Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. China rallied 2.2%; Indonesia and New Zealand also did relatively well. Europe currently leans to the downside. Belgium, Italy, Spain and Switzerland are down the most. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil is up, copper is down. Gold and silver are flat.

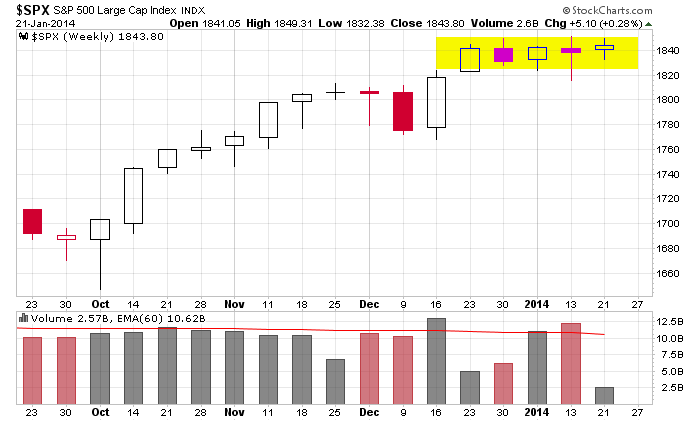

Here’s the S&P weekly. Once again the market has corrected with time, not price. Instead of moving down to work off the over-bought condition, it has moved sideways in a tight range. Rallies get sold, dips get bought. Day traders make money. Swing traders who are good stock pickers make money. Brokers make money. Everyone else churns their account. There have been some obvious leading groups to focus on the last month, so despite the lack of overall movement, we’ve had some good trades.

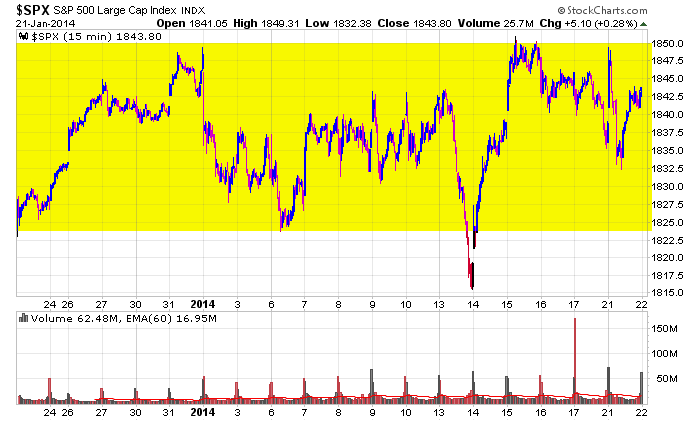

And here’s the 15-min chart.

Let’s keep playing the leaders from the strongest groups (there’s a bull market somewhere, right). More after the open.

Stock headlines from barchart.com…

Mosaic (MOS -0.45%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman.

Motorola Solutions (MSI +1.53%) reported Q4 EPS of $1.67, stronger than consensus of $1.62.

United Technologies (UTX +0.68%) reported Q4 EPS of $1.58, higher than consensus of $1.53.

Textron (TXT unch) reported Q4 EPS of 60 cents, better than consensus of 59 cents.

Coach (COH -0.02%) reported Q2 EPS of $1.06, below consensus of $1.11.

Allegheny Technologies (ATI -5.84%) reported a Q4 EPS loss of -8 cents, better than expectations of a -21 cent loss.

Texas Instruments (TXN +0.92%) fell over 1% in pre-market trading after it reported Q4 EPS of 46 cents with items, right on consensus, but then said it sees Q1 EPS of 36 cents-44 cents, below consensus of 44 cents.

Xilinx (XLNX +0.68%) reported Q3 EPS of 61 cents, stronger than consensus of 54 cents.

Nuance (NUAN -0.87%) rose 9% in after-hours trading after it raised its Q1 adjusted EPS view to 23 cents-24 cents from 18 cents-21 cents, better than consensus of 20 cents.

Cree (CREE +0.53%) climbed over 4% in after-hours trading after it reported adjusted Q2 EPS of 46 cents, better than consensus of 39 cents.

IBM (IBM -0.87%) slid nealy 4% in pre-market trading after it reported Q4 EPS of $6.13, higher than consensus $5.99, and said it sees 2014 EPS at least $18.00, better than consensus of $17.97. However, IBM said revenue declined to $27.7 billion in the 3-months throgh Dec amid plunging demand for servers, the seventh consecutive quarter revenue has declined.

Bob Evans (BOBE +0.04%) fell over 4% in after-hours trading after it cut its fiscal 2014 EPS outlook to $2.20-$2.30, well below consensus of $2.57.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

Notable earnings before today’s open: ABT, APH, ASML, ATI, COH, EAT, FCX, GD, MSI, NSC, NTRS, PGR, PH, STJ, TEL, TXT, USB, UTX, VIVO, XRS

Notable earnings after today’s close: BXS, CCI, EBAY, EGHT, ETH, EWBC, FBC, FFIV, FIO, HRC, JEC, LOGI, NE, NFLX, PLCM, RJF, RLI, SNDK, SUSQ, SYK, TCBI, TER, UMPQ, URI, VAR, WDC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 22)”

Leave a Reply

You must be logged in to post a comment.

Said this yesterday “I would expect, but don’t guarantee, an intraday move down, but it should hold 1837. If it does break that, it could go to 1830-32…..”

They held 1832 yesterday and with that they began another leg up.

Target remains 1865 unless 1827 is violated.

For today, if we go down, we should find support at 1839. An early warning of danger to upside progression would be breaking 1837. I’d be tightening stops.

Resistance exists at 1844 – 1846.

Futures range overnight +4.75 to – 3.75. Now +1.00