Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Australia, Hong Kong, South Korea and Singapore dropped more than 1%. Europe is currently mixed. Greece is down 1.5%, Austria 0.6% and Norway 0.5%. Futures here in the States point towards a moderate gap down open for the cash market.

Join our email list and be notified when reports just like this are posted.

The dollar is down 0.4% – a relatively big drop. Oil is up, copper down. Gold and silver are up.

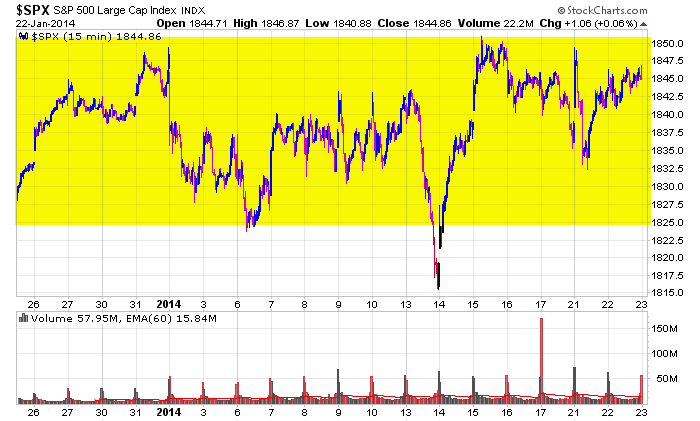

Yesterday was an inside day; all the movement took place within the high and low of the previous day. The range was small, and neither the bulls nor bears could force a directional move for very long. Here’s the 15-min S&P chart. It’s a good old-fashioned consolidation pattern. After hitting over-bought levels in December, the market has corrected with time, not a price drop.

