Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Only Australia dropped more than 1%, and no index rallied that much. Europe is currently mostly up. Italy is leading the way followed by Austria, Spain and Switzerland. Greece is down 1.6%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold is down, silver is up.

Lots of things going on and coming up.

Tonight, Obama will give the 2014 State of the Union address. The speech has become much more fluff than substance in recent years, and I find it very annoying to watch/listen because of all the clapping interruptions. Obama’s approval rating is very low, so this is a chance resurrect his presidency. With regards to the market, it’s not uncommon to voice intention to fund certain industries (solar for example), so some stocks may get boosts tomorrow. However, his words won’t permanently move anything.

The FOMC starts their two-day meeting today which will culminate in a statement tomorrow. Will the Fed maintain their $75 billion bond buying pace or taper further to $70 or $65? We’ll see.

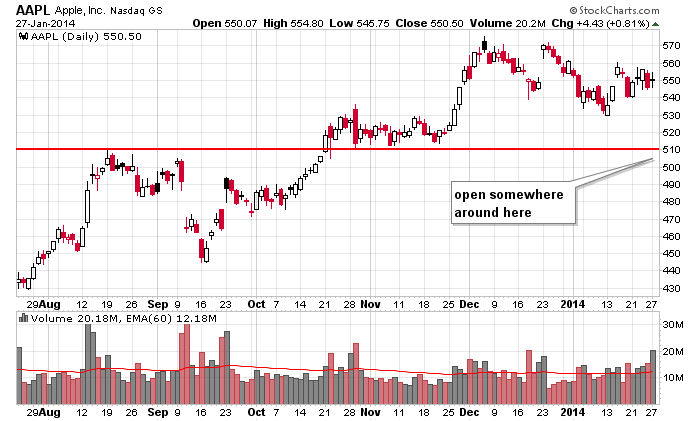

Apple (AAPL) disappointed with iPhone sales and revenue guidance. The stock is down 7.5% in premarket trading and is set to up below 510.

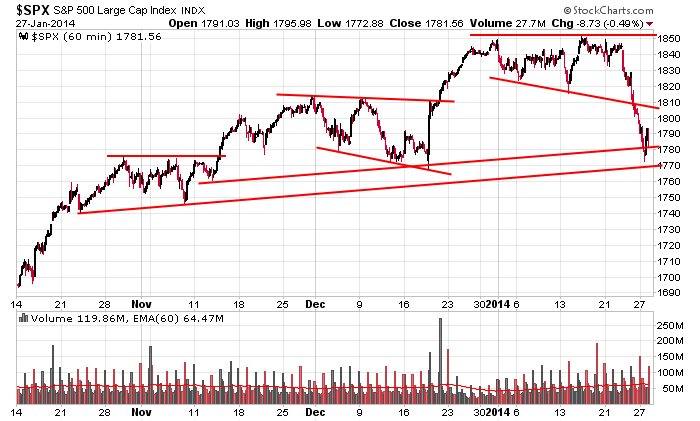

Here’s the 60-min S&P chart. The index got within three points of support created by a trendline drawn through October and November lows and closed at support created by a trendline of the same slope and drawn through the November and December lows. If I had to pick a target, I’d pick 1750, but a bounce to 1800 or a little high is certainly not unrealistic.

Lots of stuff going on, and earnings season is in full swing. If you don’t know what do to, do nothing. There is nothing wrong with that.

Stock headlines from barchart.com…

DR Horton (DHI +0.29%) reported Q1 EPS od 36 cents, stronger than consensus of 30 cents.

Corning (GLW +0.05%) reported Q4 EPS of 29 cents, higher than consensus of 28 cents.

Pfizer (PFE -1.43%) reported Q4 EPS of 56 cents, better than consensus of 52 cents.

Ford Motor (F -0.76%) reported Q4 EPS of 31 cents, higher than consensus of 28 cents.

EI du Pont de Nemours (DD +0.45%) reported Q4 EPS of 59 cents, stronger than consensus of 55 cents.

Danaher (DHR -0.04%) reported Q4 EPS of 96 cents, better than consensus of 95 cents.

