Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Australia, Hong Kong, Indonesia, Japan, New Zealand and South Korea did well. Taiwan lagged. Europe is currently mostly down. Norway, Switzerland, Austria and the Czech Republic are down the most. Futures here in the States point towards a big gap down open for the cash market.

The dollar is up. Oil is down, copper is up. Gold and silver are up.

Obama has spoken. The speech sounded more like a campaign speech than a State of the Union address. In my opinion, the most potentially impactful comment (and remember, I don’t listen to any before or after comments from the talking heads, I only listen to the speech) was his support for raising the minimum wage to $10.10/hour. If this happens it would certainly hurt retailers, who traditionally pay their employees much less than $10.10 an hour. Perhaps this is another reason retailers have been sucking wind lately – the content of the speech was leaked. But raising the minimum wage would put more money into the pockets of people who need it the most. I also found it interesting he didn’t say “America is strong.” Instead he said the “people of American are strong.” Every State of the Union since Reagan has contained the phrase “America is strong” regardless of whether it was true or not at that point in time (Presidents are good at spinning things). Perhaps saying America is strong when so many people are struggling would receive a lot of backlash.

Moving on…

We have a Fed announcement today. Rates won’t change, but it’s unknown whether the Fed will taper further (from the current $75B level) or hold steady. Also this is Janet Yellen’s first meeting as Chair, and although I doubt the wording of the statement will change much, you never know.

The big overnight, overseas news is Turkey raised its overnight lending rate from 7.75% to 12% and borrowing rate from 3.5% to 8%.

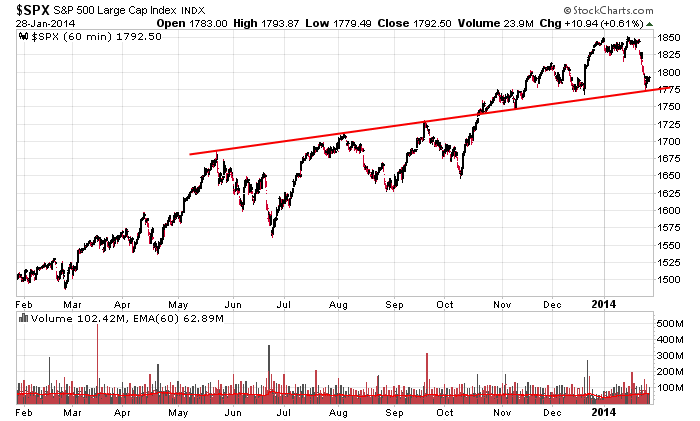

Here’s the 60-min SPX chart. Call it a line of demarcation. It’s been hit several times and has only been penetrated once. Consider it to be an important line in the sand until it’s taken out and disrespected.

I am in “wait and see” mode. I see no reason to force things right now. More after the open.

Stock headlines from barchart.com…

Marathon Petroleum (MPC -0.40%) reported Q4 EPS of $2.10, much better than consensus of $1.15.

Dow Chemical (DOW -0.09%) reported Q4 EPS of 65 cents, well ahead of consensus of 43 cents.

McCormick & Co. (MCK +1.32%) reported Q4 EPS of $1.20, better than consensus of $1.19.

Biogen Idec (BIIB +2.61%) reported Q4 EPS of $2.34, higher than consensus of $2.27.

JP Morgan reported a 6.1% passive stake in GenMark (GNMK +1.63%) .

Freescale (FSL unch) reported Q4 adjusted EPS of 19 cents, higher than consensus of 18 cents.

Owens-Illinois (OI +1.57%) reported Q4 adjusted EPS of 51 cents, weaker than consensus of 53 cents.

W. R. Berkley (WRB +2.09%) reported Q4 operating EPS of 85 cents, stronger than consensus of 77 cents.

Hub Group (HUBG -0.25%) reported Q4 EPS of 50 cents, better than consensus of 48 cents.

Yahoo (YHOO +4.28%) reported Q4 EPS of 46 cents, well above consensus of 38 cents.

Amgen (AMGN +1.84%) reported Q4 EPS of $1.82, well ahead of consensus of $1.68.

VMware (VMW +1.97%) reported Q4 adjusted EPS of $1.01, higher than consensus of $1.00.

Electronic Arts (EA +1.63%) reported Q3 adjusted EPS of $1.26, stronger than consensus of $1.23, and then raised its fiscal 2014 EPS view to $1.30, higher than consensus of $1.28.

AT&T (T +0.57%) reported Q4 adjusted EPS of 53 cents, better than consensus of 50 cents.

Texas Industries (TXI +2.88%) was downgraded to ‘Neutral’ from ‘Buy’ at CL King.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

11:30 FRN 2-Yr Note Auction

2:00 PM FOMC Announcement

Notable earnings before today’s open: AME, AUDC, BA, BABY, BIIB, CAJ, CFR, CP, CVLT, EMC, ENR, EVER, EVR, FLWS, GIB, GNTX, HES, ISSI, JBLU, MDP, MKC, MKTX, MPC, MPLX, MTOR,MWV, NMM, NVS, NYCB, PSX, PSXP, PX, RES, ROK, SEIC, SLAB, SO, TCB, TUP, VLO, WLP

Notable earnings after today’s close: ACXM, AF, ALGT, AVB, CACI, CAVM, CBT, CDNS, CLB, CMO, CNQR, COHR, CTXS, DOX, DRE, ELY, EXAR, FB, FBHS, FLEX, FTNT, HBI, IEX, INFN, ININ,INVN, IRF, ISIL, KEX, LRCX, LVS, MLNX, MUR, NOW, NSR, OPLK, PRXL, QCOM, QGEN, QLGC, QTM, SFG, SGI, SLG, SPB, SYMC, TSCO, TTEK, VPRT, VRTX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 29)”

Leave a Reply

You must be logged in to post a comment.

Down trend today looks possible. Very interesting how Turkey responded to the pressure of the global QE on Emerging markets. TUR raised its interest rates to save its currency. OK, but it means that it slows the economy and slows exports. The is the dilemma of international economics among the small and the large markets. More to the point, it makes clear the damage done by massive QE to all. So the Fed members go to the back of the cave to cast the bones, Taper is in I bet, but watch if the trend starts down again. Stay loose

It takes a strong stomach to listen to these speeches, regardless of who is giving them, although some require stronger stomachs than others. I wish they would raise the interest rates on my money market funds like Turkey raised rates. The Fed hasn’t had time to implement the first taper and measure anything. Why would they do another one right away. Just do $20 billion initially if that’s the case. I don’t think they will taper again, but as Yogi says, “You shouldn’t make predictions – especially about the future.” The market feels really bad. Every time it has felt like this for 5 years, it has made fools out of the non-believers. It comes down to how strongly you believe in the “Fed put.”

From Tuesday: “Watch that support and resistance. Whichever one is broken indicates future direction. It’s a wide range, and the market may not break either until tomorrow’s FOMC report.”

Exactly what we did Tuesday, low was 1779.50 and high was 1793.8.

Til after the closing bell……

Futures last night boomed to +13, then cratered this morning, hitting -16 within the last 30 minutes.

They are definitely going from support to resistance back to support — and the FOMC statement is 5 hours away.

There are two new layers to watch:

Resistance starting at 1792 thru 1797. (More above, of course, this is the nearest one to deal with.)

Support still starts at 1780 and extends lower now, with the lowest level at 1754. Wide range. If futures remain where they are, we’ll be in it at the open.

Could be a more interesting reaction at 2 pm than normal.

Futures at 9 am – 17 and very volatile.