of the S&P over to the local kindergarten and ask the kids “is the line going up, going down or going sideways.” Listen to the kids and trade in the direction of the line. Simple as that. If the market reverses, you don’t need to nail the first 5-10% anyways. More after the open.

Stock headlines from barchart.com…

Bank of America (BAC +2.07%) reported Q4 EPS of 46 cents, well ahead of consensus of 27 cents.

Fastenal (FAST +1.64%) reported Q4 EPS of 33 cents, below consensus of 34 cents.

Airgas (ARG +1.23%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman.

Intel (INTC +3.96%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital.

Dick’s Sporting (DKS +1.82%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

PetSmart (PETM +0.48%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Sanofi reported a 16.24% stake in Regeneron (REGN +11.78%) .

Chelsea Therapeutics (CHTP -8.00%) exploded higher by more than 150% in after-hours trading after it announced that the FDA voted 16-1 to recommend approval of Northera for the treatment of symptomatic neurogenic orthostatic hypotension.

Wells Fargo raised its price target range for Allergan (AGN +5.94%) to $132-$133 from $121-$122 and kept its ‘Outperform’ rating on the stock after Allergan received its first new Restasis patent and a district court found that Lumigan patents are valid.

Credit Suisse reported a 6.9% passive stake in Beazer Homes (BZH +1.03%) .

Watsco (WSO +2.17%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman.

General Motors (GM +1.11%) rose over 3% in after-hours trading after it announced a 30 cents per share quarterly common stock dividend, its first dividend since coming out of bankruptcy.

Credit Suisse reported a 5.36% passive stake in Chimera (CIM unch) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Producer Price Index

8:30 Empire State Mfg Survey

10:30 EIA Petroleum Inventories

2:00 PM Fed’s Beige Book

Notable earnings before today’s open: BAC, FAST

Notable earnings after today’s close: CSX, EPB, KMI, KMP, PLXS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 15)”

Leave a Reply

You must be logged in to post a comment.

Todays PPI is OK. But BAC is kidding us says Zero Hedge: Ok, so BAC would have missed wildly if it hadn’t dug into its bag of usual accounting tricks. But what about the organic business? Well, since banks traditionally make money not as hedge funds but as lenders, here is the bottom line: in Q4, just like with Wells, mortgage origination crumbled by a whopping 49%! This led to a $1.1 billion loss in the CRES group, a drop of $2.6 billion compared to a year ago.” If you can not sell mortgages sell accounting stunts.

OpEx comes this way, but maybe up a little today. My TTFS beat the SP5 last year, but god do you pay for the active management. I am long and strong.

Good suggestion: show the chart to kindergartners, Jason.

Making progress towards the target at 1865.

Could pullback down to 1828 (not saying it will, just saying it could) and uptrend would still be intact.

If it pulls back and breaks Monday’s low, uptrend is done for now.

Will be resistance at previous highs. Expect it.

Futures positive all night. +4 now