Comcast (CMCSA +0.17%) climbed 3% in European trading after people familiar with the matter said the company may buy Charter’s cable assets in New York City, North Carolina and New England. The sale is contingent upon shareholder approval of Charter’s takeover bid for Time Warner Cable.

The New York Times reported that Martin Marietta (MLM -1.48%) will acquire Texas Industries (TXI -4.69%) for $72 per share.

STMicroelectronics (STM +0.79%) reported a Q4 adjusted EPS loss of -1 cent, weaker than consensus of a 4 cent gain.

Rent-A-Center (RCII +0.61%) plunged 13% in after-hours trading after it reported Q4 EPS of 25 cents, well below consensus of 75 cents. and then lowered guidance on fiscal 2014 EPS to $2.30-$2,50, below consensus of $3.20.

Apple (AAPL +0.81%) tumbled 7% in after-hours trading after it reported Q1 EPS of $14.50, well ahead of consensus of$14.09, but then said it sees Q2 revenue of $42 billion-$44 billion, below consensus of $46.05 billion.

Swift Transport (SWFT -4.05%) reported Q4 EPS of 36 cents, higher than consensus of 35 cents.

Sanmina (SANM -2.89%) reported Q1 EPS of 41 cents, better than consensus of 38 cents.

Seagate (STX -0.89%) slid 6% in after-hours trading after it reported Q2 EPS of $1.32, weaker than consensus of $1.38.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

FOMC meeting begins

7:45 ICSC Retail Store Sales

8:30 Durable Goods

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Richmond Fed Mfg.

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

1:00 PM Results of $32B, 2-Year Note Auction

Notable earnings before today’s open: AAL, AHGP, AKS, AOS, APD, ARLP, AVX, CHKP, CIT, CMCSA, DD, DHI, DHR, F, FCFS, FMER, GLW, HMST, HRS, HUB.B, IIVI, ITW, KLIC, LXK, NEE, NUE, OSIS, OSK, PCH, PFE, PHG, PII, PNR, RDWR, TROW, WAT, WRLD

Notable earnings after today’s close: ACE, AJG, ALB, AMGN, BXP, CLMS, CRUS, EA, EFII, EZPW, FSL, GHL, HA, HLIT, HTCH, ILMN, JLL, OI, POL, RFMD, RKT, T, TGI, TSS,VMW, WRB, YHOO

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 28)”

Leave a Reply

You must be logged in to post a comment.

“If you don’t know what do to, do nothing. There is nothing wrong with that.”

Good point!

The Leading Economic Indicators came in this morning suggesting that the reporting system or the business sector itself were a little too hopeful about a recovery. The numbers by and large suggest that things slowed down or That November was just a fluke. Anyway, it will give the Fed something to talk about, of course they had the data a week ago. No change in taper policy is expected. What about the market, it will never know what hit them. Today looks up at the open, but maybe not all day. My technical indicators say that we are going to correct more, down 500 pts leads to more, the way it went down leads to a lot more. Cheers but while doing nothing is going to be OK, being short is going to be better thru July 2014.

Monday’s support level still applies:

“As long as this area holds (1780 down thru 1765), the trend is up. The target is 1885-ish.”

Selling lasted longer than expected yesterday — as in nearly all day with a brief respite around lunch and early afternoon. GOOG didn’t help, being down all day, off $40 at one point. Today AAPL will be a drag, down $42 in premarket.

We have also a clearly defined area of resistance at Mon’s aft high, 1794 and extending nearly to 1800. That resistance’s target is below 1765, which is the lowest level of the support area defined above. There is other resistance above, this is the closest one.

Watch that support and resistance. Whichever one is broken indicates future direction. It’s a wide range, and the market may not break either until tomorrow’s FOMC report. A large part of this game is stalking til the mkt tells you what it’s doing.

Futures were -4.75 to +10.75 to as low as +1 after the Durables report. Now +3

what is a bullybear

its a intraday trader that trades the ups/downs

can pick intraday tops/bottoms

is a snipper and can trade countertrends

sleps during small range non volitile moves

have fun and become a bullybear and trade when you like 24 hours a day

today is corective consolidation for the world and does not give direction

may the old highs be never seen again

many indexes have already started the long term downtrend