Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets suffered big across-the-board losses. Hong Kong, India, Indonesia and Japan lost more than 2%; China, Malaysia, Singapore, South Korea and Taiwan dropped more than 1%. Europe is currently mostly down. Spain is down 3.3%, Belgium and London are down more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

We’re coming off the single biggest down day and biggest down week in a long time. Big down days have happened the last few months, but now we’ve gotten three in two weeks and also back-to-back selling sprees.

The charts of individual stocks are as bad as I’ve seen in while. Almost nothing looks like a good buy (unless you like catching falling knives).

The breadth indicators, which have hinted at a move down (or at least didn’t support a move up) are falling and are nowhere near oversold levels.

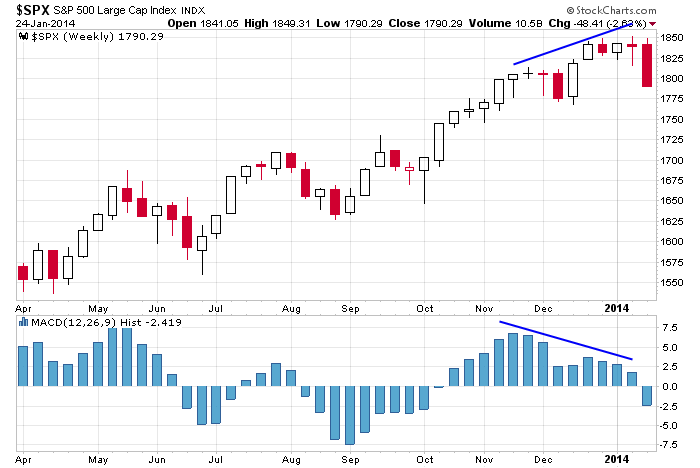

I’ve been posting the following SPX chart for about three weeks, saying the divergence needed to be worked off before the market attempted to move up again. For a while, the market corrected with time. Now it’s correcting with a price drop.

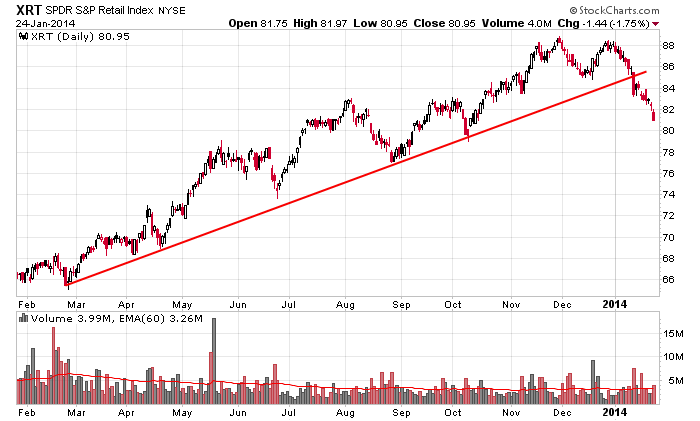

On two occasions (here and here), I’ve talked about how the declining retail stocks may be a “canary in a coal mind.” The groups continues to struggle.

If you were bullish and long heading into the end of last week, you lost a few bucks on Friday. Oh well. That’s the price you pay for riding an uptrend for so long. When the market turns, you give a little back.

If you were bearish, you got a nice move. Hopefully you just turned bearish and weren’t one of those “world is coming to an end” bears who have missed one of the greatest rallies in history.

After an oversold bounce, I’m guessing we have more downside coming. More after the open.

Stock headlines from barchart.com…

Caterpillar (CAT -2.61%) reported Q4 EPS of $1.54, well ahead of consensus of $1.28, and also approved a new $10 billion stock repurchase program.

CSX (CSX -3.03%) was downgraded to ‘Neutral’ from ‘Overweight’ at Atlantic Equities.

Honeywell (HON -1.48%) was upgraded to ‘Buy’ from ‘Hold’ at Lagenberg.

DigiTimes reports that Samsung (SSNLF -1.92%) has cut its target of notebook shipments in 2014 to 7 million from 12 million units shipped in 2013.

lululemon (LULU +1.00%) was downgraded to ‘Neutral’ from ‘Buy’ at Janney Capital.

Cisco (CSCO -1.60%) was downgraded to ‘Underweight’ from ‘Neutral’ at JPMorgan.

Merck (MRK +0.74%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Morgan Stanley.

American Electric Power (AEP -1.81%) reported Q4 EPS of 60 cents, higher than consensus of 57 cents.

Roper Industries (ROP -2.40%) reported Q4 EPS of $1.65, better than consensus of $1.61.

Northrop Grumman (NOC -3.45%) was awarded a $200 million government contract to perform acquisition and sustainment for the Embedded Global Positioning System Inertial Navigation System.

Corvex Management reported a 7.8% stake in Signet Jewelers (SIG -1.75%) .

Pershing Square reported a 30.9% passive stake in Platform Specialty Products (PAH -3.36%) .

The WSJ reported that Wal-Mart (WMT -0.72%) will eliminate 2,300 Sam’s Club employees.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 New Home Sales

10:30 Dallas Fed Manufacturing Outlook

Notable earnings before today’s open: AEP, AUO, CAT, NVR, RCL, RGS, ROP, RYN

Notable earnings after today’s close: AAPL, ASH, CMRE, CR, GGG, OLN, PCL, RCII, RMBS, SANM, SIMO,STLD, STM, STX, SWFT, X, ZION

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 27)”

Leave a Reply

You must be logged in to post a comment.

Time for a bounce? My statistical model say “cash” until July and caution in general. Brewing off in the distance is China’s internal debt on all of its building of hallow cities, and too many banks following too many policies and exports slacking. The emerging markets have a serious problem on currencies, the east is indeed red on their stock screens. The State of the Union will be a cover-up, topic change attempt, ship it – no one is listening. The debt ceiling is moving towards a standoff. The EU has disinflation problems and Draghai has no idea what to do. Sorry he knows what to do, but will not admit he has a problem.

Keep your money at home and don’t let it do into the market in spite of some hounding by the hucksters.

Jason

Agree 100%. Great work.

To provide continuity from one posting to the next, I’ll quote from Friday’s. This may enhance understanding of the market’s ebb and flow.

One possible scenario was:

“1 we will stair step lower as we did yesterday; there is major support at 1780, plus or minus.”

Futures opened lower last night and bounced off this major support level and moved steadily higher. This is a large (wide) level of support which runs from 1780 down thru about 1765 or so.

This is the key area to watch for the whole week with the FOMC statement due out Wed 2 pm. They could easily revisit that area. You know how they roll.

As long as this area holds (1780 down thru 1765), the trend is still up. The target is 1885-ish.

Futures were -6 to +10, now +5.

Could easily see some selling for the first 30 mins or so by those who learned of Friday’s sell off over the weekend and decided now’s the time to get out. Time will tell if they’re right.

My calculations say we get a bounce if the NASDAQ hits 4052… No bets on this one.

Excellent call, DP.

until high noon usa gets led lower by ftse/dax and europe–as was fri/today

there is some buying comming in now but unless ftse or dax futures turn up ,then i dont trust it

as at todays usa lows are enough for a complete wave one down ,but that puts a end to the exhaustion style trend we have seen ,meaning nas 100 has toped

a wave 2 lower high in 45 days –gann count –and same as 1929 and 87 will led to a dramatic crash–that could be around the debt ceiling time

bric countries sovereign bebt is a worry

short term we may get a tech /nas bounce this week after hours for earnings

but i only trade intraday so none of above applies to me

intraday nas 100 just made a trend change with a break of previous LH