Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. China rallied while Hong Kong, India, Indonesia, Japan, New Zealand and Singapore dropped a bunch. Europe is currently down across-the-board. Spain is down almost 3%; Austria, France, Germany, Norway, Switzerland, London, Italy, Greece and the Czech Republic are down more than 1%. Futures here in the States point towards a big gap down for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are up.

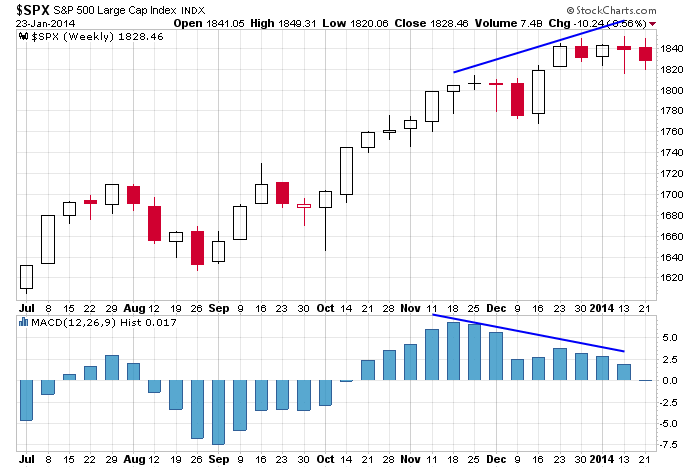

Since it’s Friday, let’s check out the weekly chart. The S&P is still working off the negative Histogram divergence which has been in place the last three weeks. Also, with today’s big gap down, it’s going to be very hard for the index to post a gain for the week. A massive intraday rally is going to be needed, and that doesn’t seem to be in the cards looking at charts of individual stocks.

The market has been range bound the last month. Today’s open will be near last week’s low. It’s not a line in the sand, but it is a level the bulls need to defend if they want to salvage a chance to break stocks out.

Stock headlines from barchart.com…

State Street Corp. (STT -3.18%) reported Q4 EPS of $1.15, below consensus of $1.19.

Procter & Gamble (PG -1.25%) reported Q2 EPS of $1.21, higher than consensus of $1.20.

Honeywell International (HON -1.42%) reprted Q4 EPS of $1.24, better than consensus of $1.21.

Stanley Black & Decker (SWK -0.64%) reported Q4 EPS of $1.32, higher than consensus of $1.30.

Bristol-Myers Squibb (BMY -1.57%) reported Q4 EPS of 51 cents, better than consensus of 43 cents.

According to Nikkei.com, Harley-Davidson (HOG -1.47%) will begin selling three-wheelers in Japan for the first time starting February 1.

Celanese (CE -0.29%) reported Q4 adj. EPS of $1.04, better than consensus of $1.02.

KLA-Tencor (KLAC -0.20%) reported Q2 EPS of 85 cents, stronger than consensus of 80 cents.

Altera (ALTR -1.17%) reported Q4 EPS of 31 cents, stronger than consensus of 30 cents.

E-Trade (ETFC -2.19%) rallied nearly 3% in after-hours tradign after it reported Q4 EPS of 20 cents, higher than consensus of 19 cents.

Leggett & Platt (LEG +1.29%) reported Q4 adjusted EPS of 35 cents, better than consensus of 34 cents.

Juniper (JNPR -0.65%) rose 2% in after-hours trading after it reported preliminary Q4 EPS of 43 cents, stronger than consensus of 37 cents.

Intuitive Surgical (ISRG -0.03%) reported Q4 EPS of $4.28, well above consensus of $3.83.

Discover (DFS -2.35%) reported Q4 EPS of $1.23, better than consensus of $1.18.

Microsoft (MSFT +0.36%) climbed 4% in after-hours trading after it reported Q2 EPS of 78 cents, well ahead of consensus of 68 cents.

Starbucks (SBUX -0.29%) reported Q1 EPS of 71 cents, higher than consensus of 69 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

No events scheduled.

Notable earnings before today’s open: BMY, COV, FNFG, GWW, HON, IMGN, KMB, KSU, PG, STT, SWK, XRX

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 24)”

Leave a Reply

You must be logged in to post a comment.

Conditions right for a correction? Mostly time is ripe for a correction? Every five to six years the market shakes out like a wet puppy. But is that all? Maybe not. For a review of the state of the states, and some interesting facts showing just how cash poor US blue chips are SEE the link below by an good analyst. The US recovery is fragile, so caution is justified.

http://globaleconomicanalysis.blogspot.com/2013/04/cash-cow-of-50-largest-us-companies-who.html

From yesterday.

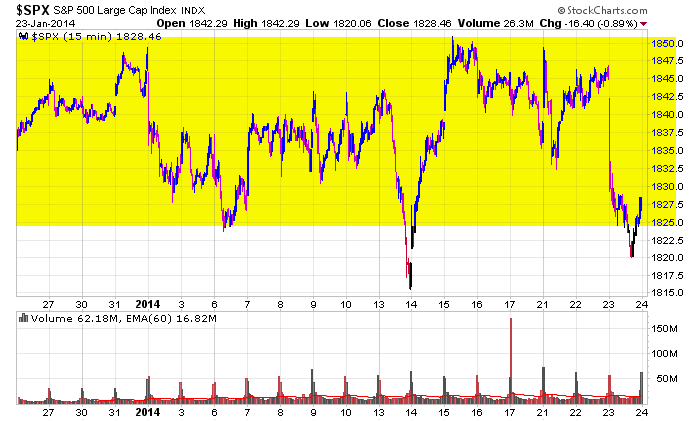

“Breaking 1827, likely to visit the lows seen on 1/13. Whether we stop there is anybody’s guess.”

Well, we broke 1827 but didn’t quite get as low at the low’s on 1/13 which are 1815.60. We held that level til the closing bell.

That was Thursday, but overnight the futures have violated 1/13’s low. Since technically, they’ve broken support, likely we will see the SPX do the same today.

Either way, the level to watch is crystal: 1815.60.

If it holds, be very cautious but that level is the absolute level for the uptrend to survive (for the present).

If it’s broken, a couple of either / or scenarios can occur: (the order does not imply the likelihood of either)

1 we will stair step lower as we did yesterday; there is major support at 1780, plus or minus.

2 we could bounce as high as 1832-1837. THEN and IF we get to that that level, there are two other possible scenarios as well:

a. if that level holds, especially 1837 and we turn back down, sub 1800 is likely

b. if 1837 is broken to the upside, expect a pullback soon after, but then a bounce. That’s a pretty tall order for today, so am thinking less likely, at least for today. If it happens, I’ll try to update.

Complicated, yes. Just trying to cover all scenarios. We are at an important inflection point. The key is 1815.60.

My hunch from the futures right now is that we have formed a minor Long, so I’ll give you that level: 1818. Lower than 1816, which isn’t that big of a margin from 1815.6, I know, tells you we’re probably going lower.

Futures low -16, now with 6 mins to the bell -12.

Good day.

has the trend changed yet