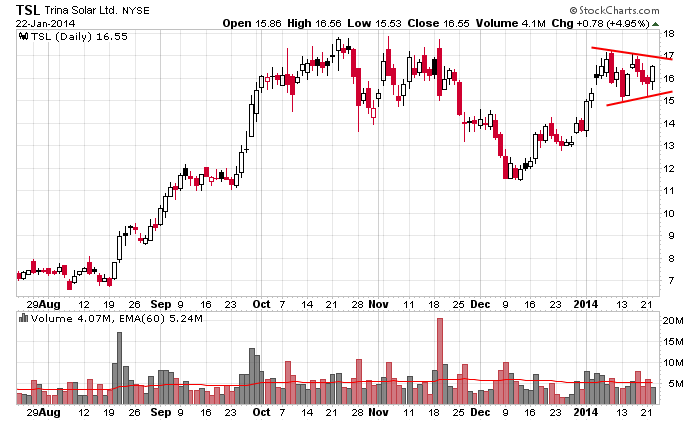

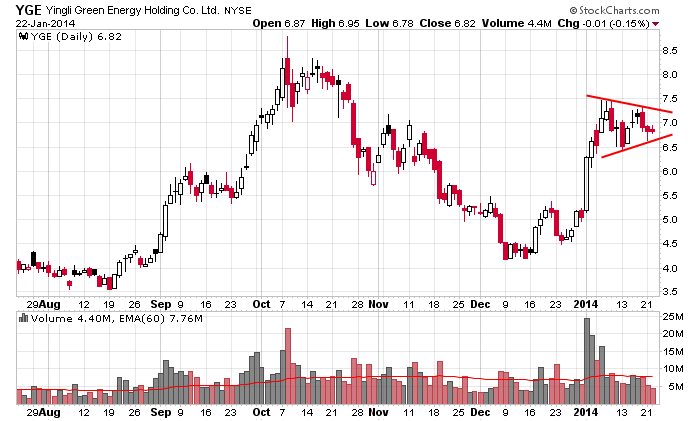

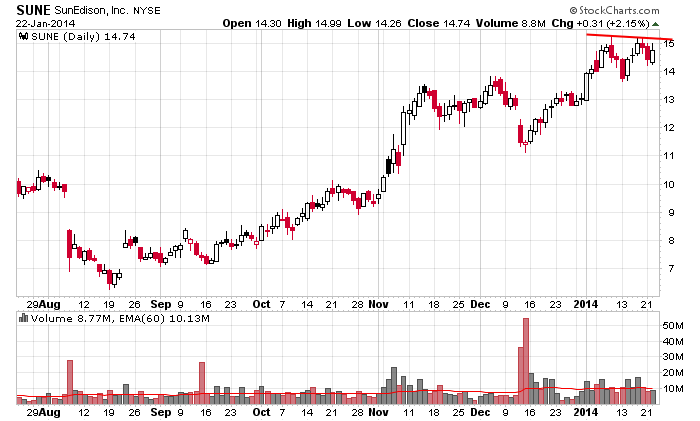

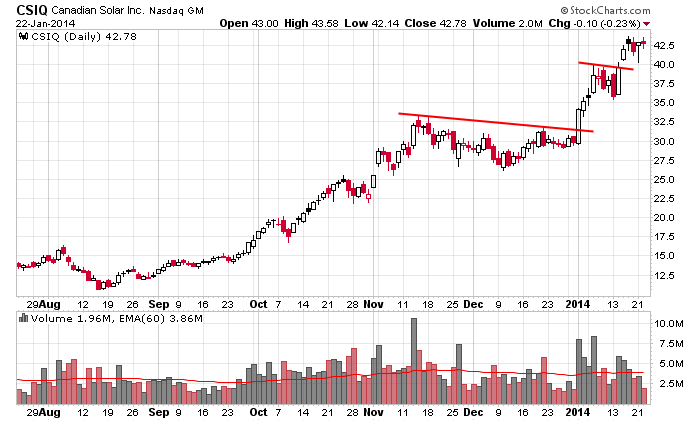

Solar is the market’s strongest group right now. We’ve had several good trades the last few months, and now several are setting up again (we’ve played these in the past; it’s time to play them again).

TSL, YGE and SUNE look ready to go.

This is in addition to SCTY and CSIQ, which have already done great.

There’s a bull market somewhere, right? More after the open.

Stock headlines from barchart.com…

Fifth Third Bancorp (FITB +0.46%) reported Q4 EPS of 41 cents, weaker than consensus of 42 cents.

Precision Castparts (PCP +0.14%) reported Q3 EPS of $2.95, below consensus of $3.03.

Lockheed Martin (LMT +1.65%) reported Q4 EPS of $2.38, well ahead of consensus of $2.11.

IBM (IBM -3.28%) rose +0.4% in pre-market trading after it announced that Lenovo Group Ltd. will buy its server business for $2.3 billion.

Microsoft (MSFT -0.66%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank who also raised their price target on the stock to $40 from $32.

Oracle (ORCL -0.34%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank who also raised their price target on the stock to $45 from $33.

Salesforce.com (CRM +0.31%) and Citrix (CTXS -0.47%) were both downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Raymond James (RJF -0.83%) reported Q1 EPS of 81 cents, well ahead of consensus of 73 cents.

United Rentals (URI +0.10%) reported Q4 adjusted EPS of $1.59, better than consensus of $1.47.

Western Digital (WDC -0.88%) fell 2% in after-hours trading after it reported Q2 EPS of $2.19, stronger than consensus of $2.08, but then lowered guidance on Q3 EPS to $180-$1.90, below consensus of $1.95.

eBay (EBAY +0.48%) gained over 5% in after-hours trading after it reported Q4 adjusted EPS of 81 cents, higher than consensus of 80 cents, although Q4 revenue of $4.53 billion was slightly below consensus of $4.54 billion.

SanDisk (SNDK +0.42%) reported Q4 adjusted EPS of $1.71, well ahead of consensus of $1.58.

Varian Medical (VAR +0.77%) reported Q1 EPS of 91 cents, stronger than consensus of 90 cents.

Stryker (SYK -0.01%) reported Q4 adjusted EPS of $1.23, higher than consensus of $1.22.

Netflix (NFLX +1.53%) rallied 17% in after-hours trading after it reported Q4 EPS of 79 cents, much better than consensus of 66 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

9:00 PMI Manufacturing Index Flash

9:45 Bloomberg Consumer Comfort Index

10:00 Existing Home Sales

10:00 FHFA House Price Index

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ABC, ACAT, ALK, AVT, BAX, BGG, BKU, BPOP, CSH, CY, DLX, FCS, FITB, GMT, JBHT, JCI, JNS, KEY, LMT, LUV, MCD, MTG, NOK, ORI, PCP, QSII, TDY, TZOO, UNP

Notable earnings after today’s close: ALTR, AMCC, CBST, CE, CPWR, CYN, DFS, DLB, ETFC, FII, HXL, IGT, INFA, ISRG, JNPR, KLAC, LEG, MSCC, MSFT, MXIM, OTEX, RMD, SBUX, SHOR, SIVB, SYNA, WAL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 23)”

Leave a Reply

You must be logged in to post a comment.

Lew, Sec of Treasury, warned the government would likely run out of borrowing authority by late next month, if lawmakers do not act swiftly to raise the federal debt ceiling, reports CNBC. Watch this play, it could be another hang up that hurts USA equities.

China PMI below 50 and suspect. Australia has a housing bubble in Sidney at least, and the us and EU futures are down.

I am Cautious with index funds. SE Asia/ Australia look like it is the start of the same balancing problem now seen in the EU and the USA. This year is shaping up with a negative bias.

Market held up pretty well yesterday despite IBM’s drag, but as Jason said, the bulls couldn’t get anything going to the upside either.

Overnight, futures initially made a run higher but were slammed lower following reports that China’s Mfg took a surprise contraction.

Futures had been +5.5 and went to -9.75 on that word.

For today, we are back in the range of Tuesday’s low, so basically a repeat of that scenario: need to hold 1832 down thru 1828. Breaking 1827, likely to visit the lows seen on 1/13. Whether we stop there is anybody’s guess.

Unemployment claims +1000.

Looking like a big gap down right now, futures – 10. Some consider that a buying opportunity. Never get too bullish or too bearish.

Have a good day.